GameStop’s stock has surged 10% this week, propelled by strong quarterly results that exceeded expectations. The company’s performance was driven by a significant increase in demand for both hardware and collectibles. This recent spike, however, prompts a question for investors: Is Upbound Group a more compelling investment opportunity now?

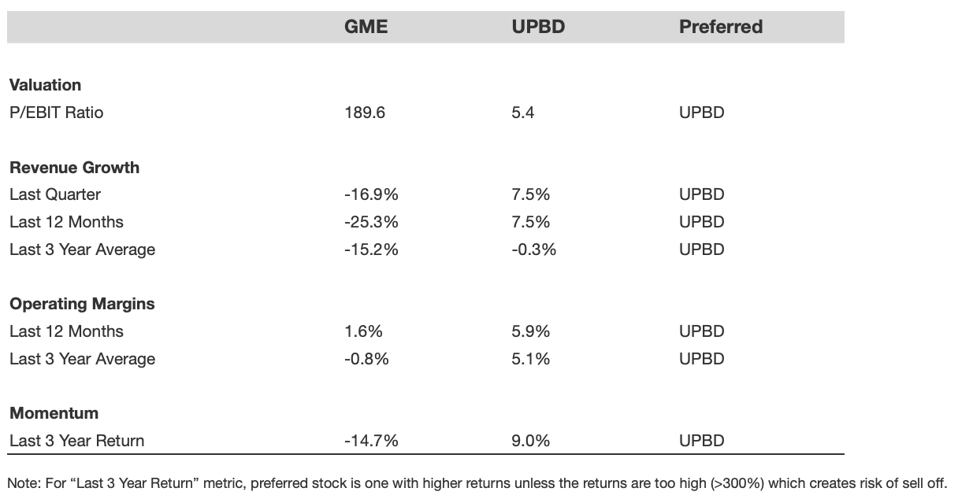

Upbound shows stronger revenue growth across key periods, better profitability, and a comparatively lower valuation than GameStop, indicating UPBD could be the preferable investment.

- UPBD’s quarterly revenue growth was 7.5%, versus GME’s -16.9%.

- Its Last 12 Months’ revenue growth was also 7.5%, ahead of GME’s -25.3%.

- UPBD leads on profitability over both periods — LTM margin of 5.9% and a 3-year average of 5.1%.

GME sells games and entertainment products via e-commerce and 4,573 stores across the U.S., Canada, Australia, and Europe under multiple brand names. UPBD provides lease-to-own options for household durable goods, operating about 1,846 locations across the U.S., Puerto Rico, and Mexico, including retail installment and Acima outlets.

Valuation & Performance Overview

Explore revenue details: GME Revenue Comparison |UPBD Revenue Comparison

Review margin details: GME Operating Income Comparison | UPBD Operating Income Comparison

Do these numbers tell the whole story? Read Buy or Sell UPBD Stock to test whether Upbound’s edge holds under the hood — and see if GameStop still has cards to play in Buy or Sell GME Stock.

That’s one lens for comparing stocks. The Trefis High Quality Portfolio weighs far more factors and aims to lower company-specific risk while preserving upside potential.

Historical Market Performance

No matter how good the numbers, stock investment is never a smooth ride. There is a risk you must factor in. Read UPBD Dip Buyer Analyses and GME Dip Buyer Analyses to see how these stocks have fallen and recovered in the past.