Those who live in rental properties and feel financial pressure every time they pay rent should know that it’s not just them. Misery offers at best some comfort to the afflicted. Reality is the opposite, and the future looks like a challenge.

Late Payments Pile Up

Chandan Economics, a data provider and consultancy to the commercial real estate industry, which includes apartment buildings, posted last week about an independent landlord rental performance report. There was good news for smaller landlords: the August on-time payment in rental units grew by 0.34 percentage points to 83.2%. (The report doesn’t show the late payments because it can take time for final information to come in.)

However, that was a slight change from a trend that started in April 2023, as on-time apartment rent payments had been on the decline. The most recent low in September 2020 was 10.7% late and 80.6% on-time payments. The most recent high was April 2023, when late payment was 8.8% and on-time, 88.3%. Then late payments continued to grow: 9.8% in August 2024, 11.8% in June 2025, 10.1% in July.

Chandan separately noted that late payments happened “as financial strains weigh on renters.”

“Late payment rates have tended to drop off in the Spring, lining up with when most households receive their tax refunds,” they wrote. “However, a sustained recent surge in late payments this year without the normal springtime improvement may indicate a structural misalignment of household cash flows, with a growing share of tenants relying on mid-month income to pay off overdue rent.”

Consumers Feel The Pinch

Put differently, there is something different in the financial dynamic of the country. Some economists have noted that at least half of the population had run through the pandemic rescue funds they received, cutting a safety net. As Chandan noted, from 2021 to 2022, people’s spending was growing faster than their incomes. The balance again switched later in 2022 as income growth pulled ahead of spending. And then, early in 2024, it turned around again; expenses rose faster than earnings.

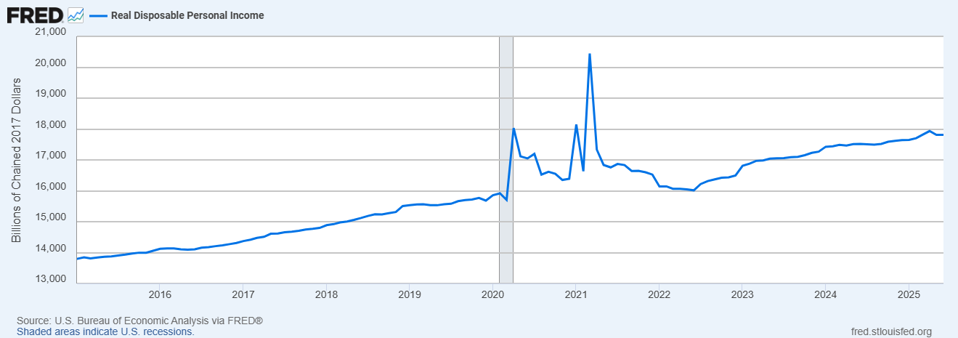

The graph below from the Federal Reserve Bank of St. Louis shows real disposable personal income.

It was growing and has been flattening out. More importantly, this is a total number across everyone. The distribution, as has long been true, will be heavily upward skewed. The growth will be much higher at the top and, equivalently, much lower at the bottom.

Jobs took a massive downward revision. New job openings are falling far below actual new jobs added. There is building pressure, according to Meredith Whitney, CEO and founder of the Meredith Whitney Advisory Group, according to MarketWatch. She warns of a bifurcated economy.

“I think employment is going to be a really big pickle,” Whitney said, further warning that stagflation, in which unemployment and inflation are both high, is a “real possibility.” Tariffs increasingly look like they might add to inflation. It isn’t certain, but quite possible. Many young people who think their choice of STEM degree focus will save them are finding that may not be the case.

Apartment Rents To Rise

Put briefly, many in the commercial real estate industry are expecting — hoping to invest in — higher eventual rents to both cover quickly rising expenses and also better profits for investors. Rents that never dropped as sharply as they grew through and after the pandemic when massive capital drove up the prices of properties that investors flocked to. Prices that jumped to a degree acted like a punch to the financial solar plexus of a large portion of renters.

What will happen? It’s impossible to know at the moment. But between rising prices and less stable financial foundations, it could be interesting, in the more strained possible interpretations of the word.