Whenever the Fed Chairman gives a speech, there is always the possibility that it will move markets. That’s why such speeches are usually devoid of policy changes. But Powell’s speech on Friday morning (August 22nd) was different. At the Fed’s annual Jackson Hole Symposium, Powell not only gave a nod toward a rate cut at the upcoming September 16-17 FOMC meeting, but his dovish tone implied that the September rate cut would be the first of several. The result was a large up day for the equity markets. For the week through Thursday, equities were showing weakness with the S&P 500 down -1.2% for the week and the Nasdaq even lower (-2.4%) (see table). But, at Friday’s close, spurred by Powell’s dovish speech, the markets more than recovered, with three of the four major indexes in positive territory for the week (only the tech heavy Nasdaq was slightly negative).

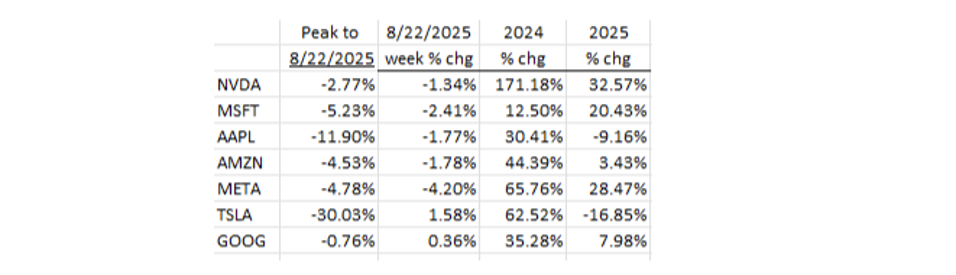

Five of the Magnificent 7 were down for the week, with only Tesla and Google showing modest gains. The last two columns in the table below tells one why these are called “Magnificent.” The price advances in 2024 were truly spectacular, and except for Tesla and Apple, prices have advanced again in 2025, with three of the seven showing double digits.

Inflation

The headline CPI for July came in at +0.2% M/M. On a Y/Y basis, the CPI is up 2.7% and the core (ex- food and energy) showed up at the expected +0.3%. That pushed the year/year core rate up to +3.1% in July from +2.9% in June. Then we had a Producer Price Index (PPI) that spiked +0.9% in July – the markets were expecting +0.2%, so a big miss. In fact, this was the sharpest increase since March ’22. The Fed had to be torn between the hotter than expected CPI (and especially the PPI) numbers and the weakening labor market, its “other” mandate, especially since the BLS revised the May and June jobs numbers down by -258K on August 1st.1 That was a record revision going back to at least 1979. Prior to the next Fed meeting in mid-September, the BLS will report both August’s inflation data and jobs numbers. Because of Powell’s dovish speech, markets currently think that a 25-basis point rate cut is a lock. August’s inflation data will be a crucial input. A benign number could push the Fed into a 50 basis-point move.

But we don’t think that is likely. Looking at the year/year change in the CPI by month from January to July, we see that the inflation rate was 2.999% in January, and it declined to 2.334% by April. But, it has been creeping up since, and by July, it was 2.732%. The Fed surely has to be concerned about this, especially if the rising trend continues. This makes the August data critically important.

The Fed’s Mandate

The Fed has a dual mandate: maximum employment and minimal inflation. The inflation side has been front and center for the last three years. But, the weakening labor market just tipped the scales. The May-June downward job number revisions of -258K put the net gain for May at +19K and for June at +14K. Furthermore, July’s initial +73K estimate ‘disappointed’ the financial markets (and likely the Fed, too) which had become used to numbers in the +150K range. (Note: That +73K July job number is likely to be revised lower as all the labor market indicators have recently shown weakness – thus Powell’s promise to move toward ease.)

In his speech, Powell stated that “…the labor market is not particularly tight and faces increasing downside risks…” and, as a result, there is little chance of “adverse wage-price dynamics.” In other words, wage demands are not currently a factor in pushing up inflation. As for tariffs, Powell said that “a reasonable base case is that the [price] effects will be relatively short-lived…”

Housing

According to Rosenberg Research (Breakfast with Dave, 8/19/25 edition), spending in the construction industry has been contracting, led by a -9.3% decline (six month annualized basis) in residential construction spending. Over those 6 months, housing starts are down nearly -24%, building permits are off -11.4%, new single-family homes sold fell nearly -24%, existing home sales were off more than -16% with their median price off -4.0%. Existing Home Sales fell -2.7% in June from May.2 Housing starts fell significantly in May (-9.7%) from April and recovered about half of that fall (+4.6%) in June. Further to home prices, the Case-Shiller Home Price Index fell in August for the third straight month, a rare event in the post-Great Recession era. The National Association of Home Builders’ Sentiment Index for August was tied for the lowest level since December ’22.3

The housing industry is especially sensitive to interest rates. Interest rates impact the cost to build but have a much greater impact on home purchases especially regarding mortgage interest payments. As this blog has noted in the past, the rents calculated for the Consumer Price Index (CPI) by the Bureau of Labor Statistics (BLS) have a 35% weight in the CPI. In the past, we’ve pointed out that the rents used by the BLS are lagged by a year. The chart below shows New Tenant Rents versus the BLS Survey data. A quick and dirty back of the envelope calculation that substitutes the New Tenant Rent Index for the BLS Survey indicates that the year/year change in the CPI would be negative if the current (not lagged) New Tenant Rent Index were used. So, going forward, we can expect significant downward pressure on the CPI from rents over the next year. In addition, the University of Michigan’s Consumer Sentiment Survey indicated that plans to buy a home fell to an index level of 32 in August. It was 40 in July’s survey. Note that, according to Rosenberg Research, an index level of 32 is one of the weakest levels ever recorded. Thus, in our view, it’s not a wonder why the Fed Chair turned dovish at the Jackson Hole Fed conclave.

Other Indicators

Most of the indicators regarding the health of the economy showed up weaker, leading us to believe that the economy has slowed and that the probability of recession has risen.

- The University of Michigan’s Consumer Confidence Index fell to 58.6 in August. It was 61.7 in July and 71.7 back in January. The average for this survey back to 1952 is 85. Of concern is the rise in one-year inflation expectations to 4.9%. In January, this number was 3.3%. Likely, the media’s unwavering attention to the inflation picture has played a role.

- The NY Fed’s Services Index registered -11.7 in August. This is even lower than July’s lowly -9.3. This index has been negative for 11 months in a row.

- It is also strange to note the divergence in Q3 (July through September) GDP forecasts from the Atlanta Fed (+2.3%) and the NY Fed (+2.1%) vs that of the folks at the St. Louis Fed (-0.3%). We wonder what their economists see that the folks in Atlanta and NY don’t?

- We’ve commented on consumer credit card and auto loan delinquencies in our past blogs. The chart below shows the rise in those delinquencies. Clearly the consumer is tapped out. Thus, our view that the economy is slowing and the risk of Recession has risen. Fed ease can’t come soon enough.

Robert Barone, Ph.D.

(Joshua Barone and Eugene Hoover contributed to this blog)

Disclosures:

Robert Barone, Joshua Barone and Eugene Hoover are investment adviser representatives with Savvy Advisors, Inc. (“Savvy Advisors”). Savvy Advisors is an SEC registered investment advisor. Material prepared herein has been created for informational purposes only and should not be considered investment advice or a recommendation. Information was obtained from sources believed to be reliable but was not verified for accuracy.

Ancora West Advisors, LLC dba Universal Value Advisors (“UVA”) is an investment advisor firm registered with the Securities and Exchange Commission. Savvy Advisors, Inc. (“Savvy Advisors”) is also an investment advisor firm registered with the SEC. UVA and Savvy are not affiliated or related.

References