Key News

Asian equities were largely higher on a weaker US dollar, except for Indonesia and Vietnam, which underperformed.

It was a fairly quiet night. August’s trade data was light versus expectations, but it did not appear to be a factor in today’s trading. Mainland investors bought a very healthy net $2.14 billion worth of Hong Kong-listed stocks via Southbound Stock Connect, including Alibaba, which saw a very large net buy, per the below chart. Alibaba gained +4.17%, leading Hong Kong higher on volume that was 42% above its 52-week average, after announcing an update to its Qwen AI model and an investment in a robotics company, X Square Robot.

Internet stocks were largely higher, led by Tencent, which gained +1.98%, NetEase, which gained +4.38%, and Baidu, which gained +9.48% and had very high volumes, at 4 times the 1-year average. After announcing a RMB bond launch, these companies finally appear to be gaining some AI respect.

Growth subsectors, such as pharmaceuticals and biotech, also outperformed. Reuters is reporting that Unitree’s 4th-quarter IPO could value the company at $7 billion (RMB 50 billion), though the listing exchange has not been disclosed. There is a rumor that the listing will be on the Mainland STAR Market, which is focused on pre-profit technology and healthcare startups.

Banks, insurance, and non-ferrous metals were all off. Labubu doll maker Pop Mart fell

-7.11% on a potential slack in demand, though Friday’s buying for today’s Hang Seng Index inclusion is likely the culprit. Ironically, the company was the largest detractor from the Hang Seng Index, accounting for a decline of -26 index points.

Biotech Akeso fell -7.89% on concerns that its lung cancer drug trials might have stalled.

Kuaishou fell -3.5%, though I am not seeing any news on the company.

Mainland China had a solid day, except for banks and several high-flying subsectors, including precious metals, mining, semiconductors, and technology hardware, including electronic equipment.

China Unicom gained +4.82% after the Ministry of Industry & Information Technology (MIIT) granted it a commercial satellite license, which was the big news.

There were several high-flyers (i.e., outperformers) that got the Icarus treatment, i.e., got their wings clipped, including Zhongji Innolight, which fell -9.09%, Eoptolink Technology, which fell -9.95%, and Victory Giant Technology, which fell -7.57%.

Mainland asset managers are expected to launch a dozen technology-focused bond funds, which is interesting, as it could deter the companies from diluting stock. It also shows the government’s focus on science and technology going into the 15th Five Year Plan is already changing behavior. The NPC Standing Committee met to draft the new bankruptcy and network security laws.

Wind is reporting “the China Passenger Car Association released data showing that the retail sales of narrow sense passenger cars in August were 1.99 million units, an increase of 4.6% year-on-year; In August, the retail sales of New Energy Vehicles (NEVs) in the market reached 1.101 million units, an increase of 7.5% year-on-year.”

August Foreign Reserves increased to $3.32 trillion from July’s $3.29 trillion, beating economists’ expectations.

The South China Morning Post had a good article on LeBron James’s 16th visit to China! I had no idea he was in China or had been to China so many times. It’s a worthwhile read!

New Content

Read our latest article:

Labubus: How Pop Mart’s Newest Craze Reflects Chinese Cultural Influence in the U.S.

Please click here to read

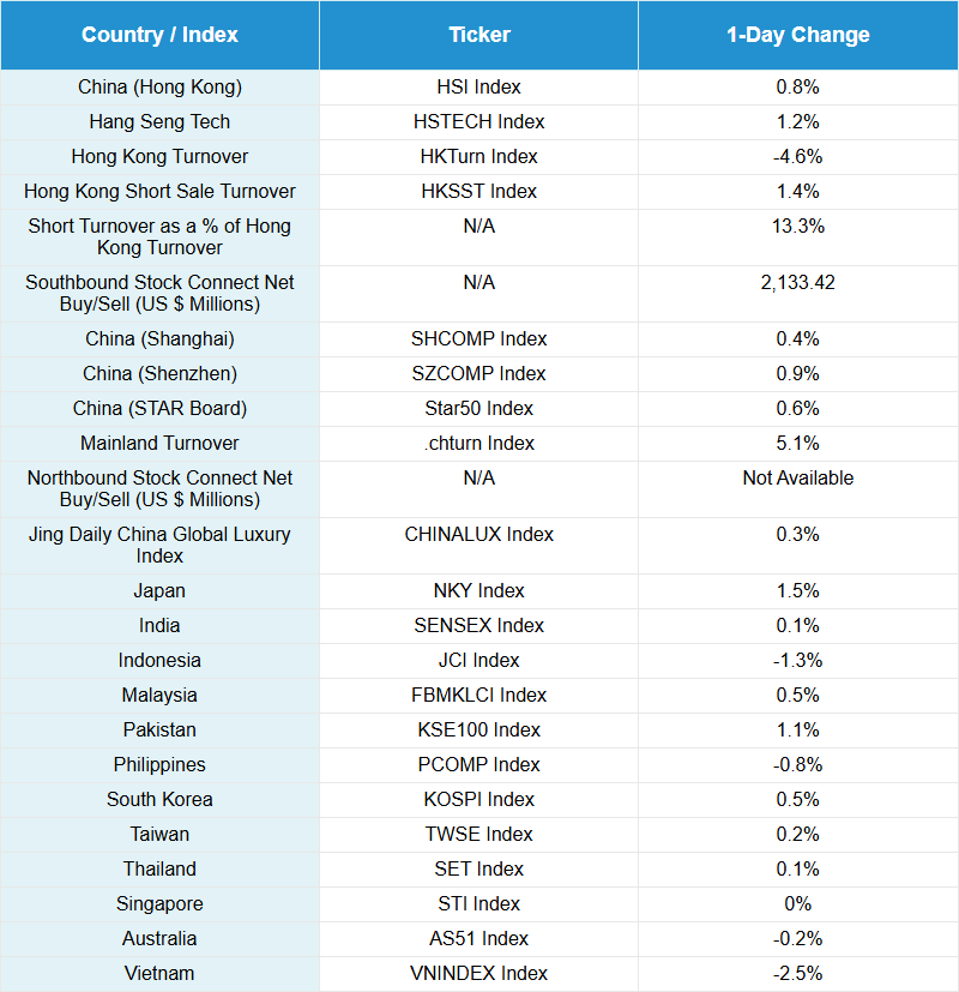

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.13 versus 7.13 yesterday

- CNY per EUR 8.36 versus 8.36 yesterday

- Yield on 10-Year Government Bond 1.85% versus 1.83% Friday

- Yield on 10-Year China Development Bank Bond 1.91% versus 1.88% Friday

- Copper Price -0.26%

- Steel Price -0.10%