Week in Review

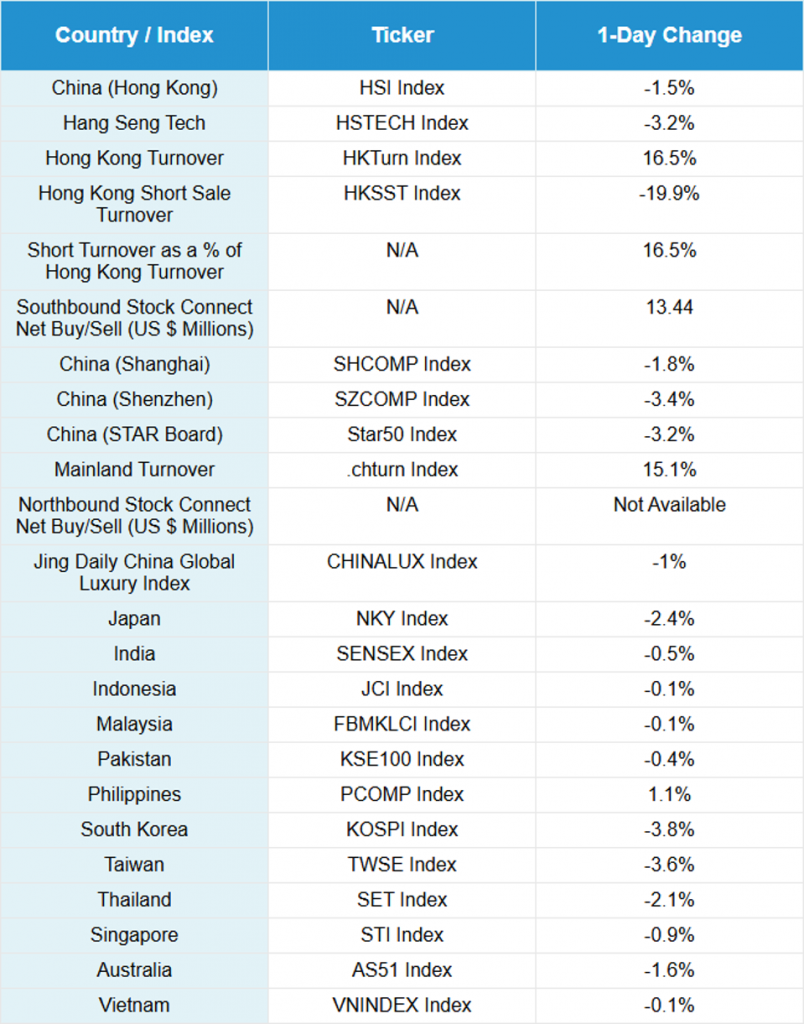

- Asian equities were down for the week as Mainland China, Hong Kong, Japan, Taiwan, and South Korea underperformed.

- Internet earnings continued this week as PDD, Baidu, & Trip.com all beat revenue estimates in the third quarter.

- Electric vehicle (EV) and soon-to-be humanoid robotics maker Xpeng reported third quarter earnings results overnight and beat estimates.

- Sina Finance reported before the China market open that COFCO Group had ordered at least 14 shipments of US soybeans on Monday, which are scheduled to be shipped in December and January, respectively.

- Xiaomi said its electric vehicle business made a profit for the first time in the third quarter, a significant milestone for the smartphone and vehicle maker.

Key News

Asian equities were down as Japan, Taiwan, and South Korea were lower by nearly 9% for the week.

Growth stocks, especially semiconductor and AI related, underperformed in a very broad sell off as decliners beat advancers by a very large margin on higher volumes. Mainland China and Hong Kong’s overbought conditions have quickly reversed into oversold from a Relative Strength Index (RSI) perspective. The percentage of stocks within the Hang Seng Index above their 10-day moving average has gone from 90% on November 13th to 28% as of yesterday (today’s value wasn’t available, though obviously lower).

Hong Kong investment banks issued “Notices of Mandatory Call Event and Early Termination” of Callable Bull/Bear Contracts and derivative warrants on individual stocks, indices, and ETFs as they hit the lower price limits allowed. Not the culprit in today’s downdraft but this likely didn’t help.

A rare bright spot today was Xiaomi, up +1.01% after announcing a better than expected 2026 EV sales goal. Xiaomi bought back shares today along with Tencent (-1.77%). Alibaba (-4.65%) has been unable to buyback stock due to their blackout period, with financial results to be announced next Tuesday post Hong Kong close.

Lithium carbonate futures on the Guangzhou Futures Exchange were down -9% after contract rules were adjusted, which weighed on lithium stocks. Mainland listed Gangfeng Lithium was down -10% in Mainland China and down -12.47% in Hong Kong.

Mainland investors were net sellers of Hong Kong ETFs via Southbound Stock Connect, though net buyers of Tencent, Alibaba, and Xiaomi. Several Mainland listed China ETFs that are favored by the National Team had above average volumes today. After the close it was announced that Innovent Biologics (-5.37%) will be added to the Hang Seng Index on December 5th, while Leapmotor will go into the HS Tech and ASMPT will be removed.

Foxconn and OpenAI’s US joint venture garnered attention in Mainland financial media. A good old fashioned risk off day.

One news item didn’t have any consequence today, but is worth putting on your radar: Local SOE Guangzhou Anju Group’s “Notice on Collecting and Promoting the Acquisition of Existing Residential Properties for Use as Affordable Housing”. The Guangzhou government is buying up unsold housing and using it for affordable housing. Apparently, several cities have issued bonds to fund such a strategy, including Sichuan, Zhejiang, Shandong, and Hunan. The Chinese government often beta tests policy on a small scale, and if successful, broadens it.

China’s electricity consumption increased by +10.4% year-over-year in October, which seems like positive news.

New Content

Read our latest article:

Labubu & Gen Z Spending: What China’s Designer Toy Craze Tells Us About the New Consumption Wave

Please click here to read

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.11 versus 7.12 yesterday

- CNY per EUR 8.21 versus 8.28 yesterday

- Yield on 10-Year Government Bond 1.81% versus 1.84% yesterday

- Yield on 10-Year China Development Bank Bond 1.88% versus 1.84% yesterday

- Copper Price -0.44%

- Steel Price +0.16%