My IPO research provides an alternative to the popular narratives on IPOs.

In April of this year, I warned investors to avoid the Klarna (KLAR) IPO. A few days after my report, the company paused its plans for an IPO due to volatility induced by President Trump’s “Liberation Day”.

Now, with stock markets soaring to new records, and the IPO market rebounding, Reuters reports Klarna will re-attempt its IPO with a valuation target between $13-$14 billion, down from the expected valuation of $15 billion last time. Even at a slightly lower valuation, Klarna earns an unattractive stock rating, and I warn investors should not buy this IPO.

Don’t Take the Bait

Klarna provides buy now, pay later (BNPL) loans to consumers, often with no interest or fees charged to the consumer. With strong revenue growth, Klarna and its bankers are attempting another IPO to capitalize on rising e-commerce spending and consumers’ increased usage of digital payment solutions.

However, in my view, Klarna’s IPO still looks more like a means for current investors to cash out and dump an unattractive stock on unsuspecting public investors. If Klarna’s current investors believed BNPL was the next big revolution in commerce, do you think they’d be marking the valuation down to the targeted $13-$14 billion from the $46 billion valuation from a funding round in 2021? No, this IPO is a fire sale of an overpriced asset.

Red Flags Abound

The company faces competition from many other similar providers, an uphill battle to improve margins, and is not yet profitable. Additionally, for even the most optimistic investors, the projected $13.5 billion valuation is far too high as it implies that Klarna will grow revenue at a 24% compounded annual growth rate while also significantly improving margins through 2032, an unlikely feat.

Add in that the company presents a misleading “adjusted operating profit”, has weak internal controls, offers almost no voting rights to IPO investors, and has less disclosure requirements than U.S.-domiciled companies, and the risks to potential IPO investors are daunting.

Below, I’ll detail these risks and use my reverse discounted cash flow (DCF) model to show the projected valuation is too expensive.

Revenue Rising But Core Earnings Declining

Klarna grew its revenue 22% compounded annually from 2022-2024. In 2024, the company grew revenue 24% year-over-year (YoY). In the first half of 2025, Klarna grew revenue 15% YoY.

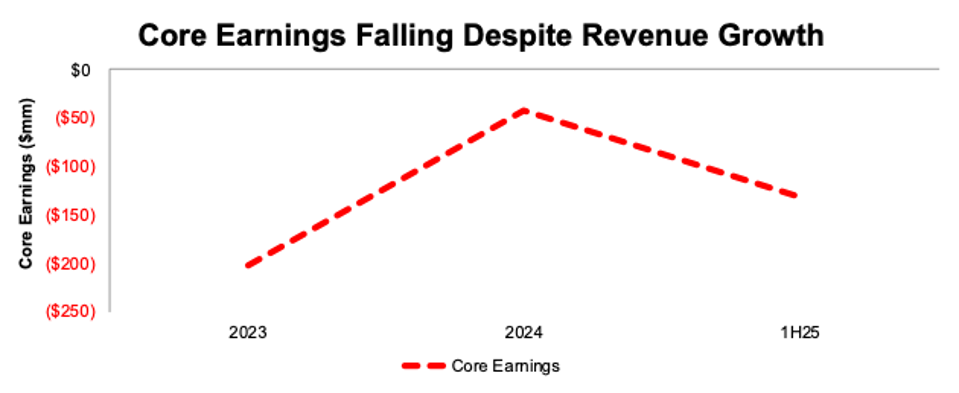

However, in 2025, Klarna’s Core Earnings are trending down. After rising from -$249 million in 2023 to -$43 million in 2024, the company’s Core Earnings are down -$132 million in the first half of 2025. See Figure 1.

Figure 1: Klarna’s Core Earnings: 2023 – 1H25

Not All Bad News

Unlike many of the unprofitable companies that went public during the booming IPO market of 2020-2021, Klarna has been able to scale its business, even if it hasn’t broken even yet.

In 2022, total expenses, which include processing and servicing costs, provision for credit losses, funding costs, technology and product development, sales and marketing, customer service and operations, general and administrative, and depreciation, amortization, and impairments, were 151% of revenue. In 2023 and 2024, total expenses fell to 114% and 104% of revenue, respectively. However, expenses reversed that trend and rose to 109% in the first six months of 2025 (1H25).

The ability to grow revenue rapidly while keeping costs in check is rare, especially for a business that has not come close to turning a profit. I do not rule out the possibility that the company could eek out a small profit in the future. But, achieving the profits implied by the expected IPO valuation is highly improbable.

Figure 2: Klarna’s Expenses as % of Revenue: 2022 – 1H25

Market Trends Look Positive for Klarna

There’s no doubt that buy now pay later (BNPL) offerings have gained popularity in recent years. The growth in the industry can be attributed to many factors according to Klarna’s 2024 F-1 and 2Q25 6-K:

- Growth in digital wallets – usage is expected to grow 20% compounded annually through 2027,

- Consumer spending growth – e-commerce global retail sales are expected to grow 12% compounded annually through 2027 and

- Low trust in banks – in 2024, only 30% of U.S. consumers had trust in their bank and its practices.

Klarna further notes in its 2Q25 6-K that it considers its serviceable addressable market (SAM) to be $500 billion. The SAM is calculated by applying Klarna’s TTM ended 2Q25 take rate to the estimated $18 trillion spent in 2023 on annual consumer retail and travel spending in markets where Klarna operates.

I recently cautioned about falling for the hype around high growth rates in my report on CoreWeave, and I am doing so again for Klarna. Anytime billions flow into an industry, competition ramps up and margins generally decline. Investors need to avoid stocks that are too expensive because they carry heightened risk because they embed huge revenue growth and super high margins far into the future.

There are also other risks of investing in Klarna, as I’ll show below.

$1.7 Trillion Elephant in the Room

Klarna’s growth-at-all-costs strategy earned it the most gross merchandise volume (aka total dollar value of purchase on its network) and more active users than its two pure-play BNPL peers, Affirm (AFRM) and Afterpay (owned by Block, ticker XYZ).

For reference, Klarna generated $112 billion in GMV in the TTM, compared to Affirm’s $34 billion. Afterpay, owned by Block, last reported $8.2 billion in GMV in 3Q24, which equals $33 billion in GMV when annualized.

However, compared to PayPal (PYPL), the pure-play BNPL companies are tiny. PayPal generated $1.7 trillion in total payment volume (TPV) in the TTM.

Figure 3: Comparing Users and GMV: BNPL Competitors: TTM

* User data from end of 2023, when Afterpay last disclosed users

**Annualized based on latest disclosed GMV of $8.24 billion in 3Q24

Numerous Undifferentiated BNPL Competitors

As I noted in my original Danger Zone report on Affirm, a large number of undifferentiated providers are in the BNPL business. Each offers generally the same service, deferred payments for purchase that are interest free or at low interest rates. Some firms cater to specific types of purchases, but the underlying operations and value proposition of each firm are the same. Here’s a list of many of the pure-play BNPL firms:

- Klarna

- Affirm

- Afterpay

- Sezzle

- GreenSky

- Splitit

- Zip

- Openpay

- Perpay

- Monzo

- Revolut

Catch-22: Take Share at the Cost of Profitability

Because the pure-play BNPL companies offer undifferentiated services, the best way for them to take market share and replace a key competitor is to charge lower fees. That’s how Klarna won Walmart (WMT) from Affirm early in 2025. Supplanting a key competitor should bode well for Klarna, right?

Unfortunately, not.

Given the decline in Klarna’s profitability in 1H2025, the Walmart deal does not appear to have been good for margins. It was not good for investors either as Klarna gave Walmart 15.3 million stock warrants, worth ~$500 million, as additional incentive to work with them.

The takeaway is that BNPL companies do not have a lot of options for growing their businesses and becoming profitable. Frankly, I see the pure-play BNPL companies as trapped between two bad business strategies:

- take share and sacrifice profitability or

- seek profitability but lose market share.

Unfortunately for potential investors in Klarna’s IPO, its valuation already implies the company will escape the catch-22 and rapidly grow revenue and improve margins at the same time, a rare and an unlikely feat for any pure-play BNPL company.

Traditional Firms Also Compete with Pure-Play BNPL Firms

Not only does Klarna compete with a large number of pure-play BNPL firms, but it also competes with more traditional banking companies that provide BNPL or similar options to their clients.

- JPMorgan Chase (JPM)

- Capital One Financial Corp (COF)

- American Express Company (AXP)

- Bank of America Corp (BAC)

- Citigroup (C)

- Synchrony Financial (SYF)

- Mastercard (MA)

- Visa (V).

Lack of Profits Is a Significant Competitive Disadvantage

Klarna’s low profitability compounds the challenges listed above. Per Figure 4, Klarna has the second lowest NOPAT margin and return on invested capital (ROIC) amongst its main competitors.

It is worth noting that, per Figure 4, the only two companies that don’t generate an ROIC and NOPAT margin above 0% are Klarna and Affirm, the two pure-play BNPL companies. Each of the other companies, including PayPal (PYPL), JPMorgan Chase (JPM), American Express (AXP), Synchrony Financial (SYF), etc. have more profitable business lines.

Given the competitive limitations of pure-play BNPL companies compared to more diversified companies in the business, I do not see sustainable profitability in Klarna’s future.

Figure 4: Klarna’s Profitability Vs. Competition: TTM

Big Red Flag #1: Presenting Misleading Profits

Many high growth and/or unprofitable companies present non-GAAP metrics to appear more profitable than they really are, in hopes of justifying a higher valuation. Klarna is no different.

Klarna provides investors with “adjusted operating profit,” and, not surprisingly, this contrived metric gives a more positive picture of the firm’s business than GAAP net income and my economic earnings.

For instance, Klarna reports adjusted operating profit of $32 million in 1H25, which is much higher than GAAP net income of -$153 million and economic earnings of -$270 million. See Figure 5.

Why would the company overstate its results by so much? Maybe, the bankers are pushing this narrative to reap a big payday with the IPO?

Figure 5: Klarna’s Adjusted Operating Profit, GAAP Net Income, and Economic Earnings: 2023 – 1H25

Big Red Flag #2: Weak Internal Controls

Even after I adjust the company’s numbers to get the right metrics in place, I don’t know if I can trust the financials because the company identified material weaknesses in its internal control over financial reporting. In fact, the company deemed its IT-dependent controls relevant to the preparation of the consolidated financial statements were ineffective in 2022 and 2023. That’s a pretty big red flag.

Ernst & Young, in the auditor’s report in the F-1 says: “We [Ernst & Young] were not engaged to perform an audit of internal control over financial reporting”…”accordingly we express no such opinion”.

In my opinion, the auditor’s report makes this big red flag even bigger.

The company notes that it has initiated a remediation plan. However, the remediation measures cannot be deemed effective until they have been operating for a sufficient period of time.

I was hoping there might be a positive update on this matter in the company’s latest 6-K filed at the end of August of this year. Unfortunately, the best the company could do is state that, as of December 31, 2024, management is unable to conclude that the material weakness was remediated. That update does not inspire a lot of confidence considering the company has had so long to remedy the matter.

Weaknesses in internal controls increase the risk that the company’s financials are fraudulent and/or misleading.

It is important for investors to note that these disclosures mean, from a legal perspective, that they’ve been given fair warning and will have no legal recourse to recoup any losses related these disclosures.

Big Red Flag #3: IPO Investors Get Almost No Voting Power

Similar to its 2024 F-1, in its 2Q25 6-K Klarna disclosed it will go public with dual class shares. Class A shares will be offered as part of the IPO. These class A shares will receive one vote per share and class B shares will receive 10 votes per share. Class C shares will also receive 10 votes per share. This super voting class gives existing shareholders significant say over corporate governance matters.

In the Risk Factors section of its 2Q25 6-K, Klarna notes that “the multi-class structure of our share capital has the effect of concentrating voting control with those shareholders who held our share capital prior to this offering, including our co-founder and chief executive officer.”

While Klarna has not provided a specific number of shares being sold in the upcoming IPO, which means ownership percentages are not yet available, one thing is clear. New shareholders will have little say in the corporate governance of the company.

Big Red Flag #4: Foreign Filer Exemptions

The SEC considers Klarna a foreign private issuer. As a result, Klarna is exempt from certain provisions that would normally be required of U.S. publicly-traded companies.

Klarna notes that the provisions the company is exempt from include:

- the sections of the Exchange Act regulating the solicitation of proxies, consents, or authorizations in respect of a security registered under the Exchange Act;

- the sections of the Exchange Act requiring insiders to file public reports of their share ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and

- the rules under the Exchange Act requiring the filing with the SEC of quarterly reports on Form 10-Q containing unaudited financial and other specified information, or current reports on Form 8-K upon the occurrence of specified significant events.

Additionally, Klarna will not be required to file its annual report until four months (120+ days) after the end of each fiscal year. Normally, U.S. companies have 75 after their fiscal year end to file.

Beyond the SEC, the New York Stock Exchange (NYSE) allows foreign private issuers to follow “home country” corporate governance practices. Klarna notes in its F-1 and most recent 6-K that it intends to take advantage of certain exemptions including:

- the requirement to obtain shareholder approval for certain issuances of securities,

- the requirement that there be regularly scheduled meetings of only the independent directors at least twice a year.

- the requirement to disclose within four business days any determination to grant a waiver of the Code of Conduct (as defined herein) to directors and officers.

- the quorum requirements applicable to meetings of shareholders.

Ultimately, because of its status as a foreign private issuer, investors in Klarna will not receive the same protections, safeguards and disclosures as they would from a comparable U.S. company.

Valuation Implies Rapid Revenue Growth and High Margins

I think the stock holds large downside risk at its projected $13.5 billion valuation, especially considering all the red flags I’ve identified.

When I use my reverse discounted cash flow (DCF) model to analyze the future cash flow expectations baked into KLAR, I find that the $13.5 billion valuation embeds very optimistic assumptions about margins and growth. Indeed, the IPO valuation implies the company will achieve a dramatic improvement in margins and grow at above-industry rates simultaneously.

Specifically, to justify its a $13.5 billion valuation, my model shows that Klarna would have to:

- immediately improve NOPAT margin to 9% (slightly below Block’s TTM NOPAT margin, compared to Klarna’s -1% TTM margin) and

- grow revenue by 24% compounded annually (above projected industry growth rate through 2032) through 2032.

In this scenario, Klarna’s revenue would reach $15.7 billion in 2032, or 5.6 times higher than the company’s 2024 revenue and nearly 70% of Block’s TTM revenue.

In this scenario, Klarna’s NOPAT would reach $1.4 billion in 2032, or 59% of Block’s TTM NOPAT, compared to Klarna’s -$84 million NOPAT in 1H25.

If I assume Klarna maintains a take rate (amount of revenue for each dollar of GMV on the platform) of 2.7% (equal to TTM ended June 30, 2025), then this scenario implies Klarna’s GMV in 2032 equals just under $582 billion, compared to TTM GMV of $112 billion.

For context, Amazon’s (AMZN) 2024 (calendar year) U.S. GMV is estimated at $792 billion. In other words, Klarna would need to generate three-fourths the GMV of Amazon to justify its projected valuation.

Also keep in mind, companies that grow revenue by 20%+ compounded annually for such a long period are also “unbelievably rare”, making the expectations in Klarna’s projected valuation even more unrealistic.

There’s 25%+ Downside If Sales Grow In-Line with the Industry

Even if Klarna can maintain revenue growth rates in line with the industry, and drastically improve margins, the stock has large downside risk.

If I assume:

- NOPAT margin immediately improves to 8% and

- revenue grows 21% compounded annually (projected industry growth rate through 2032) through 2032, then,

the stock would be worth $10.0 billion today – a 26% downside to the projected IPO valuation.

In this scenario, Klarna’s revenue would reach $12.9 billion in 2032, or 4.6 times higher than the company’s 2024 revenue.

This scenario also implies Klarna’s NOPAT would reach $1.0 billion in 2032. If I again assume Klarna maintains a take rate of 2.7%, then this scenario implies Klarna’s GMV in 2032 equals just over $478 billion, up from $112 billion in the TTM.

There’s 50%+ Downside If Margins Don’t Improve as Much

Lastly, I put together a scenario assuming margins improve, but not as much as in the previous scenarios, due to the competitiveness of the industry and propensity of peers to undercut pricing.

If I assume:

- NOPAT margin immediately improves to 5% and

- revenue grows 21% compounded annually (projected industry growth rate through 2032) through 2032, then,

Klarna would be worth just $6.2 billion today – a 54% downside to the projected IPO valuation.

This scenario implies Klarna’s NOPAT would reach $646 million in 2032.

Figure 6 compares Klarna’s implied future NOPAT in these scenarios to its historical NOPAT. For reference, I include Block’s 2024 NOPAT.

Figure 6: Projected IPO Valuation Looks Too Expensive

Each of the above scenarios assume Klarna grows revenue, NOPAT, and FCF without increasing working capital or fixed assets. This assumption is highly unlikely but allows me to create best-case scenarios that demonstrate the high level of expectations embedded in the projected IPO valuation. For reference, Klarna’s invested capital increased 41% YoY in 2024.

The economic book value, or no-growth value, of KLAR is -$4.08 per share.