Alibaba Q2 Earnings Overview

Alibaba reported fiscal year Q2 earnings after the Hong Kong close, as topline revenue beat expectations while adjusted net income and adjusted EPS missed.

Revenue growth was impacted in Alibaba’s year-over-year (YoY) comparison due to the elimination of the company’s Sun Art supermarket and Intime department store business. Topline revenue growth would have been up 15% YoY if we eliminated the two divested business lines from last year’s revenue. The company’s investments in quick commerce and cloud hit the bottom line, though the stock’s initial reaction was focused on strong cloud sale growth.

CEO Eddie Wu stated, “Robust AI demand further accelerated our Cloud Intelligence Group business, with revenue up 34% and AI-related product revenue achieving triple-digit year-over-year growth for the ninth consecutive quarter.” The company reaffirmed it will continue to invest in AI, as the previously announced RMB 380B target investment amount might be “small”. This will weigh on the bottom line, but as long as the company executes on cloud growth and gains market share, investors are apt to overlook. The company mentioned having a 35.8% market share according to an industry report.

- Revenue increased by +5% YoY to RMB 247.80B ($34.81B) from RMB 236.50B and versus analyst expectations of RMB 245.20B.

- Alibaba China E-Commerce Group revenue grew by 16% YoY to RMB 132.58B from RMB 114.77B.

- Alibaba International Digital Commerce Group (“AIDC”) revenue grew by 10% YoY to RMB34.80 million (US$4.89 million).

- Cloud Intelligence Group revenue was RMB39.82 million (US$5.59 million). The YoY growth of total revenue, and revenue excluding Alibaba consolidated subsidiaries, accelerated to 34% and 29%, respectively.

- “All others” (Freshippo, Cainiao, Alibaba Health, Hujing Digital Media and Entertainment Group, Amap, Intelligent Information Platform (which mainly consists of UCWeb and Quark businesses), Lingxi Games, DingTalk and other businesses), revenue decreased by -25% YoY to RMB 62.97B from RMB 84.48B.

- The “All others” decrease was primarily due to the revenue decrease as a result of the disposal of Sun Art and Intime businesses, as well as the decrease in revenue from Cainiao, partly offset by the increase in revenue from Freshippo, Alibaba Health, and Amap.

- Adjusted Net Income decreased by -72% YoY to RMB 10.35B ($1.45B) from RMB 36.36B and versus analyst expectations of RMB 13.51B.

- Adjusted EPS decreased by -71% YoY to RMB 2.39 ($0.34) from RMB 15.06 and versus analyst expectations of RMB 6.34.

- Alibaba bought 2 million ADSs in the quarter for a total of US$253 million.

Key News

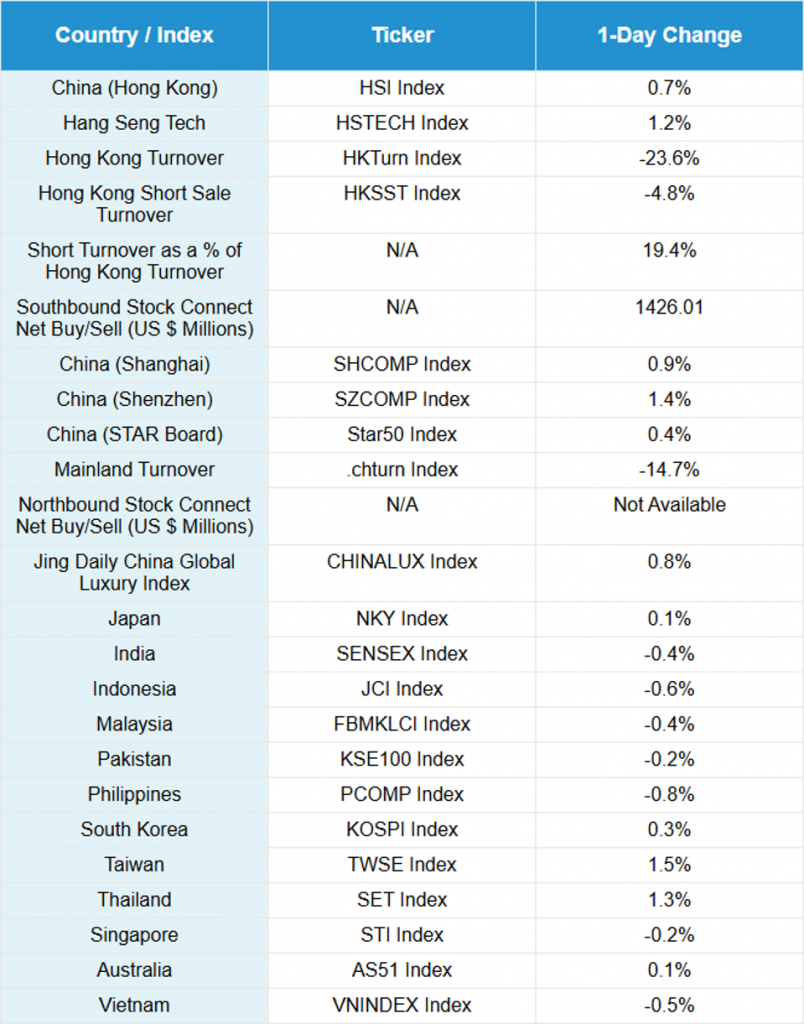

Asian equities were mixed overnight despite a weaker dollar as the renminbi appreciated to 7.08 (US $/CNY so a decline is appreciation).

Both Hong Kong and Mainland China had a broad rally as advancers outpaced decliners. The rally was led by growth stocks. Volumes were a touch light in both markets, though foreign investors might have been involved in Hong Kong. Southbound Stock had a healthy $1.44B of net buying, though only accounted for 22% of Hong Kong turnover.

Fairly light from a news perspective, though Alibaba gained +2.14% in advance of its post-close financial results, as Singapore’s National AI Strategy announced it will use the company’s AI over Meta’s. Mainland investors bought a healthy $722mm of Alibaba’s Hong Kong stock via the Southbound Stock Connect.

Xiaomi gained +4.35% after yesterday’s post-close announcement that founder and CEO Lei Jun bought US $12.9mm/HK $100mm of stock. EV maker NIO gained +3.04% in advance of its post Hong Kong close financial results. Humanoid robot maker UBTech fell -0.81% after it announced a private share sale at a -11.4% discount to yesterday’s close. The sale, which is the company’s sixth such sale, will raise US $398mm/HK $1B by selling 31.5mm shares.

Baidu gained +4.56% after several analysts commented on the company’s Kunlun AI chip and growth expectations. Similar analyst upgrade tailwinds for Bilibili as it gained +5.22%. Tech hardware stocks had a good day as Huawei announced the launch of the Mate 80 series.

Mainland China had a very strong day with advancers trouncing decliners. A mainland media sourced noted “1,365 Chinese listed firms executed repurchase plans totaling approximately RMB 227.5 billion” year-to-date, as the pivot to shareholder friendly policies of Mainland companies hasn’t garnered significant attention. The Ministry of Foreign Affairs characterized the Trump-Xi phone call as “positive, friendly and constructive”.

New Content

Read our latest article:

Does Harnessing AI For Investment Decisions Work? Quant Insight Gets Results In China

Please click here to read

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.08 versus 7.10 yesterday

- CNY per EUR 8.18 versus 8.19 yesterday

- Yield on 10-Year Government Bond 1.83% versus 1.82% yesterday

- Yield on 10-Year China Development Bank Bond 1.89% versus 1.88% yesterday

- Copper Price +0.82%

- Steel Price +0.03%