Worse-than-expected job growth on Friday sent the S&P 500 lower after reaching a closing high on Thursday.

Job Growth

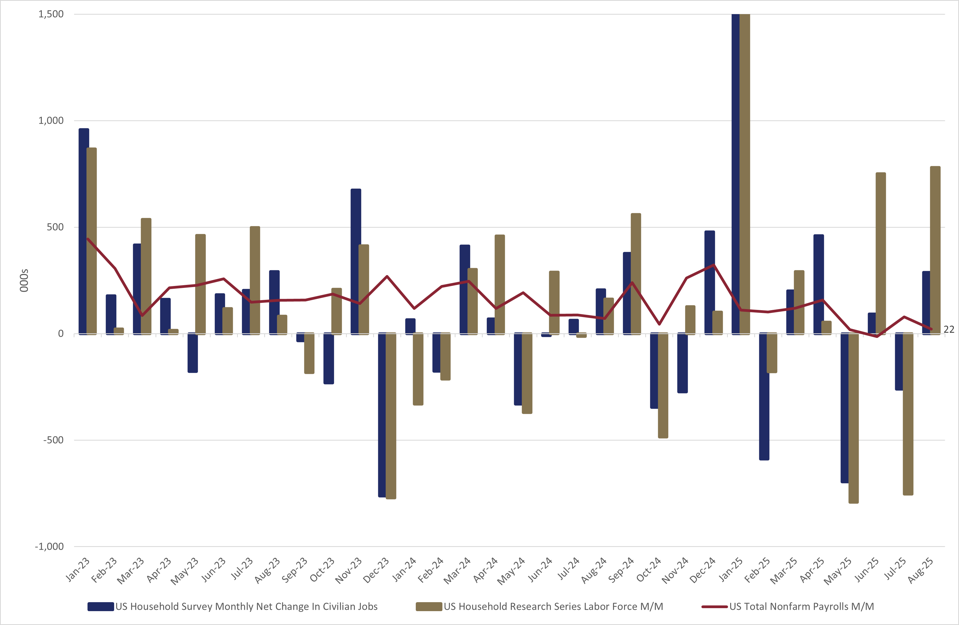

Employment grew by just 22,000 nonfarm jobs, which was below expectations. Previous data was revised slightly lower, though only by 21,000, compared to the massive downward revision last month. The household survey data were solid, with a gain of 288,000 jobs following a decline of 260,000 jobs the previous month. The household survey research series, which aligns with the payroll report criteria, increased by 781,000. The significant increase in the research series is merely little more than a slight reversal of the 753,000 decline from the previous month.

The unemployment rate ticked up to 4.3% from 4.2%. This increase in unemployment was mainly due to relatively positive reasons, with job gains of 288,000 in the household survey and an increase of 436,000 in the labor force.

The underemployment rate is a broader measure of unemployment, which includes “unemployed people, plus everyone marginally attached to the workforce, plus all people employed part-time for economic reasons.” The underemployment rate is 1.5 percentage points above the December 2022 low, while the unemployment rate has risen 0.9 percentage points from its low. The underemployment rate can serve as a leading indicator of unemployment, reflecting the growing slack in the labor market.

Wage growth was below expectations at 3.7% year-over-year, down from 3.9% last month. The average workweek hours held steady at 34.2, just above the five-year low of 34.1 in January, which was depressed by weather and the LA fires.

Monitoring the employment-to-population ratio among prime-age individuals, aged 25 to 54, should signal when concern about the unemployment rate is warranted. The three-month average of the prime-age employment-to-population ratio has been teetering around the current level, but the labor market has remained resilient. It should be monitored closely, but it has been able to maintain a steady level so far and improved fractionally this month.

Initial weekly filings for unemployment benefits remain benign. However, continuing claims for benefits are above the lows, indicating some slowdown in people being rehired after losing their jobs.

Recession Imminent?

The Sahm Rule states that a recession begins when the three-month moving average of the unemployment rate rises by 0.5 percentage points or more relative to its low during the previous 12 months. The three-month average of the US unemployment rate is 4.23%, well below the 4.51% Sahm Rule trigger. The Sahm Rule has had an unblemished historical record of predicting recessions. However, its perfection is in jeopardy since the rule was triggered in July and September 2024 with no economic contraction yet in sight.

Another useful predictor of recessions has been earnings growth, as a recession is typically associated with a year-over-year decline in corporate profits. For this analysis, the NIPA corporate profits are used rather than S&P 500 earnings. NIPA data includes all US companies, including both public and private entities, as well as small companies and S corporations. For the second quarter of 2025, NIPA profits grew by 4.3% year-over-year, which remains positive but looks to be decelerating. Notably, S&P 500 earnings grew at a 12% year-over-year pace; however, much of that rapid growth was driven by technology and artificial intelligence-related companies. Therefore, NIPA provides a better window into the overall economy.

Federal Reserve

Following the weaker jobs data, markets expect three 25-basis-point (0.25%) Fed cuts in 2025. The softer labor market has made a 25-basis-point cut at the Federal Reserve’s September 17 meeting a virtual certainty.

Bottom line: Following the shockingly large downward revision last month, this month’s jobs report makes it clear that the labor market has been softening and is teetering on the edge. These facts will not escape the Fed’s notice, so a September rate cut is now a fait accompli following the release of the monthly payrolls report last week.

Recent Market Performance

The S&P 500 reached an all-time high during the week but declined fractionally on Friday following the release of the jobs report. The Magnificent 7, comprising Microsoft (MSFT), Meta Platforms (META), Amazon.com (AMZN), Apple (AAPL), NVIDIA (NVDA), Alphabet (GOOGL), and Tesla (TSLA), outperformed primarily due to a favorable legal outcome for Alphabet and enthusiasm about Elon Musk’s ambitious Tesla performance targets.

One Chart (Still) Tells The Story

As the threat of recession has waned, as illustrated by the lower betting odds of recession, stocks have rallied to new highs. At the early April stock lows, the massive US tariffs announced on Liberation Day sent the betting odds of recession soaring to 65%. As the tariff threat eased and some progress was made on trade agreements, stocks have recovered sharply. Though the recession odds rose intra-week, the betting odds held steady week-over-week.

What To Watch This Week

There are only four companies in the S&P 500 scheduled to report earnings, but Oracle (ORCL) and Adobe (ADBE) are certainly notable.

Producer (PPI) and consumer inflation (CPI) rates for August are scheduled for Wednesday and Thursday respectively. While a higher-than-expected PPI report would garner attention, the CPI will be more critical, as the extent to which price increases, including those from tariffs, reach consumers is the crucial variable.

CPI is expected to rise year-over-year to 2.9% from 2.7%. The consensus forecast is consistent with the estimates from the Cleveland Fed, so this result is unlikely to hinder the September rate cut. A hot set of inflation reports would likely decrease the number of rate cuts expected in 2025, rather than endangering the September move.

Despite the slight decline on Friday, stocks are still pricing in low odds of recession and forecasting that the Fed will begin rate cuts soon enough for this to remain a soft spot in the labor market rather than a full-fledged downturn. The bond market is less sure of the Fed’s success, with corporate bond spreads widening to levels last seen during the build-up to the tariff worries earlier in the year. While conditions should be monitored closely, there is currently little evidence of an impending recession. However, as noted, some storm clouds are on the horizon that could shift the economy in that direction.