JD.com Q2 Earnings Overview

- Revenue +22% to RMB 356.7B ($49.7B) versus estimate RMB 335.5B ($46.8B)

- Net Income RMB 5.6B ($0.8B)

- Margin 1.6%

- Earnings per Share (EPS) RMB 5.0 ($0.7) versus estimate RMB 3.8 ($0.5)

JD.com beat estimates on both top-line revenue and bottom-line net income. The revenue surge was mainly driven by strong growth from instant commerce, mainly through promotions. The net income hit was not as bad as expected, though it did decline 50% quarter-over-quarter. Other alternative income sources, including lower taxes and tax rebates, benefited net income and operating profits. Growth in the crucial home appliance segment was more substantial than expected. Meanwhile, logistics and other revenue increased more than overall revenue, by over 30% year-over-year. According to analysts, JD also continues to increase mindshare in non-traditional product categories. All in all, it was a solid beat as analysts were expecting the worst, us included.

NetEase Q2 Earnings Overview

- Revenue +9% to RMB 27.9B ($3.9B) versus estimate RMB 28.3B ($3.9B)

- Net Income RMB 9.5B

- Margin 30%

- Earnings per Share (EPS) RMB 14.8 ($2.1) versus estimate 15.0 ($2.1)

NetEase missed estimates for total revenue and slightly missed estimates for earnings per share. The slight miss in game revenue sent the stock lower in Hong Kong overnight. The new agreement with Blizzard/Microsoft should help with profitability, though, over the long term. Evergreen titles performed well. The dividend released this quarter was significant, at one-third of net profits, while buybacks slowed, which is happening all over the internet as share prices recover. The market reaction to NetEase’s earnings was likely overblown, but the company has done well so far this year, a top-performer in the internet space.

Key News

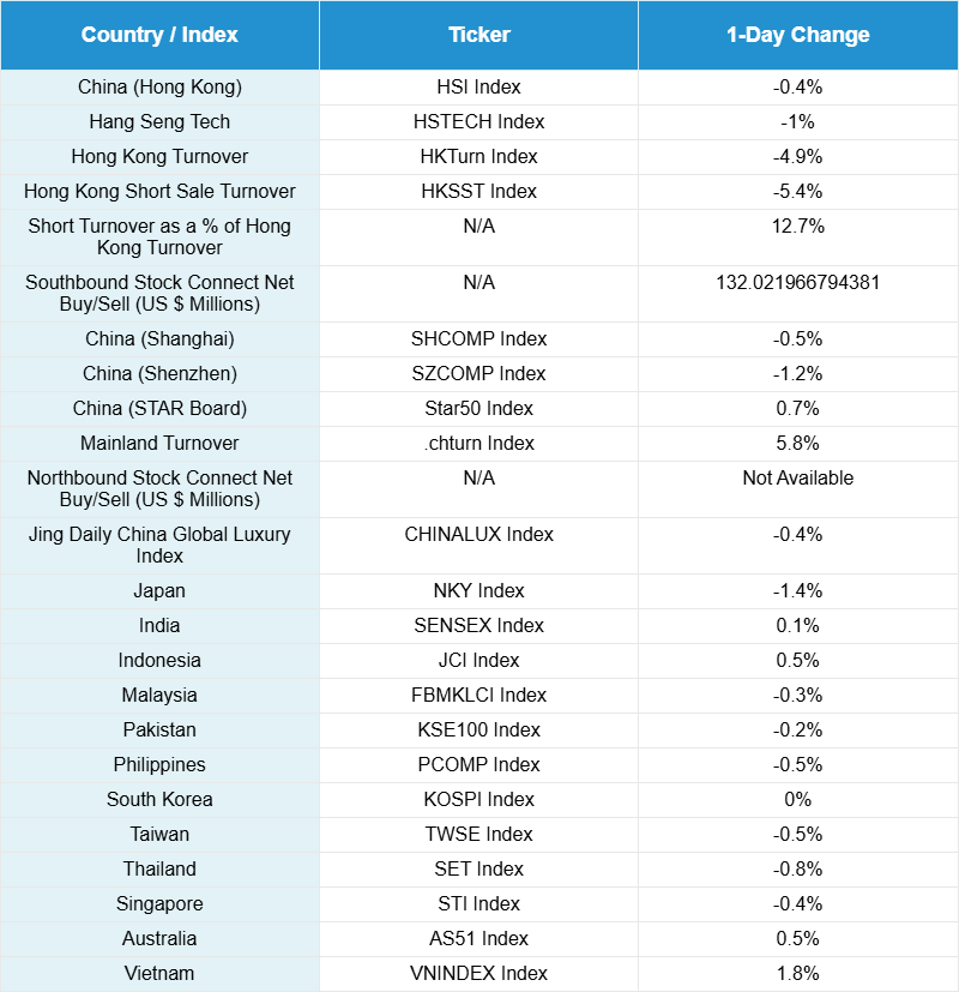

Asian equities were mostly lower overnight, as Vietnam and Mainland China’s STAR Market outperformed, while Japan and Hong Kong underperformed.

Volumes were substantial overnight in Mainland China, as the STAR Market, which is the Nasdaq of China, gained, while the overall market was lower. Turnover reached a staggering 151% of the 1-year average last night. Bloomberg released a commentary that investors globally are clamoring for Asian exposure. The piece also noted that China is currently favored over India, though the latter could be a better opportunity for fixed income investment due to an impending S&P credit upgrade.

Meanwhile, China’s government bonds are prime for a sell-off, as investors pivot to equities globally. That is good! Yields in China are rock-bottom and need to rise. The inflation story is also favorable for equities over bonds. China’s chronic deflation looks to be coming to an end thanks to key policies, especially “anti-involution”, i.e. the calming of price wars in E-Commerce, and overcapacity curbs for electric vehicles and solar panels, among other industrial outputs. Meanwhile, the consumption push is gradually gaining steam, with the latest development supporting consumer borrowing. However, this takes time, as evidenced by China’s flat consumer price index (CPI) in July.

Real estate was the top-performing sector in Hong Kong overnight on further assurances that the government will buy up unsold homes to turn them into affordable housing. Most of the troubled developers are now out of the market. Real estate equities in Hong Kong, those left, are seeing demand from investors and appreciating. Their bonds are still trading at discounts, which means they could be the next opportunity for investors.

Internet names were mixed overnight, as investors await earnings releases. Social media platform Weibo also reported Q2 earnings overnight, beating many estimates on positive advertising and user growth. Vipshop reported too, beating estimates on net income and revenue on a recovery in apparel sales, which are the platform’s bread-and-butter.

New Content

Read our latest article:

Labubus: How Pop Mart’s Newest Craze Reflects Chinese Cultural Influence in the U.S.

Please click here to read

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.17 versus 7.18 yesterday

- CNY per EUR 8.37 versus 8.39 yesterday

- Yield on 10-Year Government Bond 1.73% versus 1.73% yesterday

- Yield on 10-Year China Development Bank Bond 1.85% versus 1.83% yesterday

- Copper Price -0.49%

- Steel Price -1.82%