Key News

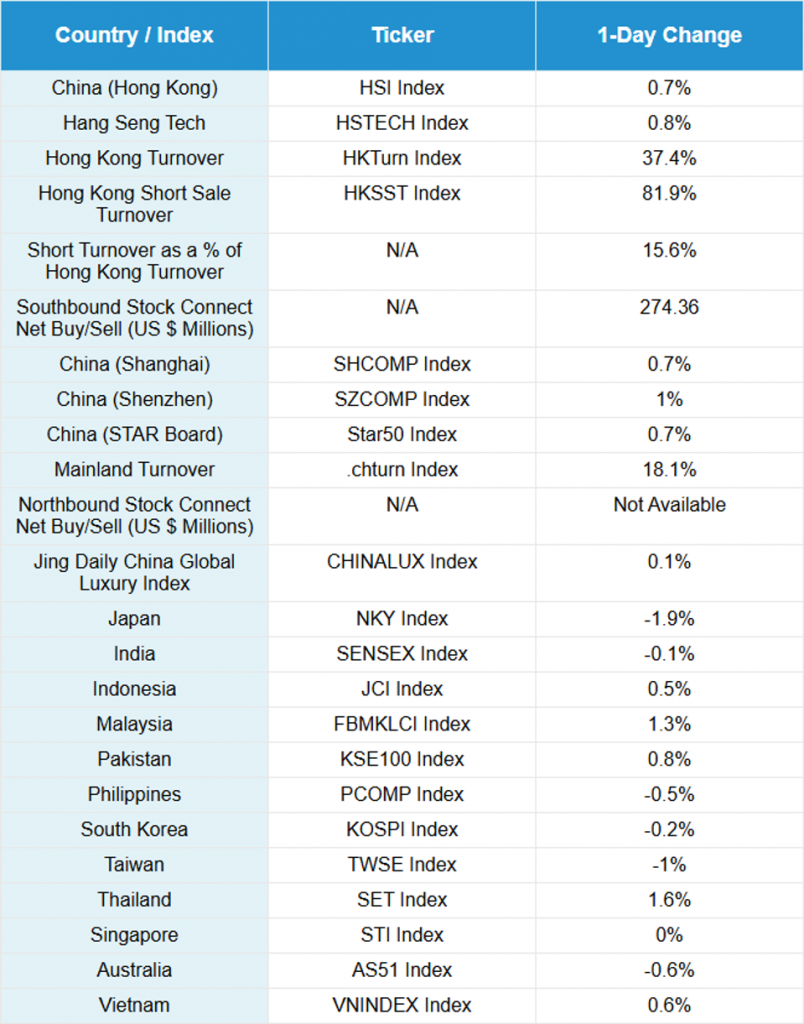

Asian equities were mixed on rising expectations of another US interest rate cut, though Japan and Taiwan underperformed. China’s currency, the renminbi (CNY), appreciated versus the US dollar (USD) to another 52-week high of 7.07 per USD.

Media headlines are focused on November’s purchasing managers’ indexes (PMIs), which missed expectations. The “official” National Bureau of Statistics (NBS) survey Manufacturing PMI was 49.2, which is up from October’s 49.0 but short of an expected 49.4. The “official” Non-Manufacturing PMI was 49.5, which is down from October’s 50.1 and below an expected 50. Meanwhile, the “private” Manufacturing survey, conducted by S&P and Rating Dog, was 49.9, down from October’s 50.6 and short of an expected 50.5.

Both Hong Kong and Mainland China were higher, despite the PMIs, as our trader buddy says, “market no care, you no care.” The Hang Seng Index closed above the 26,000 level. Investors appear to be more focused on further supportive policies from the China Economic Work Conference (CEWC) following the release of the pro-stimulus 15th Year Plan draft.

Battery giant Contemporary Amperex Technology (CATL) gained +2.33% in Hong Kong and +2.62% in Mainland China, as the Ministry of Industry and Information Technology (MIIT) announced a symposium attended by twelve companies to address “irrational competition in power and energy storage battery industry”. It is great to see the MIIT expanding the anti-involution effort beyond the solar panel industry.

Shareholders of Meituan, which fell -2.88% overnight, would love to see more anti-involution nudging applied to instant commerce and food delivery, after the company’s bottom line collapsed due to subsidies to fend off competitors. The stock is down -78% from its 2021 high, despite revenue doubling since then, although net income swung back into a loss.

ZTE gained +13.94% in Hong Kong and 10% in Mainland China after partnering with ByteDance on an AI-enabled cell phone. The news, along with speculation that Apple’s foldable phone is set to launch by 2026, has lifted the mobile phone supply chain and technology hardware in both Hong Kong and Mainland China.

Hong Kong-listed automaker Seres gained +5.22% after being added to Southbound Stock Connect.

Tencent gained +1.31% on another big stock buyback announcement after the close.

Non-ferrous metals in both Hong Kong and Mainland China were higher as silver prices rose.

The China Index Academy announced that new home prices increased by 0.37% month-over-month (MoM) in November and by 2.68% year-over-year (YoY), while used home prices decreased by -0.94% MoM and by -7.95% YoY. That represents a slight improvement following the disappointing October numbers from the NBS.

The China Securities Regulatory Commission (CSRC), China’s SEC, appears to be greenlighting Commercial real estate investment trusts (REITs).

Hunan and Guangdong provinces initiated the “direct payment of maternity allowances”.

November Vehicles Sales (Top Manufacturers):

% Changes are year-over-year (YoY) based on number of units

- BYD -5.25% to 480,186

- Xpeng +18.88% to 36,728

- Nio -45.62% to 36,275

- Li Auto -31.92% to 33,181

- Zeeker +6.78% to 63,902

- Great Wall Motors +4.57% to 133,216

- Geely +76.33% to 310,428

New Content

Read our latest article:

Does Harnessing AI For Investment Decisions Work? Quant Insight Gets Results In China

Please click here to read

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.07 versus 7.07 Friday

- CNY per EUR 8.23 versus 8.21 Friday

- Yield on 10-Year Government Bond 1.84% versus 1.94% Friday

- Yield on 10-Year China Development Bank Bond 1.90% versus 1.90% Friday

- Copper Price +1.86%

- Steel Price +0.77%