Friday was a down day for the major averages, and they closed the week slightly negative. But they closed out August significantly in the green, especially the small-cap Russell 2000.

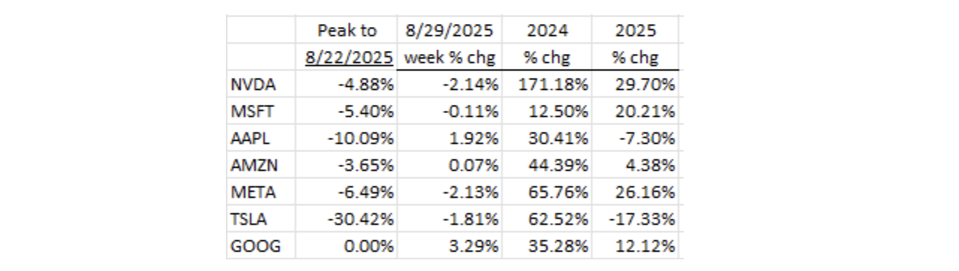

The Magnificent 7 were mixed for the week. Nvidia and Meta were off more than -2% with Tesla right behind. While Google hit a new high on Friday, the other six are significantly off their peak values (see table). The week was generally a downer, especially for tech.

Fed Independence

The independence of the Fed is an important topic. And it should be a consideration in the current controversy over President Trump’s assertion that he can fire (for cause) sitting Fed governors.

In its 1913 legislation, the Congress wisely made the monetary authority separate and distinct from the sitting Administration so that monetary policy couldn’t be a White House tool, especially during an election cycle.1 (Note that since fiscal policy is overseen by Congress, the Administration doesn’t directly control either monetary or fiscal policy.) The Fed’s Federal Open Market Committee (FOMC) is composed of the seven members of the Board of Governors of the Fed, the President of the Federal Reserve Bank of New York, and four of the remaining 11 Federal Reserve Bank Presidents (with these four positions rotating every year). Note that all the Reserve Bank Presidents attend the policy meetings and participate in the discussions – the above describes the voting dynamics.

The U.S. President has the power to nominate a person to fill an empty Fed Board of Governors’ seat. Recently, President Trump has nominated Stephen Miran, his current Chairman of the Council of Economic Advisers, to fill a Board of Governor seat recently vacated by Adriana Kugler. The President can theoretically also fire a sitting Board member, but only for “cause.”

Now here is the controversy: The President has “fired” Governor Lisa Cook (who was appointed by President Biden in 2022). The reason (i.e. “cause”): after a deep dive by Bill Pulte, Trump’s appointed Director of the Federal Housing Finance Agency, it was discovered that Governor Cook purchased two properties within two months of each other, both of which she claimed as her “primary residence” and a third property which she listed as a “second home.” The mortgage rates she obtained were lower than the rates on “investment” properties. One of the properties was put up “for rent” soon after closing. “Mortgage fraud” is the accusation.

This is still early days. It is likely that the courts will decide whether or not this rises to the “fraud” level and whether or not Trump has the power to terminate her. And if he does, under what circumstances (i.e., is the “mortgage fraud” accusation viable?).

As of this writing (Friday, August 29th), a court hearing in Washington D.C., requested by Governor Cook to bar the President from firing her, ended without an immediate ruling. Meanwhile, the Fed has a dilemma – do they allow Lisa Cook to remain as a voting committee member? Will the Chair or the other six Governors ask her to take a leave of absence until the courts decide (which is what they should do)? Or will they do nothing? As Chairman of the Board, this would appear to fall on Powell’s plate.

Our view over the past few months has been that current economic conditions warrant lower interest rates. At the Fed’s recent Jackson Hole Symposium, Chairman Powell signaled that the Fed would be embarking on a rate cutting campaign beginning in September. The President is going to get his wish. So, while we certainly don’t condone what Governor Cook did on her mortgage applications, we don’t see any victims. The lenders haven’t been hurt, which is the argument the President made when he was accused of exaggerating his financial net worth when he applied for bank loans several years ago when he was a citizen/businessman.

The Slowing Economy

Confidence: The Conference Board’s Consumer Confidence Index fell in August to 97.4 from 98.7 in July.3 A year ago, this was sitting at 105.6, so nearly an 8% pullback. The behavior of consumer spending and debt delinquencies reinforce this reading. As a side note, in September ’07, just prior to the financial crisis, this index was 99.5. So, there is less confidence now than at the start of the Great Recession. In August, 29.7% of survey respondents said jobs are “plentiful.” That was down from 29.9% in July.3 Additionally, 20.0% of respondents said jobs are “hard to get,” up from 18.9% in July. This slow softening in the labor market confirms data we see elsewhere. The lower level of consumer confidence manifests itself in consumer intentions to purchase a home or auto, both of which are now at depressed levels.

Housing: When housing struggles, it is a sure sign of a weakening consumer (and economy). The Case-Shiller Home Price Index (20 City Index) fell in June (the latest data) by -0.25%. While, mathematically, that doesn’t seem like much, the fact that this index has deflated for four months in a row is significant. The last time there were four declines in a row was in late ’22-early ’23, and before that, 2012. On a year/year basis, prices are up +2.1% (negative after taking inflation into account). A year earlier (June ’24), the year/year price change was +6.4%.

Weakness in housing is also seen in lower rents which have been slowly deflating since the middle of 2023.

Other indicators per Rosenberg Research (August 27 – Breakfast with Dave): 1) “For Sale” signs: +15.7% year/year, a decade high; 2) Unsold Inventory: +7.3% year/year while demand has fallen -8.2%; 3) Mortgage, auto, and credit card delinquencies have risen with mortgage delinquency at a four year high.

Jobs: The National Bureau of Economic Research (NBER) is tasked with dating Recessions. Their key indicators include Industrial Production which peaked in June, and Real Personal Income which peaked in April. Consumption, probably the most important indicator, appears to be stagnating as seen from the delinquency charts above. The missing link is Nonfarm payrolls (NFP). The -258K revision to the May and June NFP gives us insight into the labor market. The net job gain for May was +19K and for June +14K (the markets have become used to +150K monthly job gains).2 In our view, it is likely that July’s +73K will be revised downward. And let’s not forget that the Bureau of Labor Statistics (BLS) adds about +80K uncounted jobs per month via their Birth/Death model. In reality, the actual NFP counts have likely been negative since at least May.

Final Thoughts

The independence of the Fed is an important issue. Fed Governors shouldn’t be subject to bullying by the President or members of this Administration as is clearly happening today. The best outcome, in our view, is for the courts to rule that there is insufficient cause for Governor Cook’s removal by the President. So far, while there has been a court hearing, there has been no court ruling. In addition, we think the other six members of the Board of Governors should become active and decide Governor Cook’s fate.

The economy is slowing. Consumer Confidence has fallen and housing, always an early barometer of the state of the economy, is “stagnating” at best. Rents continue to fall and mortgage delinquencies are at a four year high, as are credit card and auto loan delinquencies.

The NBER uses four key criteria to date Recessions: Industrial Production, Real Personal Income, Consumption, and the Labor market. Industrial Production and Real Personal Income have already peaked, and Consumption has stagnated. The -258K negative revisions to May and June Non-Farm Payrolls indicate a softening labor market. Recession appears to be a high odds probability.

Robert Barone, Ph.D.

(Joshua Barone and Eugene Hoover contributed to this blog.)

Disclosures:

Robert Barone, Joshua Barone and Eugene Hoover are investment adviser representatives with Savvy Advisors, Inc. (“Savvy Advisors”). Savvy Advisors is an SEC registered investment advisor. Material prepared herein has been created for informational purposes only and should not be considered investment advice or a recommendation. Information was obtained from sources believed to be reliable but was not verified for accuracy.

Ancora West Advisors, LLC dba Universal Value Advisors (“UVA”) is an investment advisor firm registered with the Securities and Exchange Commission. Savvy Advisors, Inc. (“Savvy Advisors”) is also an investment advisor firm registered with the SEC. UVA and Savvy are not affiliated or related.

References:

2 https://www.bls.gov/news.release/empsit.nr0.htm

3 https://www.conference-board.org/topics/consumer-confidence/