The One Big Beautiful Bill Act (OBBBA), signed into law by President Donald Trump on Thursday, July 4, 2025, makes permanent several of the expiring tax cuts contained in Trump’s signature 2017 tax legislation—the Tax Cuts and Jobs Act (TCJA). It also introduced a handful of new, temporary deductions—including “no tax on tips.”

Under OBBBA, tip income is temporarily deductible—only for tax years 2025 through 2028—for individuals in jobs “which customarily and regularly received tips on or before December 31, 2024, as provided by the Secretary.

So which jobs are covered? The Treasury has released a preliminary list of jobs that qualify. A whopping 68 occupations made the list—and some of them may surprise you.

Eligible Occupations For “No Tax On Tips”

- Bartenders, such as mixologists, barkeeps, and sommeliers;

- Wait Staff, including cocktail waitresses and dining car servers;

- Nonrestaurant Food Servers who serve food to those outside of a restaurant (like hotels or residential care facilities), including room service food servers, boat hoppers, and beer cart attendants;

- Dining Room and Cafeteria Attendants and Bartender Helpers includes those who facilitate food service by cleaning tables or removing dirty dishes, such as bussers and barbacks;

- Chefs and Cooks, ranging from executive and pastry chefs to fast-food cooks, private chefs, food truck operators, and caterers;

- Food Preparation Workers not classified as cooks, such as sandwich makers, salad prep staff, and kitchen stewards;

- Fast Food & Counter Workers, including baristas and ice-cream servers;

- Dishwashers;

- Host Staff in restaurants, lounges, and coffee shops; and

- Bakers—of all kinds (not only breads and pastries—bagel bakers are specifically included, too).

- Gambling Dealers;

- Gambling Change Persons, like slot attendants and mutuel tellers (not a typo—mutuel tellers work in racing and betting environments to process bets, cash winning tickets, and handle transactions);

- Gambling Cage Workers, including cashiers;

- Gambling and Sports Book Writers and Runners, including betting runners, bingo workers, keno runners, and race book writers;

- Dancers, including club dancers and dance artists;

- Musicians and Singers;

- Disc Jockeys, including those who perform in clubs and emcees (but not those on radio);

- Entertainers and Performers, including comedians, clowns, magicians, and street performers;

- Digital Content Creators who produce original content, including streamers, online video creators, social media influencers, and podcasters;

- Ushers, Lobby Attendants, and Ticket Takers; and

- Locker Room, Coatroom, and Dressing Room Attendants, including washroom and bathhouse attendants.

- Baggage Porters and Bellhops, including hotel and curbside airport check-in assistants;

- Concierges;

- Hotel, Motel and Resort Desk Clerks; and

- Maids and Housekeeping Cleaners.

- Home Maintenance and Repair Workers, such as handymen, roofers, window repairers, house painters and floor installers;

- Home Landscaping and Groundskeeping Workers, including lawn mowers, gardeners, tree trimmers, weed sprayers, and an oddly specific nod to those who install “mortarless segmental concrete masonry wall units”;

- Home Electricians;

- Home Plumbers;

- Home Heating and Air Conditioning Mechanics;

- Home Appliance Installers and Repairers;

- Home Cleaning Service Workers, including not only housecleaners, but pool cleaners, carpet cleaners, and windown washers;

- Locksmiths, including safe installers and keymakers; and

- Roadside Assistance Workers, like tow truck drivers, car battery technicians, tire repairers, tire changers, and car fuel deliverers.

- Personal Care & Service Workers, such as companions for the elderly, personal aides, butlers, house sitters, and personal valets;

- Private Event Planners, like wedding and party planners;

- Private Event and Portrait Photographers;

- Private Event Videographers;

- Event Officiants, including wedding officiants, funeral celebrants, and clergy;

- Pet Caretakers, including groomers, walkers, kennel workers, and pet sitters;

- Tutors; and

- Nannies and Babysitters.

- Skincare Specialists, like facialists, spa estheticians, and electrologists;

- Massage Therapists;

- Barbers, Hairdressers, Hairstylists, and Cosmetologists, including wig stylists, beauticians, hair colorists, and hair cutters;

- Shampooers;

- Manicurists and Pedicurists;

- Eyebrow Threading and Waxing Technicians;

- Makeup Artists;

- Exercise Trainers and Fitness Instructors, including yoga teachers and personal trainers;

- Tattoo Artists and Piercers;

- Tailors; and

- Shoe and Leather Workers and Repairers, such as cobblers and shoe shiners.

- Golf Caddies;

- Self-Enrichment Teachers, including knitting instructors, piano teachers, art instructors, and dance teachers;

- Recreational and Tour Pilots, like helicopter tour pilots, hot air balloon aeronauts, and skydiving pilots;

- Tour Guides and Escorts, including museum and sightseeing guides;

- Travel Guides; and

- Sports and Recreation Instructors, including diving, surfing, or ski instructors and tennis teachers/

- Parking and Valet Attendants;

- Taxi and Rideshare Drivers and Chauffeurs;

- Shuttle Drivers, including those at the airport;

- Goods Delivery Personnel, like pizza, grocery, and package delivery workers;

- Personal Vehicle and Equipment Cleaners, such as car washers and detailers, and boat waxers;

- Private and Charter Bus Drivers;

- Water Taxi Operators & Charter Boat Workers;

- Rickshaw, Pedicab, and Carriage Drivers; and

- Home Movers.

See any surprises on the list? (I’ll admit that I wasn’t aware that it was common to tip your roofers.)

The deduction only applies to tips in the listed occupations—not all wages paid to those who work in those jobs. Those who rely on tip-sharing arrangements are covered—meaning, for example, that runners and bussers in restaurants that pool or split tips will qualify. But, for example, runners and bussers who are not tipped won’t qualify.

Who Won’t Qualify For The “No Tax On Tips” Deduction?

Self-employed individuals in a Specified Service Trade or Business (SSTB) under section 199A are not eligible—the same is true for employees whose employer is in an SSTB. That includes businesses that provide professional services, such as doctors, lawyers, consultants, athletes, and brokers—typically, any business whose success depends on the reputation or skill of its employees.

(And yes, I’m sure there are those already contemplating all of the ways that we can combine professional services with a side of entertainment—like clown lawyers and magician doctors—to try to eke in under the rules and out of the exceptions.)

Treasury and the IRS anticipate issuing additional guidance on the types of occupations and trades, or businesses that will fall under this carve-out.

Related Standard Occupational Classification (SOC) System Codes

The preliminary list includes codes from the 2018 Standard Occupational Classification (SOC) System. The SOC system is a federal statistical standard used by federal agencies to classify workers into one of 867 detailed occupations for the purpose of collecting, calculating, or disseminating data. Detailed occupations in the SOC with similar job duties, skills, education or training are grouped together.

The SOC codes on the list, explains Treasury, are those that most closely correlate to the Treasury Tipped Occupation Code (TTOC). However, some occupations described by the TTOC may be either narrower or broader than the Related SOC code occupation to better reflect the occupations in which individuals “customarily and regularly received tips on or before December 31, 2024.” An occupation with a related SOC code that did not “customarily and regularly received tips on or before December 31, 2024” would not be included in the TTOC list.

The “No Tax On Tips” Deduction

Under the new tax law, tip income is temporarily deductible for the tax years 2025 through 2028 and can be claimed whether or not you itemize your deductions. That means it is retroactive to the beginning of this tax year (2025).

It’s important to note that this is a federal income tax deduction, not an exclusion, which means that payroll taxes (Social Security and Medicare) still apply. It also means that tips are reportable—and taxable—at the state and local level.

You must include your Social Security Number on the return and file jointly if married to claim the deduction. The deduction phases out with modified adjusted gross income over $150,000 ($300,000 for joint filers).

The deduction is available to taxpayers who receive qualified tips in occupations listed as customarily and regularly receiving tips on or before December 31, 2024. That’s the purpose of the list released by Treasury—only those with jobs on the can qualify for the deduction.

The deduction is limited to $25,000 of reported qualified tips. Qualified tips are voluntary cash or charged tips (meaning those made by credit card) received from customers or through tip sharing.

The deduction isn’t limited to W-2 wage earners. Self-employed taxpayers can qualify, too, although the deduction cannot exceed your net income (before the deduction) from the trade or business in which the tips were earned.

Additional Considerations For “No Tax On Tips”

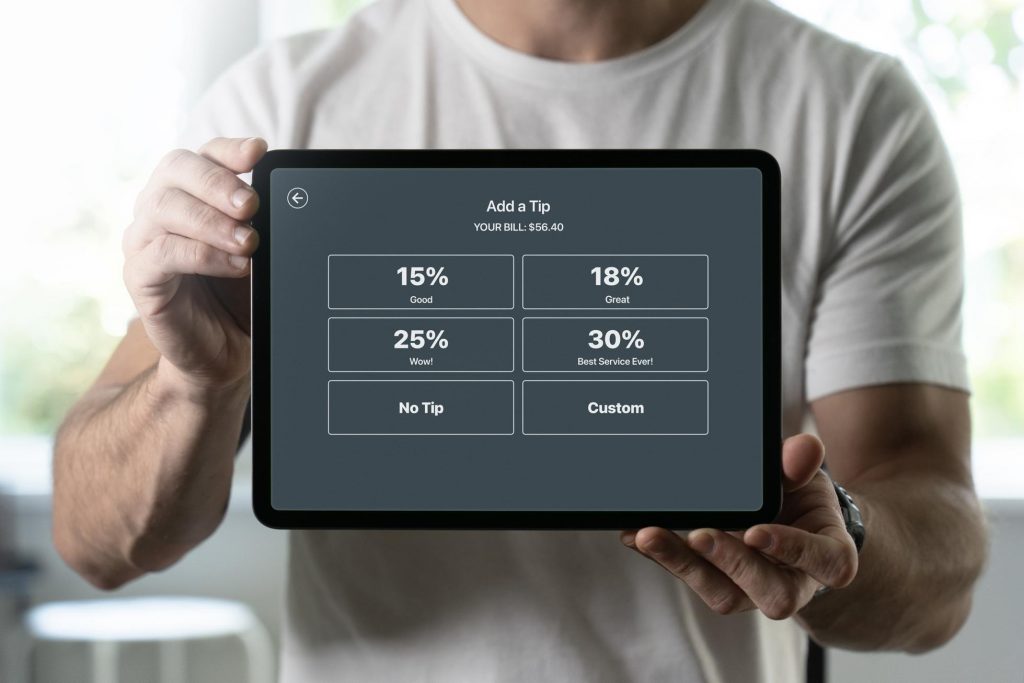

If you think you can just put a tip line on your invoice to avoid paying taxes on compensation, think again. Tips must be paid voluntarily—service charges and mandatory “tips” don’t count towards the deduction.

Don’t let those social media threads on “cash only tips” throw you—the deduction applies to cash or cash-equivalent tips (including those tips on credit cards).

And, since Congress expects workers and employers to be (cough) creative when characterizing wages as tips to avoid paying taxes on otherwise taxable income, Treasury is authorized to issue additional guidance to prevent abuse.

Reporting And Form W-2

The IRS has confirmed that there will be no changes to Form W-2 for the tax year 2025. The IRS has previously said that the omissions are “intended to avoid disruptions during the tax filing season and to give the IRS, business and tax professionals enough time to implement the changes effectively.” There are already spaces for reporting tips on Form W-2—remember that tips must be reported to qualify for the deduction.

Form W-2 has already been redesigned for 2026. As many tax practitioners predicted, the IRS is relying on new box codes to address new deductions, like the tip deduction. Specifically, the new draft Form W-2 includes three new Box 12 codes, including code TP – Total amount of qualified tips (for figuring the new “no tax on tips” deduction).

A new Box 14b will be used to report the Treasury occupation code for an employee’s tipped occupation. Remember, the tips deduction is only available to taxpayers with occupations on the Treasury list. If you qualify, the code for your occupation will end up in Box 14b.

(You can see what the new Form W-2 for 2026 looks like in draft form here.)

As for this year? There are no changes to the forms, but the IRS has indicated that it will provide transition relief for the tax year 2025 to taxpayers claiming the deduction, as well as to employers and payors subject to the new reporting requirements—this means more guidance is yet to come.

Don’t Count Your Deductible Tips Just Yet

The official occupation list will be published in the Federal Register as part of proposed regulations from the Treasury and IRS. Treasury was expected to provide a list by October 2, 2025—the preliminary list, while not yet official, beat that deadline.

Regulations are official interpretations of the law. Since they are so important, federal law generally allows for public comment on proposed regulations. Agencies consider those comments before publishing any final rule. In this case, public comments will be requested on the official proposed list of occupations, as well as other pieces of the proposed regulations like carve outs and additional guidance.

What’s Next?

There’s more information to come on OBBBA, including the “no tax on tips” provision, so check back with Forbes. To keep it easy, I recommend that you subscribe to our free tax newsletter—that way, the information you need will land in your email inbox each Saturday morning with no additional work on your part.