Broadcom‘s stock has increased by 106% in the last year, greatly outshining its competitors amid the AI and data-center surge. But how does this leader in AI infrastructure truly stack up against its elevated valuation? A detailed examination uncovers remarkable profitability and a strong revenue growth, propelled by AI semiconductors. Nevertheless, its high valuation indicates that future growth might depend on continued hyperscale demand, managing fierce competition, and a U-shaped recovery in non-AI sectors. Separately, read about the turmoil in Bitcoin: Before Bitcoin Hits $50,000, Ask This One Question.

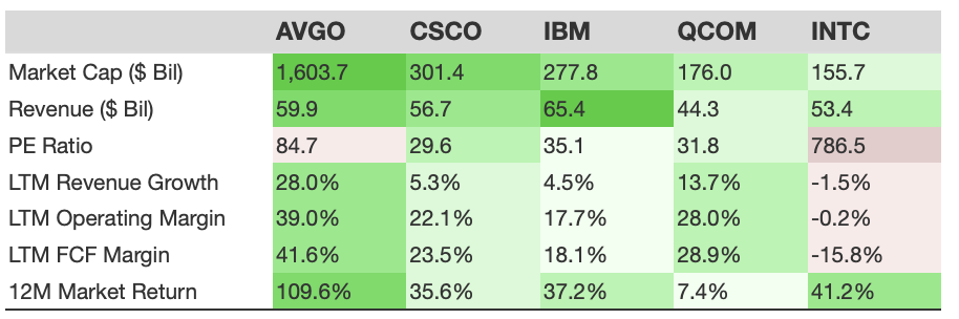

- AVGO’s 39.0% operating margin, the highest among its competitors, demonstrates its lucrative software segment (VMware) and strong pricing for AI chips.

- AVGO’s 28.0% revenue growth, outstripping its rivals, results from solid AI demand and the strategic integration of VMware.

- AVGO’s 109.6% annual increase and 85 P/E reflect strong investor confidence in its AI dominance and growth potential.

Here’s how Broadcom measures up in terms of size, valuation, and profitability compared to key competitors.

For further insights on Broadcom, read Buy or Sell AVGO Stock. Below, we compare AVGO’s growth, margin, and valuation with its competitors over the years.

Revenue Growth Comparison

Operating Margin Comparison

PE Ratio Comparison

Still uncertain about AVGO stock? Evaluate a portfolio strategy.

Multi-Asset Portfolios Provide Greater Upside With Reduced Risk

Markets behave in different ways, but a blend of assets can help smooth out volatility. A multi-asset portfolio ensures you remain invested while diminishing the effects of abrupt declines in any specific area.

The asset allocation model offered by Trefis’ Boston-based wealth management partner generated positive returns during the 2008-09 period when the S&P suffered losses exceeding 40%. Our partner’s strategy currently incorporates Trefis High Quality Portfolio, which has consistently outperformed its benchmark, encapsulating all three – the S&P 500, S&P Mid-Cap, and Russell 2000 indices.