Key News

Asian equities were largely higher overnight, led by Vietnam, Singapore, and the Hang Seng Tech Index, while Japan underperformed.

The Asia Dollar Index gained versus the US dollar, as CNY appreciated following last week’s weakness on Trump tariff concerns. The Hang Seng Index snapped a four-day losing streak as local investors recognized the importance of the National Development and Reform Commission’s (NDRC) anti-involution announcement aimed at Alibaba, JD.com, and Meituan for their instant commerce price war on Friday.

Alibaba’s Hong Kong share class appreciated 1.04% on Friday, while its US listing fell -2.95%! This was similar to the price action in JD.com, which fell -0.16% in Hong Kong on Friday, while its US listing fell -1.84%.

Growth stocks and subsectors led Hong Kong higher, including Tencent, which gained +2.80%, Xiaomi, which gained +2.15%, Kuaishou, which gained +3.22%. Meanwhile, reports that the Chinese government wants assurances from Nvidia that there is no “backdoor” on its H20 chips, leading Semiconductor Manufacturing International (SMIC) to gain +2.90% and Hua Hong Semiconductor to gain +8.69%. Alibaba was off -0.6%, though the ADR is rebounding, as it was at a -1.73% discount to the Hong Kong share class this morning. In addition to semiconductors, metal and mining stocks followed gold prices higher, while online entertainment continues to outperform, led by Kuaishou, Tencent Music Entertainment, which gained +8.70%, and Bilibili, which gained +1.45%.

Baidu gained +0.7%, though, after the close, it announced a Robotaxi partnership with Lyft in Europe, with services in Germany and the UK slated to launch in 2026.

It was a solid day in Hong Kong overall, as 81% of the Hang Seng Index constituents are above their 200-day moving averages, as the market took a healthy breather last week. Let’s see if the pullback turns previous resistance into support.

Southbound Stock Connect saw very large sells in the Hong Kong Tracker and Hang Seng China Enterprise ETFs, with $2.30 billion worth of outflow today, though Alibaba had a strong day of net buying. Mainland investors had bought a very healthy, abnormally large $10.56 billion worth of Hong Kong-listed stocks and ETFs from July 24th to last Friday.

Oil & gas names were mostly lower in both Hong Kong and Mainland China.

Mainland investors’ appetite for stocks is increasing as evidenced by July’s new brokerage account openings, which increased 71% year-over-year (YoY) to 1.96 million, though the month-to-month data can be volatile based on market performance.

As in Hong Kong, growth stocks outperformed in Mainland trading, as the Shenzhen gained +0.78% and the STAR Board gained +1.22%, versus Shanghai, which gained +0.66%. There was some chatter of the National Team buying ETFs, though favored ETFs did not have above-average volume.

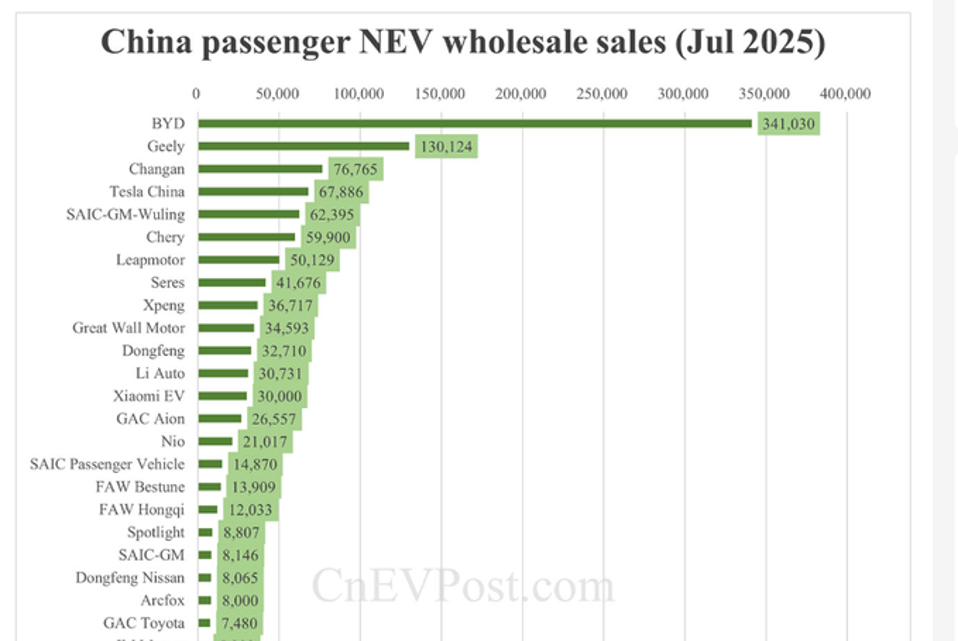

Over the weekend, the China Passenger Car Association (CPCA) announced July new energy vehicle (NEV), which includes EVs and hybrids, sales of 1.18 million, which is up +25% YoY, though down -4% from July. BYD led auto makers, with 341,030 units sold in July, followed by Geely’s 130,124 units, Changan’s 76,765 units, and Tesla’s 67,886 units, according to CnEVPost. Year-to-date (YTD) NEV sales are up +35% to 7.6 million YoY. Sounds good to me!

Live Webinar

Join us on Wednesday, August 6th, at 11 am EDT for:

Private AI Unicorn Access: How Our AI ETF Opens Doors to xAI and Anthropic

Please click here to register

New Content

Read our latest article:

KraneShares KOID ETF: Humanoid Robot Rings Nasdaq Opening Bell

Please click here to read

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.18 versus 7.19 Friday

- CNY per EUR 8.32 versus 8.29 Friday

- Yield on 10-Year Government Bond 1.71% versus 1.71% Friday

- Yield on 10-Year China Development Bank Bond 1.79% versus 1.76% Friday

- Copper Price -0.06%

- Steel Price -0.75%