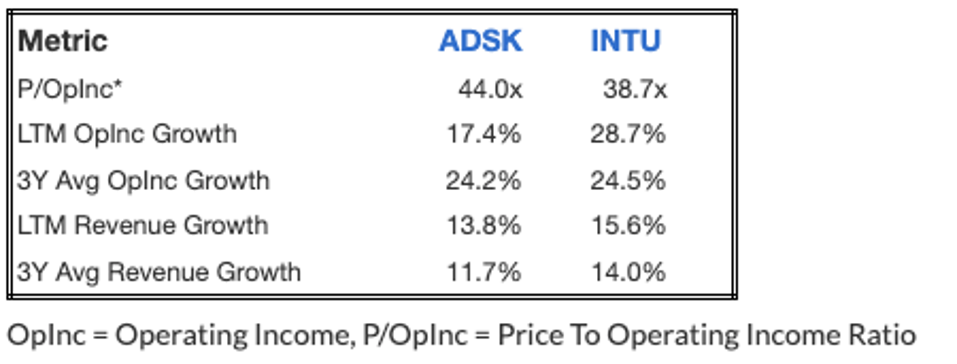

Intuit is Autodesk’s peer within the Application Software sector and offers:

1) A lower valuation (P/OpInc) relative to Autodesk stock

2) However, it surpasses Autodesk in revenue and operating income growth.

This disparity between valuation and performance may indicate that purchasing INTU stock is more advantageous than buying ADSK stock.

There are other factors to consider as well. Intuit holds a strong position in the financial software market, which is seeing major gains from the growing adoption of AI. Its business is predictable and less affected by economic cycles, since tax and accounting demand remains steady. In contrast, Autodesk operates in the design and engineering software sector, which is more sensitive to economic fluctuations and competitive innovation pressures.

Investing in a single stock can pose risks, yet a more comprehensive and diversified strategy, like the one we utilize with Trefis High Quality Portfolio, holds significant value. Our strategy includes more than just equities—consider a mix of 10% commodities, 10% gold, and 2% crypto, alongside equities and bonds. This combination is likely to yield better returns over the next 1-3 years and safeguard your investments if the market drops by 20%. We have analyzed the figures.

Key Metrics Compared

OpInc = Operating Income, P/OpInc = Price To Operating Income Ratio

But do these numbers reveal the complete picture? Read Buy or Sell ADSK Stock to determine whether Autodesk maintains an advantage that withstands scrutiny. For context, Autodesk (ADSK) offers 3D design, engineering, and entertainment software, including solutions for civil engineering applications such as land development, transportation, and environmental projects, which are distributed directly and through resellers worldwide.

This is merely one method for assessing investments. Trefis High Quality Portfolio analyzes a broader range of factors and aims to mitigate stock-specific risks while allowing for potential upside.

Is The Discrepancy In Stock Price Short-Lived?

A potential approach to evaluate whether Autodesk stock is currently overpriced compared to other tickers would involve examining how these metrics compared among companies exactly a year ago. In particular, if there has been a significant reversal in Autodesk’s trend over the past 12 months, it could indicate that this current discrepancy may soon be resolved. Conversely, an ongoing underperformance in revenue and operating income growth for Autodesk would support the conclusion that the stock is indeed overpriced relative to its competitors, and this situation may persist.

Key Metrics Compared 1 Year Prior

Additional Metrics To Analyze

Purchasing based on valuation, while appealing, must be carefully assessed from multiple perspectives. This multi-faceted analysis is precisely how we develop Trefis portfolio strategies. If you seek upside potential alongside a more stable experience than investing in individual stocks, consider the High Quality portfolio, which has outperformed the S&P and achieved returns exceeding 105% since its launch.