Amid macroeconomic concerns, Delta Air Lines seems to be a more solid bet compared to its peer American Airlines for three fundamental reasons.

By DM Martins’ Research

Summary

- Airline stocks tend to be highly sensitive to the business cycles, and the sector has already started to correct in the face of macroeconomic concerns

- But if I were to invest in a US-based airline in hopes of an eventual rebound, or maybe to set up a long-short trade, which would be my chosen winner?

- I will present below three reasons why I believe that Delta has an edge over American, including operational superiority and stronger balance sheet

There is little that I can say to investors in the airline space to ease their anxiety over the current market environment. Airline stocks tend to be highly sensitive to the business cycles, as evidenced by the U.S. Global Jets ETF (JETS) having already corrected 20% from the January 52-week high in the face of serious concerns over an imminent recession.

To be clear, I currently believe that now is not the best time to invest in airline stocks. Having said so, I can always be wrong, and maybe the bottom is not about to fall off. Equally importantly, it may still be helpful to explore the question: If I were to invest in a US-based airline in hopes of an eventual rebound, or maybe to set up a long-short trade, which would be my chosen winner?

Today, I face off two of the largest carriers in the country, Delta Air Lines and American Airlines. Who might be the best buy relative to its peer? I will present below three reasons why I believe that Delta has an edge over its Fort Worth, Texas-based competitor.

Better operationally

Delta has been operationally superior to American for some time. To be clear, there are a few ways that one can define the term “operationally superior”, including by looking at things like on-time departures. In this regard, Delta ranked the highest in North America and third globally in 2024, at a rate of 84%, while American at 79% did not make the top 10 list worldwide. The higher ranking speaks to Delta’s ability to deliver on customer service, which could be a positive for consumer loyalty and, ultimately, the stock as well.

But I like to look at one metric that I believe best reflects how efficient an airline is at operating vis-a-vis its ability to charge its customers for the services that the airline provides: per-unit margin, excluding fuel costs and other non-core expenses. One unit, in this case, is ASM, or available seat mile.

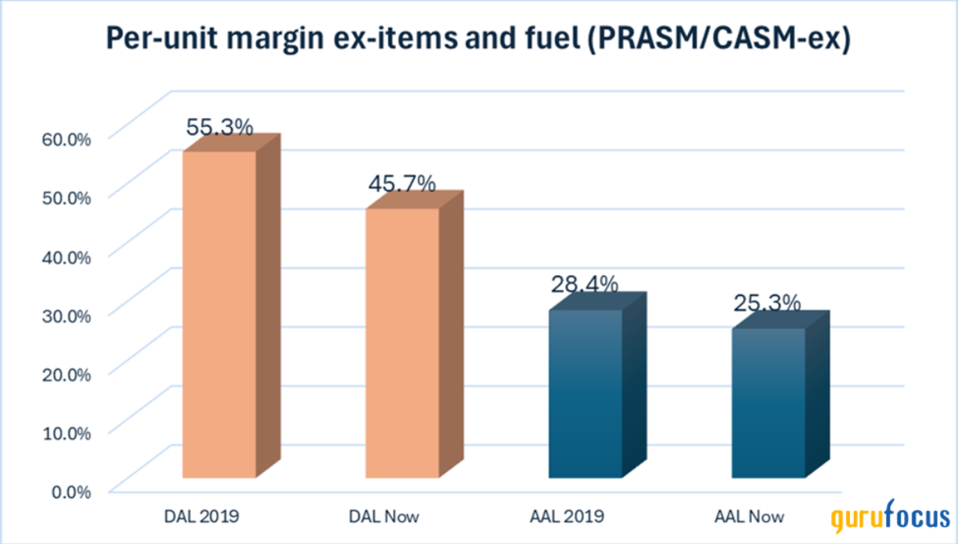

Even before COVID-19, Delta’s per-unit margin ex-items stood out at 55% vs. American’s meager 28%. To be fair to the latter, American managed to defend its profitability a little better through the pandemic, as the chart below shows.

Having substantially higher operating margins means first that Delta is noticeably more competent at operating, keeping costs down relative to its passenger revenues. In my view, this is a combination of a better established hub-and-spoke network in the US and a better competitive position in the profitable premium and international businesses.

Second, higher per-unit op margins also means that Delta’s bottom line is better protected. That is: when revenues (the top line) fluctuate, all other things held equal, Delta’s earnings should not swing as widely as American’s due to lower operating leverage. It helps to explain why, since the start of 2020, Delta’s quarterly non-GAAP EPS has ranged from -$4.43 to $2.68, while American’s EPS has dipped as low as -$7.82.

Higher-quality balance sheet

The second pillar that supports my bullish views on Delta compared to American is balance sheet robustness. Here, debt and equivalents (I like to include debt-like items, such as leases and pension obligations, and exclude cash in my analysis) matter most to me. The more financially leveraged a company is, the more exposed it becomes to a deterioration in the business environment.

Delta’s net debt and equivalents represent 30% of its total assets. This is not too bad for a US-based airline, certainly one of the so-called legacy ones. By comparison, American’s debt ratio is much higher, at nearly 52% (see chart below).

While American’s bloated balance sheet is partly explained by the company’s investment in its younger aircraft fleet (Delta operates 62 airplanes aged 30 years or more, while American does not), heading into a period of economic deceleration with a heavier debt load does not appeal to me as a potential investor.

Attractive valuation, with a catch

On the surface, American Airlines beats Delta Air Lines in one key aspect: its stock is cheaper. The chart below shows that American stock trades at a very low 2025 P/E of 5.2x. This is nearly one turn lower than Delta’s 6.1x. Compare these figures to American’s 7.6x and Delta’s 8.3x multiples as recently as three months ago, before the start of the current stock market unwind.

But there is a catch. These ratios assume stable 2025 EPS consensus expectations. Should the economy hit a soft patch, driven mostly my the global trade wars but also by the potential impact of US federal spending cuts on employment, I expect American’s EPS estimates to drop more pronouncedly than Delta’s, which could make its stock’s valuation look less appealing.

Therefore, I prefer to pay what seems to be slightly more to own Delta today (still a low P/E, mind you), understanding that the company is likely to weather a turbulent period better than American Airlines.

One final word on ownership

Sometimes, it helps individual investors to see what some of the renowned money managers think about particular stocks. In that regard, DAL also seems to be a favorite among famous value investors relative to AAL.

Currently, Stan Druckenmiller’s Duquesne Family Office owns shares of the Atlanta-based airline. The position does not crack the fund’s list of top 5 holdings, but the acquisition of 818,000 shares in Q4 of last year was the fund’s largest in over a decade.

That said, another investment guru has thrown in the towel on the airline business altogether. Shortly after the start of the COVID-19 crisis, Warren Buffett sold all of Berkshire Hathaway’s airline stocks. He is famous, among many other things, for having said that “the secret to becoming a millionaire is to start off as a billionaire and buy an airline.”