Meituan Q2 Earnings Review

Meituan reported second quarter financial results after the Hong Kong close that missed analyst expectations on revenue, adjusted net income, and adjusted earnings per share (EPS). The company described JD.com’s recent entry into restaurant delivery as “intensified competition in the food delivery sector.” In reality, this has proven to be a significant negative for the balance sheets and stock prices of both companies, as aggressive competition has eroded investor confidence.

Contrary to the perception that China’s markets are anti-capitalist due to government intervention, competition in China remains intense, with “winners” only emerging after surviving persistent industry headwinds. Despite JD.com diverting profits from its core online electronics business and burning capital in restaurant and instant E-Commerce delivery, Meituan stated, “Despite intensifying competition, our on-demand delivery business solidified its market position in the second quarter.” In effect, JD.com’s move has so far accomplished little except damaging sector stock prices.

Fortunately, broad diversification across multiple stocks and subsectors, such as mobile payments, online video, online gaming, and online travel, has led Meituan to demonstrate resilience. The E-Commerce sub-sector was mentioned as part of the anti-involution campaign, but progress remains pending. Notably, Alibaba Group only generates approximately 10% of its revenue from restaurant delivery through its Ele.me unit.

Meituan’s share price has declined just over 40% from its peak in early October 2024, and is down roughly 73% from its all-time high in March 2020. At its all-time high, Meituan reported first quarter 2020 revenue of Renminbi (RMB) 16.75 billion, compared to RMB 91.84 billion in this year’s second quarter. This represents a five-fold revenue increase, while the stock is 73% below its peak!

- Revenue increased 11.7% year-over-year to RMB 91.84 billion (analyst expectation was RMB 93.7 billion, a 14% increase).

- Adjusted Net Income declined 89% to RMB 1.493 billion (from RMB 13.61 billion; analyst expectation was RMB 9.85 billion, a 28% decrease).

- Adjusted Earnings per Share (EPS) declined 90% to RMB 0.22 (from RMB 2.20; analyst expectation was RMB 1.55, a 30% drop).

- The company repurchased 3,018,700 shares in the first half of the year.

Key News

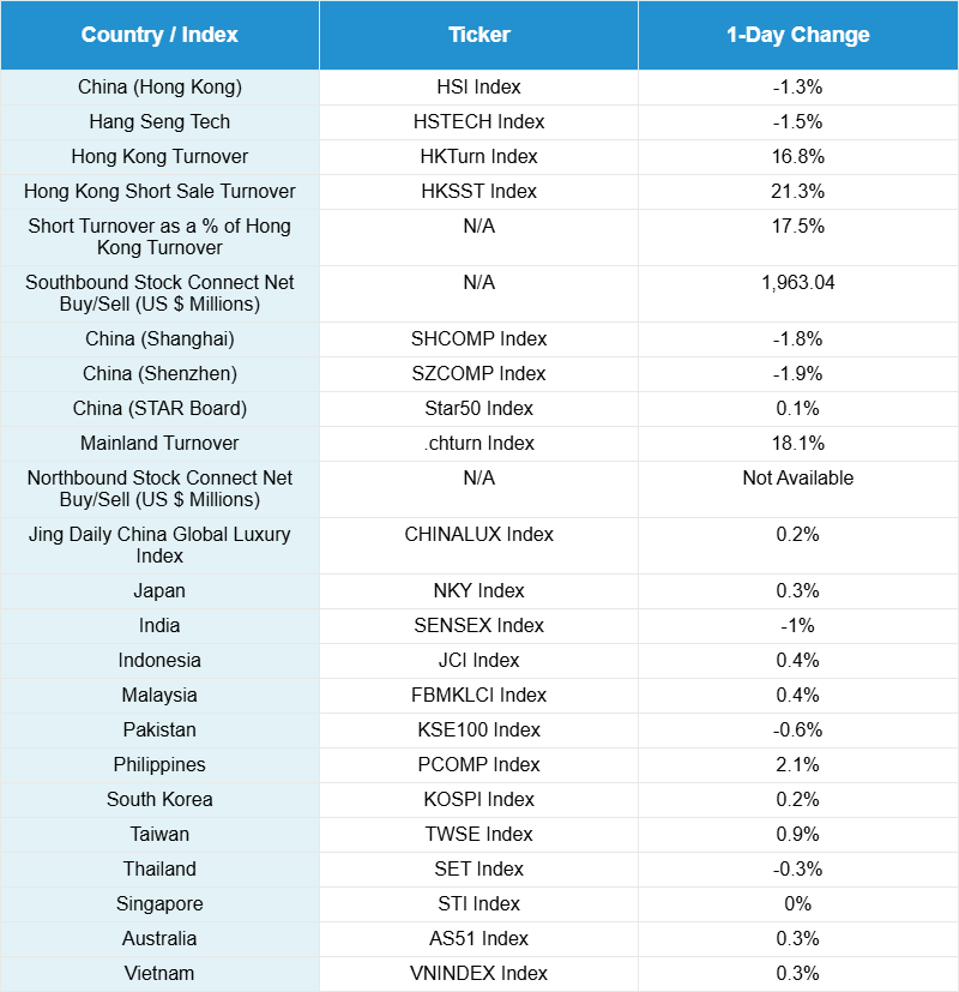

Asian equities were mixed overnight as a stronger US dollar weighed on Hong Kong and Mainland China’s markets. India was closed for Ganesh Chaturthi, a major Hindu festival celebrating the birth of Lord Ganesha, the deity of wisdom and new beginnings.

Both Hong Kong and Mainland China opened higher, following yesterday’s post-close announcement of significant Chinese government policy support for artificial intelligence (AI). However, markets reversed in the afternoon on aggressive profit taking that erased the previous two days’ gains.

A sharp drop in FTSE A50 Index futures traded in Singapore was cited by some media outlets as a trigger for the profit-taking moves, though the underlying cause for the sell-off remains unclear. Despite the volatility, the Hang Seng Index remained above the 25,000 level, the Shanghai Composite Index finished at 3,800, and the Shenzhen Component Index closed just below 2,400. As noted in yesterday’s post, the AI news reporting after the close indeed triggered a sharp move, consistent with recent gains observed after the DeepSeek AI model upgrade.

The STAR Board outperformed, driven by Cambricon Technologies Corporation Limited (688256 CH), which reported a staggering 4,425% year-over-year increase in second quarter revenue to RMB 1.77 billion. CNBC highlighted Cambricon’s $40 billion market capitalization and potential to become China’s equivalent of Nvidia.

The pullback came despite new consumption stimulus, as the Ministry of Commerce announced plans to unveil additional policies to expand service consumption in September, though no specific date was provided. Mainland investors made net purchases of $1.97 billion via Southbound Stock Connect, including notable inflows into the Hong Kong Tracker ETF and Alibaba. Market breadth was poor, and both Hong Kong and Mainland China appear technically stretched, suggesting the potential for near-term consolidation. Market sentiment remains constructive, but a pause may allow investors to reevaluate and capitalize on any market dip.

A lesser-discussed aspect of President Trump’s announcement of 50% tariffs on India is the limited exposure of United States companies to Indian revenue. While tracking United States company revenue exposure to China has long been discussed, only one United States-listed company, Genpact Limited, generates more than 20% of its revenue in India (at 52%), compared to 27 companies that meet this threshold in China.

New Content

Read our latest article:

Labubus: How Pop Mart’s Newest Craze Reflects Chinese Cultural Influence in the U.S.

Please click here to read

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.16 versus 7.15 yesterday

- CNY per EUR 8.29 versus 8.33 yesterday

- Yield on 10-Year Government Bond 1.80% versus 1.76% yesterday

- Yield on 10-Year China Development Bank Bond 1.86% versus 1.85% yesterday

- Copper Price -0.14%

- Steel Price -0.45%