After a sharp sell-off this year, Iridium Communications (IRDM) now trades at a steep discount despite steady expansion and strong cash generation. With the business investing in new services and maintaining solid fundamentals, the key question is whether the market has pushed the stock too low—and if IRDM is poised for a rebound.

We believe that IRDM stock merits consideration: It is expanding, generating cash, and trading at a remarkable valuation discount. Companies like this can deploy cash to drive additional revenue growth or simply distribute it to shareholders via dividends or buybacks. Either strategy enhances their appeal in the market.

Current Developments with IRDM

IRDM has experienced a decline of 42% up to this point in the year and is now offered at a substantial discount compared to its 3-month, 1-year, and 2-year peaks. This downturn can be linked to the tightening of 2025 service revenue growth forecasts and delays in PNT (positioning, navigation, and timing) revenue. A decrease in government subscribers has also been a factor.

While the stock may not yet reflect this, there are several positive developments for the company: Commercial IoT revenue rose by 7% in Q3 2025, with expectations for double-digit growth for the full year. Revenue from engineering/support services surged over 30% in Q3 2025 due to government contracts. Project Stardust, a 3GPP direct-to-device service, is set for testing in 2025 with a launch planned for 2026. The acquisition of Satelles (2024) will establish a new PNT service stream. Robust cash flow enabled a 5% dividend increase and share repurchases in 2024. Overall debt leverage is anticipated to decline significantly by 2025, enhancing financial stability.

Strong Fundamentals for IRDM

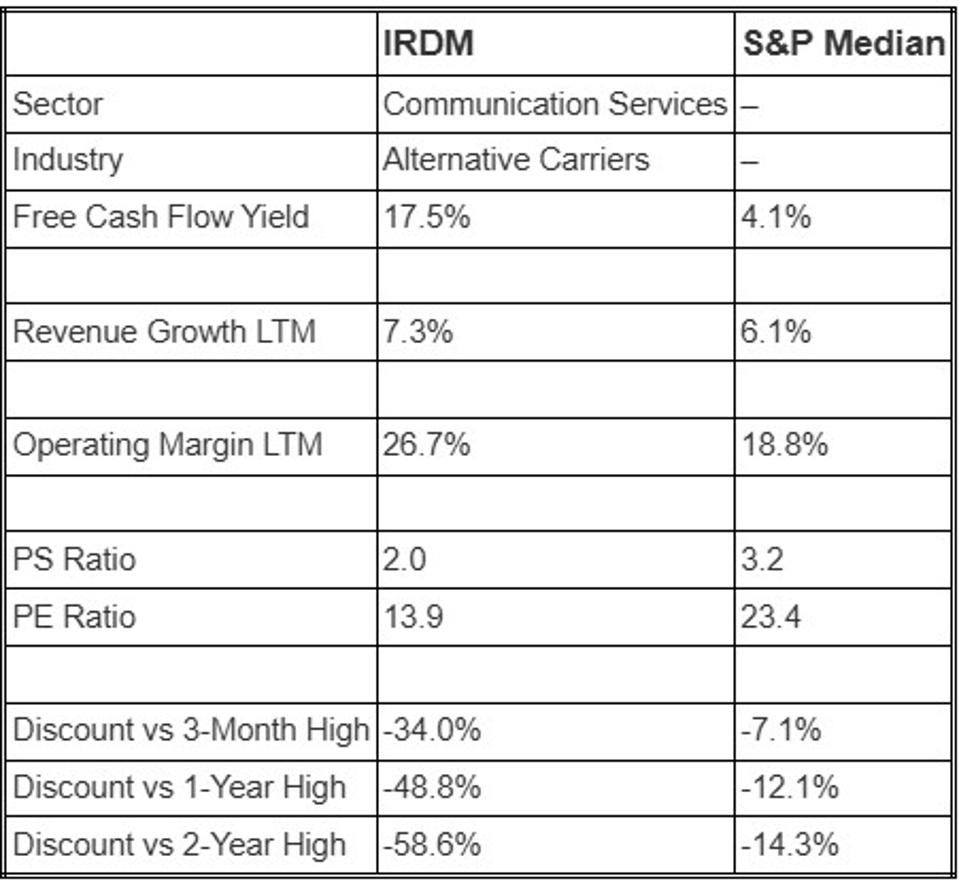

- Cash Yield: Iridium Communications boasts an impressive cash flow yield of 17.5%.

- Growth: A revenue increase of 7.3% over the last twelve months indicates that the cash reserves will continue to grow.

- Valuation Discount: IRDM stock is currently trading 34% below its 3-month peak, 49% below its 1-year peak, and 59% below its 2-year peak.

Here is a quick comparison of IRDM’s fundamentals against S&P medians.

*LTM: Last Twelve Months

But What About the Associated Risks?

Even though IRDM stock appears to be an attractive investment, it’s beneficial to understand a stock’s history of drawdowns. IRDM has faced significant declines during previous downturns, including a drop of 31% during the Global Financial Crisis, nearly 30% in the 2018 correction, and over 43% during the Covid pandemic. The inflation surge was even more impactful, with a downturn of 47% from the peak to the trough. Despite its robust fundamentals, this stock is not insulated against severe market sell-offs. It underscores the reality of risk, regardless of how favorable conditions may seem on paper. Yet, the risks are not confined to significant market crashes. Stocks can decline even amidst favorable market conditions – consider events like earnings announcements, business updates, and changes in outlook. Read IRDM Dip Buyer Analyses to learn about how the stock has bounced back from sharp declines in the past.

If you would like to delve into more details, read Buy or Sell IRDM Stock.

Other Similar Stocks to Consider

Not ready to make a decision regarding IRDM? You may want to explore these alternatives:

These stocks were selected based on the following criteria:

- Market capitalization exceeding $2 billion

- Positive revenue growth

- High free cash flow yield

- Meaningful discount to 3-month, 1-year, and 2-year highs

A portfolio constructed starting on 12/31/2016 with stocks meeting the criteria above would have had the following performance:

- Average 6-month and 12-month forward returns of 25.7% and 57.9% respectively

- Win rate (percentage of picks yielding positive returns) exceeding 70% for both 6-month and 12-month spans

A Diverse Asset Portfolio Outperforms Individual Stock Selection

Markets operate differently, but a diverse array of assets helps to mitigate volatility. A multi-asset portfolio keeps you invested and lessens the impact of sharp declines in any one sector.

The asset allocation strategy by Trefis’ wealth management partner in Boston produced positive returns during the 2008-09 period when the S&P dropped over 40%. Our partner’s current strategy includes Trefis’s High Quality Portfolio, which has a history of consistently outperforming its benchmark, encompassing all three indices – the S&P 500, S&P mid-cap, and Russell 2000.