Most investors would never guess the world’s hottest stock market in 2025. Here is a clue: it was nearly bankrupt a decade ago. The answer is Greece. The MSCI Greece Index is up more than 70% this year, more than double the return of broader European indices and far ahead of the S&P 500. Just a decade ago, Greece was at the center of the European debt crisis, forced into three bailouts and facing 10-year government bond yields above 36%. Today, it borrows at rates 0.50% below the United States and on par with France, and its stock market is booming.

From Crisis To Recovery

The 2009 global recession exposed years of overspending and weak tax enforcement in Greece, triggering a full-blown sovereign debt crisis. By 2012, the country had accepted three bailouts from the European Union and the IMF, and there was rampant speculation that it would be tossed out of the Euro system. The economy went into a tailspin. Unemployment peaked at 28%, GDP shrank by approximately 27% from peak to trough, and nearly half of assets on banks balance sheets were non-performing.

Painful reforms were unavoidable. Lenders believed austerity measures were the answer and forced Greece into making politically unpopular but economically required structural changes. The fiscal budget was slashed, uncompetitive wages were cut, tax collection was enforced and wide-spread corruption was tackled. At first, the austerity measures deepened the downturn, but they laid the foundation for a dramatic recovery.

Over the last decade, the government has pushed through structural reforms that modernized the economy. Rapid digitization of public services and the myDATA e-invoicing system improved tax revenues. Privatization of the Piraeus Port and regional airports attracted foreign investment and upgraded infrastructure. Changes to bankruptcy laws allowed Greek banks to clear out bad loans, slashing the non-performing loan ratio from 49% to around 3% for the largest banks.

A surge in tourism after the pandemic also helped generate growth. The added revenue and reforms had a meaningful impact. Greece’s debt-to-GDP ratio fell from over 200% to about 153%, unemployment dropped to 7.9%, and the European Commission projects GDP growth of 2.3% in 2025, well above the Eurozone average.

The Greek Stock Market Rally

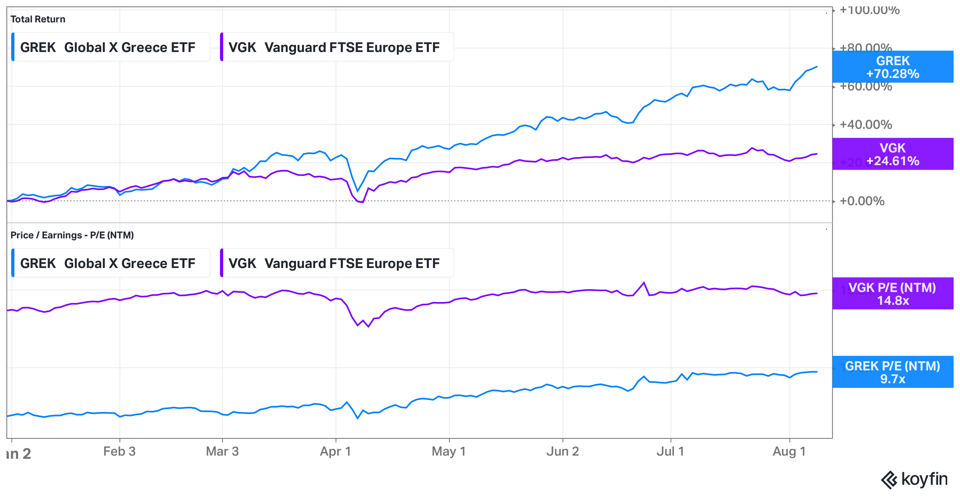

The stock market has rewarded the improved outlook. Performance of the Global X Greece ETF, ticker GREK, reflects the improved outlook. It has rallied 70% in 2025 compared to 25% for the broader European market. The outperformance is led by banks, which represent a 50% weight in the portfolio.

According to Malcolm Dorson, Head of Emerging Markets at Global X, Greek equities offer a compelling investment opportunity that combines emerging market growth prospects with developed market stability. Dorson thinks there is more room to run, noting that the “Potential reclassification of Greek equities to developed market status by FTSE Russell and MSCI could attract significant passive inflows.”

Valuations remain attractive. GREK trades at a price-to-earnings ratio of 9.7 versus 14.8 for the Vanguard FTSE Europe ETF. That discount, combined with a 4% dividend yield, has drawn in both momentum and value-oriented investors.

Who should consider Greek stocks? They may appeal to momentum investors seeking diversification who subscribe to Peter Lynch’s growth at a reasonable price philosophy. Greece offers economic expansion, corporate earnings growth, and an equity market trading at a meaningful discount to much of Europe. While the upside may not match the explosive gains of U.S. technology leaders, the valuations are far more modest, providing an opportunity to capture growth without paying a lofty premium.