So far, 2025 has been a volatile but positive year for U.S. stock investors. Despite a broad market correction in March and the beginning of April, equities have rallied strongly from mid-April until November. In fact, as shown in Table 1, it was one of the most successful S&P 500 rally legs of the past 55 years. The recent six-month period from mid-April until late-October was the fifth-greatest single leg* since 1970 and just the sixth with gains of at least 30%. It has been true in similarly sized or larger rallies that once a 5% pullback occurs, the market typically consolidates for a few weeks to several months. But it is also true that none of these largest rally legs were the last leg in a bull market.

*A >5% move in either direction constitutes one leg.

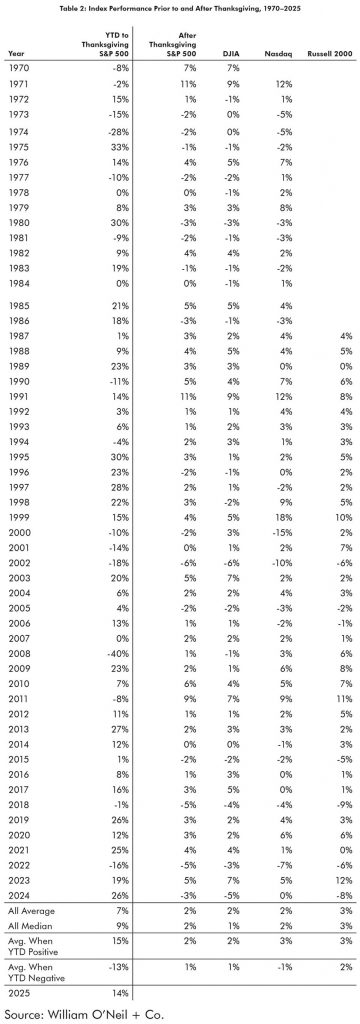

Normally, when the market has strong positive performance up until Thanksgiving, returns for the rest of the year are positive. As shown in Table 2, stocks average an additional +2–3% gain after the holiday through the end of the year as the earlier positive momentum continues. Since 1970, there have been 37 instances where the market entered the Thanksgiving holiday up for the year. In 8 of these periods, or 22%, returns were negative for the remainder of the year. Clearly, the odds are in investors’ favor that the current market will be able to post additional gains in the year-end rally this year.

Lastly, November–December is very often the strongest period of the year for the market. Even in instances when November has been negative (17 times in 56 years since 1970), which is on pace for this year, December has still been mostly positive. As shown in Table 3, only three times was December also negative following a down November.

In conclusion, while the current pullback is a new challenge for investors, we would make several points. First, bull markets usually do not end with the first down leg after the initial upward thrust. Second, odds are high that the market can rally during the coming holiday period. And finally, as of this writing, the predicted odds of an additional rate cut by the Federal Reserve are over 80%. Generally, fighting the Fed in stock investing is a losing strategy, so we would caution investors against becoming too bearish during this pullback.

Kenley Scott, Director, Global Sector Strategist at William O’Neil + Company, made significant contributions to the data compilation, analysis, and writing for this article.