Micron Technology (MU) stock hit day 5 of a continuous streak of days with gains, with cumulative gains over this period amounting to a 14% return. The rally is driven by a couple of factors, including analyst upgrades for Micron stock, as well as expectations that the Fed could cut interest rates this month.

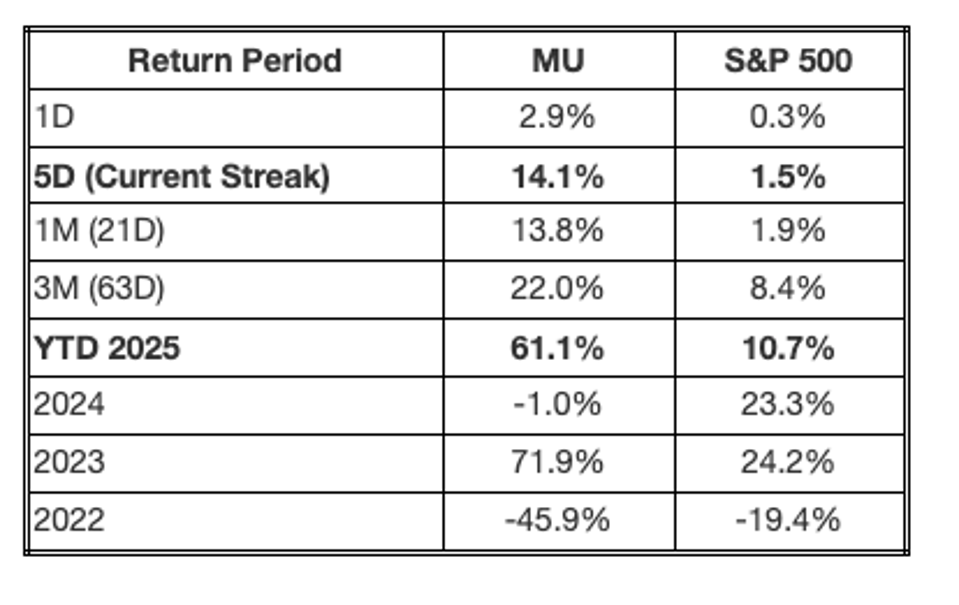

The company has gained about $21 billion in value over the last 5 days, with its current market capitalization at about $151 billion. The stock remains 61.1% above its value at the end of 2024. This compares with year-to-date returns of 10.7% for the S&P 500.

MU provides memory and storage products, including DRAM semiconductor devices, through segments focused on compute, networking, mobile, storage, and embedded business units. After this rally, is MU still a buy – or is it time to lock in gains? Deep dive with Buy or Sell MU.

The following table summarizes the return for MU stock vs. the S&P 500 index over different periods, including the current streak:

What is the point? Momentum often precedes conviction. A multi-day win streak can signal growing investor confidence or spark follow-on buying. Tracking such trends can help you ride the strength, or prepare for a well-timed entry if momentum fades. However, big gains can follow sharp reversals – but how has MU behaved after prior drops? See MU Dip Buyer Analysis to learn more.

Key Financials for Micron Technology (MU)

While MU stock looks attractive given its winning streak, investing in a single stock without detailed, thorough analysis can be risky. The Trefis High Quality (HQ) Portfolio, with a collection of 30 stocks, has a track record of comfortably outperforming its benchmark that includes all 3 – the S&P 500, S&P mid-cap, and Russell 2000 indices. Why is that? As a group, HQ Portfolio stocks provided better returns with less risk versus the benchmark index; less of a roller-coaster ride, as evident in HQ Portfolio performance metrics.