Key News

Asian equities had a strong, resilient day despite President Trump’s tariff threats as the US dollar weakened overnight. Hong Kong and Mainland China fell during morning trading, though grinded higher with a value bias in both markets, though Hong Kong internet stocks had a positive day.

Strong July trade data helped lift markets with Exports +7.2% versus expectations of 5.6% and June’s 5.8% while Imports +4.1% versus expectations of -1% versus June’s 1.1%. ASEAN continues to be China’s largest export destination ($54B), followed by the EU ($50B) and then the US ($35B). So China isn’t collapsing despite US tariffs? Hmmm.

With that said, healthcare in Hong Kong -3.81% and Mainland China -0.53% fell on President Trump’s threat of tariffs on pharmaceuticals with Mainland-listed Beigene -4.02%, Hong Kong-listed Akeso -8.06% and Wuxi AppTec -4.3%.

Apple’s ecosystem was higher after announcing a White House investment deal with Mainland-listed Foxconn +3.95%, Luxshare +2.24%, Hong Kong-listed Sunny Optical +3.3%, and AAC Tech +2.14%. Xiaomi -3.98%, Hong Kong’s most heavily traded by value, after a broker downgrade on mobile phone sales concerns. Alibaba +2.14% after announcing new AI models.

After I bragged about them yesterday, Mainland China’s internals were notably weak as mega-cap banks and oil helped keep market indices higher, which is why Shanghai (value stocks) outperformed Shenzhen (growth stocks).

Real estate was the top performer in Hong Kong +2.07% and Mainland China +1.16% following the Shanghai government’s announcement that the implementation of the Shanghai Urban Renewal Action Plan will begin in 2026, running through 2028. I assume older housing projects will be torn down and replaced.

Distressed/overleveraged Hong Kong-listed New World Development +10.19% on chatter that the company is working on a $2.5B financing deal with Blackstone, though after the close, the company denied the rumor. Remember, due to the evisceration of overleveraged real estate developers during China’s housing downturn, only seven stocks in Hong Kong and six stocks in China qualify for MSCI indices, which is why we prefer to play housing company bonds versus the stocks. Additionally, the bonds, which are rated high yield, offer a near double-digit yield, though I still can’t find any investors interested.

The Ministry of Industry and Information Technology (MIIT) and seven other government agencies, including the NDRC, announced “Implement Opinions on Promoting the Innovation and Development of Brain-Computer Interface Industry”. I am pretty confident my wife believes I need a brain computer chip.

The Ministry of Finance commented on China’s demographics, stating that “population development” was a focus, and several supporting measures were implemented, such as the recent free preschool education benefiting 12 million people. S&P kept China’s sovereign credit rating at an “A” with a “stable” outlook.

The 2025 World Robot Conference kicks off in Beijing today through the 12th, followed by the “world’s first world humanoid robot games” also in Beijing starting on August 14th. Huayan Robot is expected to announce an Hong Kong IPO to raise $200mm. Tesla’s Optimus humanoid robot is expected to enter China’s market later this year, with 1 million robots made within the next five years, according to a Mainland media source. This follows Unitree’s recent announcement, which is rumored to be heading to a Hong Kong listing, launching its R1 humanoid robot for CNY 39,900 ($5,558).

New Content

Read our latest article:

KraneShares KOID ETF: Humanoid Robot Rings Nasdaq Opening Bell

Please click here to read

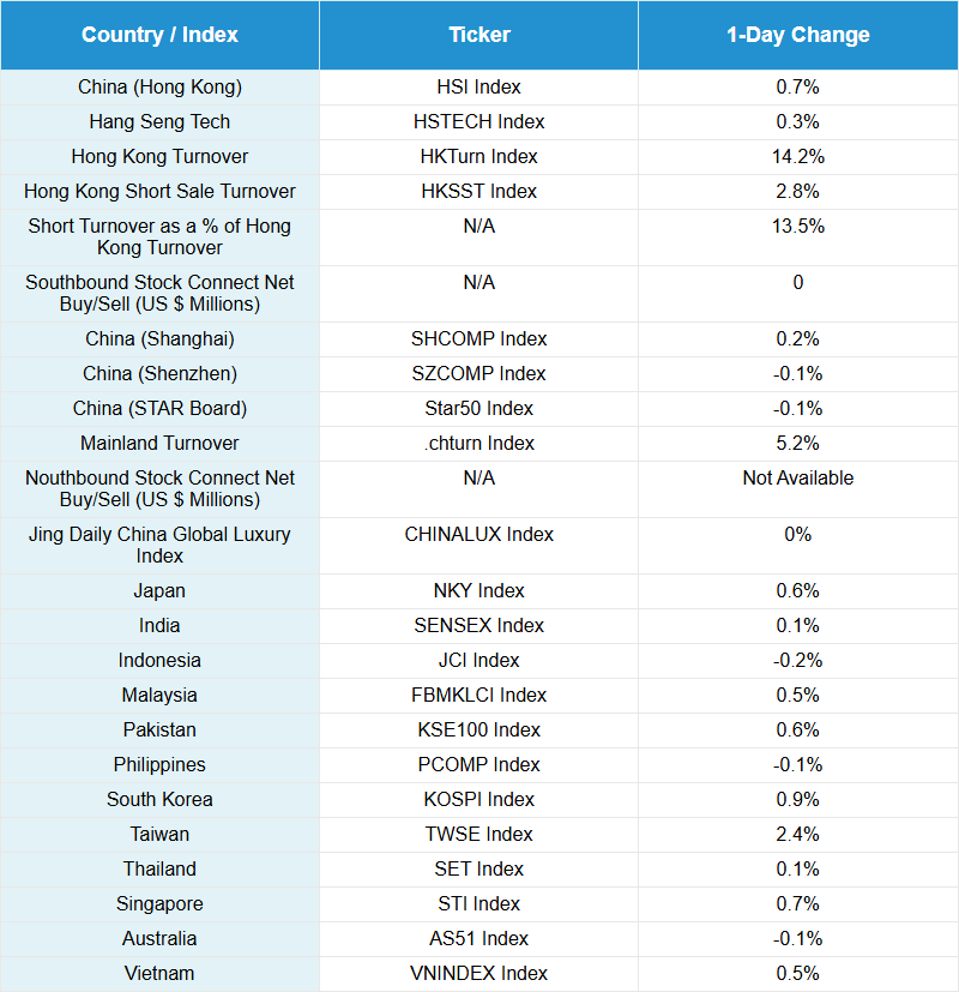

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

CNY per USD 7.17 versus 7.18 yesterday

CNY per EUR 8.37 versus 8.33 yesterday

Yield on 10-Year Government Bond 1.69% versus 1.70% yesterday

Yield on 10-Year China Development Bank Bond 1.78% versus 1.79% yesterday

Copper Price +0.28%

Steel Price +0.19%