Deal Overview

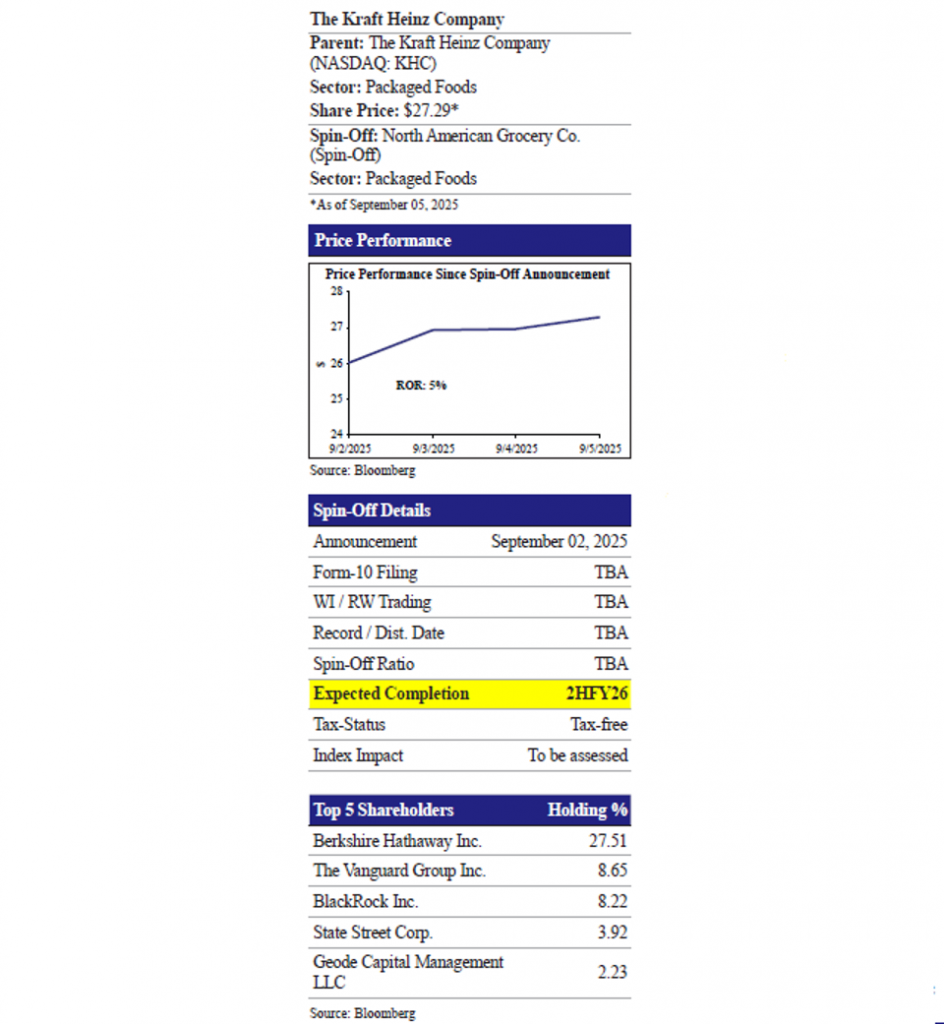

On September 02, 2025, The Kraft Heinz Company (NASDAQ: KHC, $27.29, Market Capitalization: $32.30 billion), a leading global packaged food company, announced its intent to spin-off its grocery business while retaining its high-growth condiments and sauces segment. Kraft Heinz has provisionally named its two entities as Global Taste Elevation Co. (RemainCo), focused on condiments and sauces, and North American Grocery Co. (SpinCo), centered on its grocery portfolio.

Post-separation, Global Taste Elevation Co. will retain Kraft Heinz’s iconic global brands and focus on high-growth platforms such as condiments, sauces, and flavor enhancers. With a strong international presence, Global Taste Elevation Co. aims to drive global expansion and elevate everyday meals through its products like Heinz, Kraft, and Philadelphia. In FY24, the Global Taste Elevation Co. segment generated $15.4 billion in revenue (59.7% of total revenue) and approximately $4.0 billion in Adjusted (Adj.) EBITDA (63.5% of total Adj. EBITDA).

The newly formed entity, North American Grocery Co., will be a dedicated North America-focused grocery business, built around trusted household staples including Kraft Mac & Cheese, Oscar Mayer, and Lunchables. With a streamlined portfolio and deep retail relationships, North American Grocery Co. will prioritize operational agility, consumer-centric innovation, and margin expansion in the dynamic US and Canadian markets. In FY24, the North American Grocery Co. segment generated $10.4 billion in revenue (40.3% of total revenue) and approximately $2.3 billion in Adj. EBITDA (36.5% of total Adj. EBITDA).

Kraft Heinz expects $300.0 million in dis-synergies from its business separation, divided equally across three areas. One-third will affect Cost of Goods Sold due to reduced purchasing power and inefficiencies in manufacturing and supply chains. Another third stems from IT-related expenses, including the setup of separate ERP systems, software licenses, and cybersecurity frameworks. The remaining one-third involves SG&A costs, split between restructuring sales and marketing operations and duplicating corporate functions such as finance, HR, and legal. Kraft Heinz was formed in July 2015 through a merger between Kraft Foods Group and H.J. Heinz Company. Berkshire Hathaway and 3G Capital led the deal to create a global packaged food giant. It combined Kraft’s grocery staples with Heinz’s condiments. Despite high hopes, the merger struggled due to shifting consumer preferences.

The company has been actively reshaping its portfolio to align with evolving consumer preferences for healthier, less processed foods. Recent initiatives include removing artificial dyes from US products and divesting underperforming brands. In May 2025, Kraft Heinz announced a strategic review aimed at unlocking shareholder value, and Berkshire Hathaway relinquished its board seats, signaling potential structural changes.

The separation is expected to be completed in the 2HFY26 and is intended to be tax-free for US federal income tax purposes. Completion is subject to several customary conditions, including final approval by Kraft Heinz Board of Directors, the filing and effectiveness of a Form 10 registration statement with the US Securities and Exchange Commission. Centerview Partners is serving as financial advisor, and Paul, Weiss, Rifkind, Wharton & Garrison LLP and Skadden, Arps, Slate, Meagher & Flom LLP are acting as legal advisors.

Deal Rationale

Kraft Heinz’s decision to spin-off its grocery business is a significant step toward improving focus and performance. The move reflects a broader effort to recalibrate the business around its most promising assets and future growth drivers. The new grocery entity will include many of Kraft Heinz’s traditional staples, such as processed cheeses, lunch meats, boxed meals, and snack brands. Meanwhile, Global Taste Elevation Co. will focus on its premium condiments and sauces segment, which has demonstrated stronger growth, higher consumer engagement, and a broader global appeal. The separation allows each business to operate with strategies tailored to their distinct market dynamics, enabling the grocery unit to focus on cost efficiency and potential consolidation in the value segment, while the high growth condiment division can prioritize global expansion and targeted capital investment.

The spin-off also addresses operational inefficiencies that have plagued the company since its 2015 merger, which was driven by aggressive cost-cutting under 3G Capital’s zero-based budgeting model. That approach ultimately failed to deliver sustainable results, leading to a 62.6% fall in stock value since the merger. The operating margin fell to 6.5% in FY24 from 14.4% in FY16. The separation will enable Global Taste Elevation Co. to move forward in areas such as clean-label formulations, bold global flavors, and cross-border expansion, areas where consumer trends are clearly shifting.

Global Taste Elevation Co. will be well-positioned to drive industry leading growth across attractive categories and geographies, leveraging a proven go-to-market model and the brand growth system to deliver scale and performance. Approximately 20.0% of FY24 revenue is from Emerging Markets, and approximately 20.0% through Away from home, which are faster growth segments. Over the longer term, management expects revenue growth in the range of approximately +2.5-3.0%. For North American Grocery Co., management anticipates sales to grow at a very low single digit or LSD (appears around 1.0%) over the long term, but will have strong cash flow generation and margin opportunities.

While the market sees potential for significant value creation if Kraft Heinz’s North American division achieves a meaningful turnaround, the current low single-digit growth expectations suggest it may not justify the approximately $20 billion valuation being attributed to it. However, RemainCo could benefit from a valuation uplift, given its portfolio of high-growth businesses.

Kraft Heinz’s restructuring mirrors a broader industry shift, similar to Kellogg’s 2023 split into Kellanova and WK Kellogg, which helped both companies grow independently. Since then, Kellanova’s stock rose 50.7%, WK Kellogg gained 72.1%, while Kraft Heinz’s shares dropped by 17.5% during the same period. Kraft Heinz has already demonstrated a willingness to pare down its portfolio through the divestment of non-core units, such as its Italian infant nutrition division, signalling that the potential spin-off is part of a larger recalibration of its brand ecosystem. With both Berkshire Hathaway stepping back from board involvement and 3G Capital having exited its stake by the end of 2023, it becomes easier for Kraft Heinz to take a bold step, such as a spin-off.

The Kraft Heinz Company is a global leader in the food and beverage industry, known for its iconic brands. The company operates across three strategic geographic segments: North America, International Developed Markets, and Emerging Markets. Kraft Heinz delivers products that span eight consumer driven platforms, including Taste Elevation, Easy Ready Meals, Substantial Snacking, Desserts, Hydration, Cheese, Coffee, and Meats. These platforms are aligned with strategic roles to accelerate growth, protect core categories, and balance the portfolio.

With a strong presence in retail, e-commerce, and foodservice channels, Kraft Heinz leverages its scale and agility to meet evolving consumer needs. The company’s brand portfolio includes globally recognized names such as Kraft, Heinz, Oscar Mayer, Philadelphia, Velveeta, and Lunchables, supported by a robust intellectual property strategy and regional adaptations that ensure relevance across diverse markets.

North America

North America is the cornerstone of Kraft Heinz’s global operations, encompassing the US and Canada. This segment is home to many of the company’s most iconic brands, including Kraft, Oscar Mayer, Heinz, Philadelphia, Lunchables, Velveeta, Ore-Ida, Capri Sun, Maxwell House, Kool-Aid, and Jell-O. These brands are deeply embedded in American households and are central to platforms like Taste Elevation, Easy Ready Meals, and Meats. The segment focuses on delivering convenience, comfort, and quality through trusted products that span condiments, cheeses, snacks, beverages, and ready to-eat meals. The North America segment generated 75.6% of FY24 revenue.

Kraft Heinz continues to invest in digital transformation, supply chain modernization, and consumer insights to drive innovation and efficiency. The North America segment is characterized by strong retail partnerships, including Walmart, and a strategic emphasis on pricing agility, promotional effectiveness, and operational excellence. It also plays a key role in shaping the company’s sustainability agenda, with initiatives aimed at reducing packaging waste and improving nutritional profiles.

International Developed Markets

The International Developed Markets segment includes operations in Europe and the Pacific, where Kraft Heinz adapts its global brands to regional tastes and preferences. Key brands in this segment include Heinz, Golden Circle, Wattie’s, and Plasmon. The segment is known for its premium offerings in sauces, baby food, and beverages, and leverages the strong equity of the Heinz brand to expand across categories and channels. Regional innovation is a hallmark of this segment, with tailored products that reflect local culinary traditions and consumer expectations. The International Developed Markets segment generated 13.7% of FY24 revenue.

This segment is also focused on sustainability and digital growth, with increasing investments in e-commerce, data analytics, and environmentally responsible sourcing. Strategic partnerships and retail expansion are helping Kraft Heinz strengthen its footprint in developed international markets. The company is also recovering from prior-year disruptions, such as Cyclone Gabrielle in Australia and New Zealand, and is enhancing its supply chain resilience to better serve consumers across Europe and the Pacific.

Emerging Markets

Emerging Markets represent Kraft Heinz’s growth frontier, spanning Latin America, Asia, Eastern Europe, the Middle East, and Africa. This segment includes a mix of global and locally resonant brands such as Heinz, Master, Quero, Kraft, and Pudliszki. The company tailors its offerings to meet diverse consumer needs, often through smaller pack sizes, localized flavors, and affordable formats. Platforms like Taste Elevation and Easy Ready Meals are adapted to regional preferences, enabling Kraft Heinz to build relevance and loyalty in fast-growing markets. The Emerging Markets segment generated 10.7% of FY24 revenue.

The segment is focused on expanding its reach through strategic investments in go-to market capabilities, brand building, and digital channels. Kraft Heinz is also streamlining operations through targeted divestitures, such as the sale of its infant nutrition business in Russia and its Papua New Guinea subsidiary. Despite macroeconomic challenges and currency volatility, Emerging Markets continue to offer significant long-term potential, driven by rising middle-class demand and increasing urbanization.

2QFY25

Total revenue fell by 1.9% YoY to $6.3 billion (+1.3% vs. consensus), primarily due to volume/mix declines in North America and International Developed Markets, especially in cold cuts, Lunchables, frozen snacks, and powdered beverages, partially offset by pricing gains and strong growth in Emerging Markets. North America segment revenue fell by 3.3% YoY to $4.7 billion, due to lower volumes in key categories like cold cuts, frozen snacks, and powdered beverages, and commodity inflation pressures that offset pricing and efficiency gains. Emerging Markets segment revenue improved 4.2% YoY to $698.0 million, driven by strong double-digit growth in the Heinz brand and successful execution of the go-to-market model, with gains from both pricing and volume/mix across Latin America, the Middle East, and Africa. Segment revenue from International Developed Markets increased by 1.4% YoY to $897.0 million, driven by a higher pricing in select categories, offset by input cost inflation, particularly in coffee. Adjusted operating profit fell 7.5% YoY to $1.3 billion (+5.4% vs. consensus), and the corresponding margin contracted ~122 bps to 20.1%, due to commodity cost inflation and unfavorable volume/mix, which outweighed pricing gains and efficiency initiatives. Adjusted net profit declined 12.8% YoY to $822.0 million (+8.1% vs. consensus), and the corresponding margin contracted ~162 bps to 12.9%. Adjusted diluted earnings per share came in at $0.69 (2Q24: $0.78), beating the consensus estimates by 8.2%.

FY24

Total revenue fell by 3.0% YoY to $25.8 billion (-0.4% vs. consensus), due to lower volumes from economic uncertainty and weak demand for key products like Lunchables and Kraft Macaroni & Cheese. Planned exits from low-margin businesses and a temporary plant closure also impacted sales. Emerging Markets segment revenue declined 4.3% YoY to $2.8 billion, due to continued softness in Brazil and China, which offset strong double-digit growth in other countries. North America segment revenue fell by 2.9% YoY to $19.5 billion, due to lower volumes and reduced demand. Segment revenue from International Developed Markets decreased by 2.4% YoY to $3.5 billion, due to volume pressure from customer negotiations and declines in non-core categories.

Adjusted operating profit grew 1.2% YoY to $5.4 billion (+0.1% vs. consensus), and the corresponding margin expanded ~85 bps to 20.7%, driven by higher pricing, lower variable compensation, and efficiency gains in procurement and logistics. Adjusted net profit grew 1.3% YoY to $3.7 billion (+2.2% vs. consensus), and the corresponding margin expanded ~60 bps to 14.4%. Adjusted diluted earnings per share came in at $3.06 (FY23: $2.98), beating the consensus estimates by 1.8%.

Company Description

The Kraft Heinz Company (Parent)

The Kraft Heinz is a packaged food company, incorporated on July 2, 2015, following the merger of Kraft Foods Group, Inc. and the H.J. Heinz Company. With net sales of $25.8 billion in FY24, Kraft Heinz operates across eight consumer-driven product platforms: Taste Elevation, Easy Ready Meals, Substantial Snacking, Desserts, Hydration, Cheese, Coffee, and Meats. Kraft Heinz maintains a global footprint with operations segmented into North America, International Developed Markets, and Emerging Markets, supported by 70 manufacturing and processing facilities worldwide. The company features iconic product names such as Heinz ketchup, Grey Poupon mustard, and a portfolio of hot sauces, dressings, and condiments.

North American Grocery Co. (Spin-Off)

The grocery business will house a significant portion of Kraft Heinz’s traditional grocery business. This includes products like Kraft cheese, Oscar Mayer meats, Maxwell House coffee, Jell-O, Planters nuts, Lunchables, Capri Sun, and other staples. These offerings are typically shelf-stable, processed, and widely distributed through grocery channels.