PDD Holdings Q2 Earnings Overview

E-commerce company PDD Holdings reported Q2 financial results before the US market opened that beat analyst expectations for top-line revenue slightly, by 0.05%. The company beat expectations for adjusted net income by 46% and adjusted EPS by 42%.

During the earnings call, management acknowledged the fierce competition in the E-Commerce space in China. “Revenue growth further moderated this quarter amid intense competition,” said Ms. Jun Liu, Vice President of Finance. Management also maintained its reputation for being exceedingly direct, stating they could not be confident that the company would remain profitable by repeatedly stating: “We do not believe this quarter’s profit levels are sustainable and fluctuations in profitability is likely to continue in the coming quarters.” While the honesty is appreciated, it arguably crosses the line into self-defeating as the stock gave up strong early gains of +9% from Friday’s close to barely higher.

% Changes are Year-over-Year (YoY)

- Revenue increased +7% to RMB 103.98 ($14.52 billion) from RMB 97.06 billion, versus analyst expectations of RMB 103.93 billion

- Adjusted Net Income decreased -5% to RMB 32.708 billion ($4.57 billion) from RMB 34.43 billion, versus analyst expectations of RMB 22.39 billion

- Adjusted Earnings per Share (EPS) decreased -5% to RMB 22.07 ($3.08) from RMB 23.24, versus analyst expectations of RMB 15.50

Key News

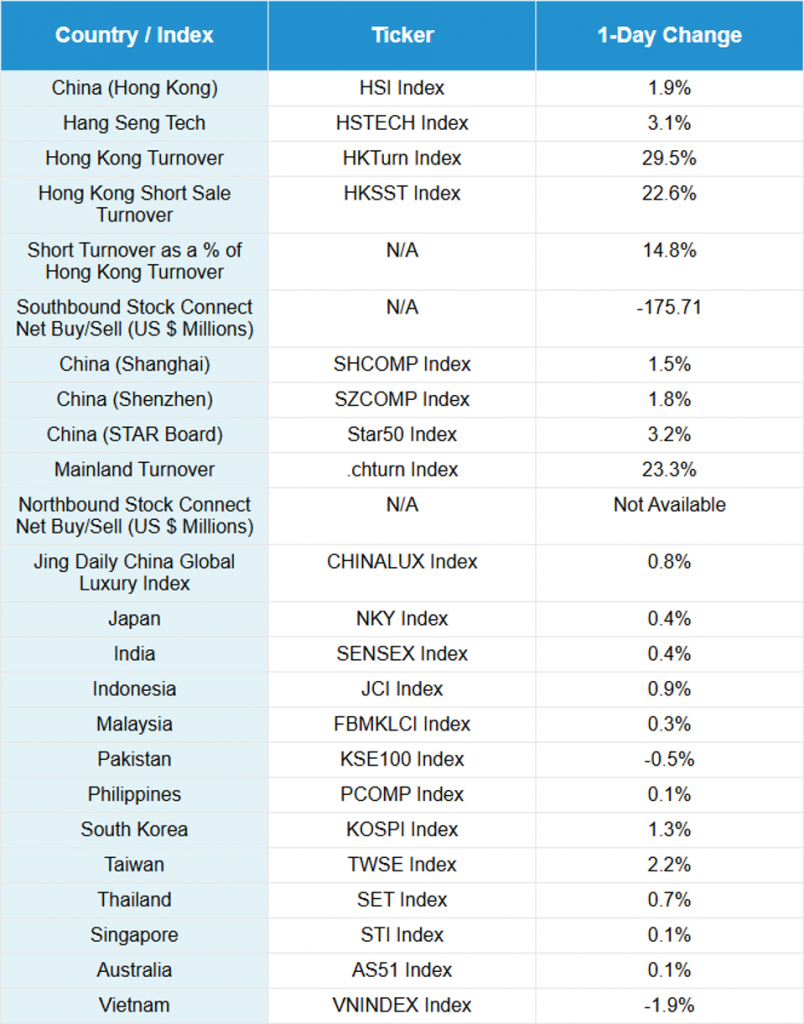

Asian equities had a strong start to the week following Jerome Powell’s dovish press conference from Jackson Hole on Friday, which raised hopes for a September US interest rate cut. Mainland China, Hong Kong, Taiwan, and South Korea outperformed, while Vietnam underperformed, and the Philippines was closed for National Heroes Day.

Hong Kong and Mainland China gapped higher from Friday’s close, posting robust returns on very high volumes. Bloomberg stated it was the second-highest volume day ever in Mainland China. Going into the session, Mainland media reiterated the recent State Council release on continued support for consumer goods subsidy trade-ins. Growth stocks and subsectors led both markets, along with non-ferrous metals.

A key catalyst that led the real estate sector higher in Mainland China, where it gained +4.28%, and Hong Kong, where it gained +3.5% after six Shanghai government departments released the “Six Rules for the Real Estate Market” focused on “…reducing housing purchase restrictions, optimizing housing fund, optimizing personal housing credit, and improving individual housing property tax.” The key points were:

- “There will be no limit on the number of units purchased by eligible residents outside the outer ring.”

- The home purchase loan amount will be increased by 15%.

- There will “No longer be a distinction between the first and second home in terms of interest rate pricing”

- Non-resident, first-time home purchases are exempt from property taxes.

Separately, the Shanghai Municipal Government and People’s Bank of China (PBOC), China’s central bank, also announced that home loans will no longer note whether the loan is for a first or a second home. The second home loan rate was 3.25%, versus 3.05% for first home loans, thus providing an incentive. The move follows a May 2024 decision to eliminate the higher down payment for second homes at 35% versus the first home at 20%.

Hong Kong-listed growth stocks had a powerful day as the volume leaders by value with Alibaba, which gained +5.51% on volume 4X pre-September 2024 stimulus levels, followed by Tencent, which gained +2.42%, and Semiconductor Manufacturing International (SMIC), which gained +1.58%.

Dongfeng Motor Group gained +54.1% after announcing a go-private deal.

Mainland investors were small net sellers today via Southbound Stock Connect, as the Hong Kong Tracker ETF hit, though Alibaba was a net buy. Semiconductors, technology hardware, and electrical equipment stocks all had strong days.

The initial work started on the 15th Five Year Plan for “national economic and social development.”

July‘s foreign direct investment (FDI) “improved” to -13.4% from June’s -15.2%.

A local broker is reporting that at the end of July, Mainland China’s ETF market is now Asia’s largest, with $640 billion in total assets, exceeding Japan’s $622 billion.

Meituan will report after the close in Hong Kong on Wednesday.

MSCI’s Semi-Annual Index Review will be implemented tomorrow, though not Friday or at the month-end, due to next Monday being the Labor Day market holiday in the US.

New Content

Read our latest article:

Labubus: How Pop Mart’s Newest Craze Reflects Chinese Cultural Influence in the U.S.

Please click here to read

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.16 versus 7.17 Friday

- CNY per EUR 8.37 versus 8.40 Friday

- Yield on 10-Year Government Bond 1.76% versus 1.78% Friday

- Yield on 10-Year China Development Bank Bond 1.86% versus 1.89% Friday

- Copper Price 0.70%

- Steel Price 0.90%