As I wrote back in 2019, and McKinsey wrote back in August, once AI-powered software agents (that is, bots) start making more sophisticated financial decisions on behalf of customers, we will see a reshaping of banking that will affect billions of dollars in revenue. My bumper sticker version of future agentic finance landscape is quite straightforward: The AI revolution isn’t banks getting AI, it is customers getting AI.

Agentic Finance Is Inevitable

This has huge implications for the banking sector. The former Standard Chartered Group Chief Data Officer Shameek Kundu said in the Citi GPS’ report on “AI in Finance: Bot, Bank & Beyond” that “the biggest new thing will be the growth of non-human customers” and I could not agree more, which is why I have been looking at the implications for some time. In particular, I have become fascinated to see how banks and other financial services organisations (who sell very commoditised products such as checking and savings accounts) will adjust to acquiring agent customers who do not care about the bank Superbowl ads or which sports teams it sponsors.

When my AI-controlled smart wallet uses open banking data and decides that I need a different savings account or refinance my car loan, how will my network of bot advisors decide which provider to use? After all, savings accounts and car loans are boring, there are lots of them to choose from and even if I did take the time to read the terms and conditions I wouldn’t understand them. When it comes down to it, I don’t really want to be in the loop on these because I’ve got better things to do. Bot’s don’t/

Now one rather obvious thing that bots will base their decisions on will be price, so from a strategic perspective it seems to me that banks will likely need to compete much more sharply on price to retain clients’ wallet share. Bots can compare multiple prices simultaneously, so being the cheapest will likely always be a significant factor. One strategic response from institutions could therefore be to adopt an execution-focused strategy focused on operational efficiency. They could cut out the money wasted on TV advertisements that bots don’t look at and use the modern to modernise and revitalise their IT infrastructure, thereby enabling them to compete on volume and win those deals that are purely based on price.

In this kind of environment, as you might easily imagine, all prices will rapidly fall to the lowest level and this has very significant implications on the business models of commercial banks and others. In fact McKinsey’s new Global Annual Banking Review for 2025 says that $23 trillion of the $70 trillion in the consumer banking sector are held in zero interest accounts. Unless banks adapt their offerings, this could amount to a loss of 9% to the bottom line, which would push average returns for banks below the cost of capital.

AI has a role to play in revitalising the banks infrastructure, of course, and this will help to reduce costs (McKinsey think this might mean initial savings of between 15% and 20% of operating costs) but of course those benefit will soon be competed away. This means that banks will need to find other competitive advantages. But what could these be?

In common with many other industry observers, I think that one area to focus on is digital identity. For commercial banks, they have an inbuilt advantage. As Kirsty Rutter, the Fintech Investment Director at Lloyds Banking Group in the U.K., said “our digital identity has become our most valuable digital asset”. Numerous fintech companies have emerged working to tackle different aspects of the identity challenges across identification, authentication and authorisation but there is still way to go to get a comprehensive infrastructure in place to provide the essential elements of the trust framework.

When you look at the rapid evolution of agentic finance and agentic commerce, it is clear that the platforms and protools are outpacing the trust frameworks needed to build real-world products and services. In another of their recent reports, McKinsey pointed in this direction and said that what they label “credentialling and identity” is the first of their key control points in the agentic economy because agents need secure, user-granted permission before they can initiate transactions across multiple institutions. Therefore, as they point out, organisations that already manage high-trust credentials start with a clear advantage. They go on to highlight some success factors: zero-trust architectures that never assume persistent access, dynamic consent via standardized protocols (for example, OAuth2/OpenID Connect) and continuous audit trails.

Agentic Finance As Dark Energy

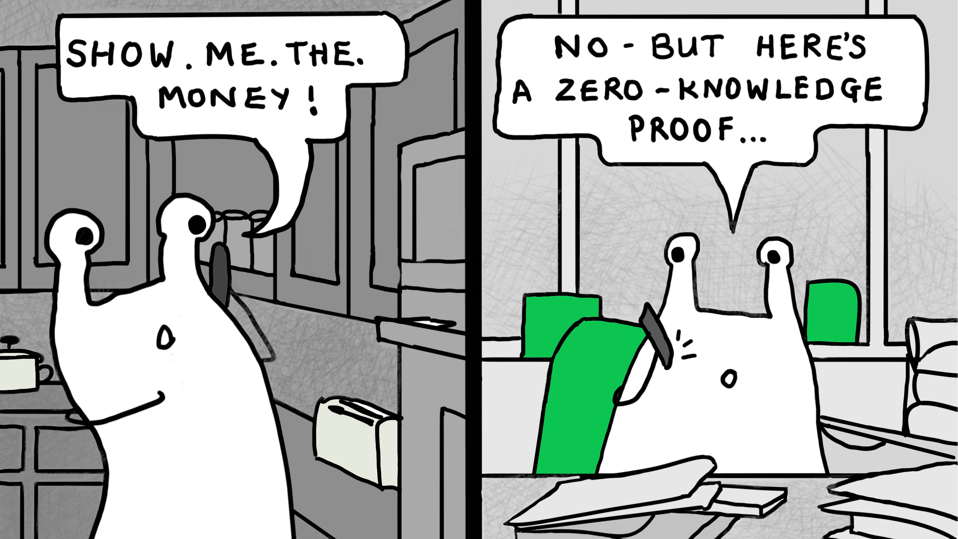

Financial institutions should be looking at the opportunities here as a way of staying relevant, as a way for remaining relevants to transactions that pass unnoticed through the current financial systems, a kind of financial dark energy made of wallets and stablecoins, AP2 and x402, exchanging value without ever touching banks and banking networks. All of those transactions wll need varying kinds of trust and one of the reasons why I am so bullish about the transition to agentic finance is precisely because of the transition from antiquated security theatre based on passwords, pictures of buses and emailing photos of passports to an infrastructure of privacy-by-design privacy and actual security. The fact of the matter is that people are just not very good at security: We are the weakest link and, as I am fond of remarking, it’s quite easy to fool someone with a fake picture of Brad Pitt, it’s impossible to fool their bot with a fake Brad Pitt digital signature.

It’s not a hard prediction to make that AI is going to change our industry just as its going to change every other industry. But I think it’s important to note that this is about more than saving a few people in the call centre or making slightly better credit decisions. The industry is going to be shaped by what customers do with AI and the evolution of agentic finance will lead to a very different kind of industry but it will be an industry that services its customers far better than the half-analogue, half-digital transition industry that we have today.