Micron Technology (MU) has a remarkable track record of rapid increases, with the stock climbing more than 50% in less than two months on several occasions, particularly in significant years such as 2013 and 2020. Moreover, it has experienced increases exceeding 30% in similar short periods multiple times. If historical trends continue, certain catalysts may drive MU shares to notable new peaks, presenting considerable prospects for investors.

Micron Technology’s stock has risen sharply, driven by unquenchable demand for its high-bandwidth memory essential to the AI transformation. With 2025 HBM production fully booked and strong fiscal 2026 revenue projections, ongoing AI infrastructure expansion and a tightening memory market suggest further upside, indicating that its specialized products are ready to take advantage of persistent technological changes.

Triggers That Could Boost The Stock

- AI HBM Leadership: Micron’s HBM3E is sold out until 2026, with advanced 12-stack HBM and HBM4 shipments commencing in Q2 FY26. This AI-driven demand has established an $8 billion annual HBM revenue run rate in FQ4 2025.

- Memory Price Upswing: DRAM and NAND prices are expected to increase broadly through 2026, with some DRAM climbing 20-70% since September 2025, fueled by restricted supply and strong AI/datacenter demand.

- Strategic Expansions: Considerable investments, including $9.6 billion in Japan and $7 billion in Singapore for HBM, will boost advanced memory production, positioning Micron for sustained capture of the AI market by 2028.

How Strong Are Financials Right Now

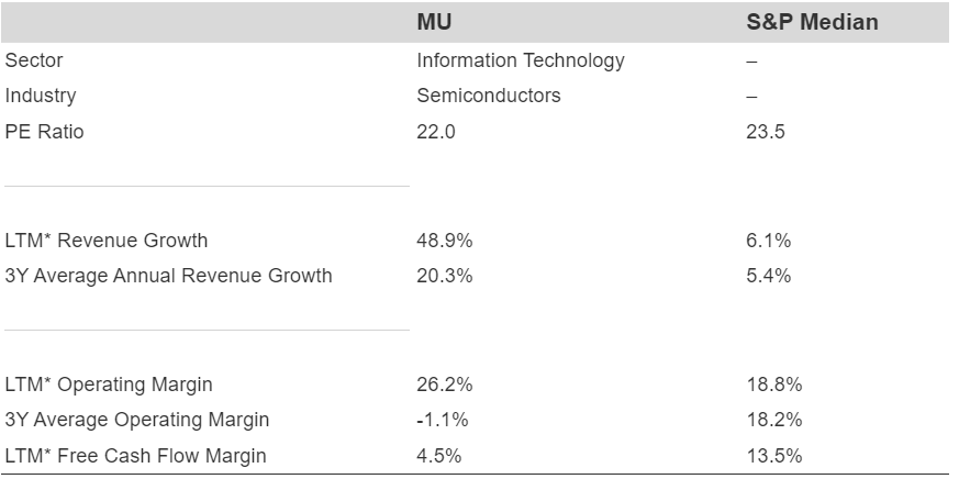

Below is a brief comparison of MU fundamentals with S&P medians.

- Revenue Growth: 48.9% LTM and 20.3% last 3-year average.

- Cash Generation: Nearly 4.5% free cash flow margin and 26.2% operating margin LTM.

- Valuation: Micron Technology stock trades at a P/E multiple of 22.0

*LTM: Last Twelve Months | If you want more details, read Buy or Sell MU Stock.

Micron Technology exhibits strong fundamental health, evidenced by impressive revenue growth and solid cash generation metrics. Nonetheless, grasping these fundamentals is just part of the equation; it is equally crucial to assess the potential investment risks associated with how the stock might behave during more extensive market downturns.

Risk Quantified

Analyzing Micron’s historical declines, it’s evident that the stock can suffer severely when the market falters. During the Dot-Com Bubble, MU fell more than 82%, and the Global Financial Crisis affected it even more severely, with a drop of nearly 88%. The 2018 correction reduced shares by approximately 54%, while the Covid selloff and the recent inflation shock both experienced declines near 42-50%. Even with solid fundamentals, those are significant downturns. It illustrates that no matter how robust the situation appears, Micron is not shielded from broader market disruptions.

However, the risk does not solely pertain to major market crashes. Stocks can decline even when markets are robust — consider events such as earnings reports, business updates, and outlook revisions. Read MU Dip Buyer Analyses to explore how the stock has bounced back from sharp declines in the past.

Still uncertain about MU stock? Think about a portfolio strategy.

Move Beyond Single Stocks With A Multi-Asset Portfolio

Stocks can rise and fall, but bonds, commodities, and other assets can help stabilize the journey. A multi-asset portfolio maintains steadier returns and mitigates single market risk.

The asset allocation framework of Trefis’ Boston-based wealth management partner has produced positive returns during the 2008-09 period when the S&P dropped more than 40%. Our partner’s strategy currently incorporates the Trefis’ High Quality Portfolio, which boasts a history of comfortably outperforming its benchmarks, including all three S&P 500, S&P mid-cap, and Russell 2000 indices.