Television once gave brands a reliable path to scale. Must-See TV. E.R. Friends. Seinfeld. You bought reach. You got reach.

Then the audience’s behavior changed.

Younger consumers shifted their attention to creator-driven entertainment. Social scrolling became the new channel surfing.

Brands followed their audiences, but they entered an organic system designed around individual posts rather than the scale and control required for enterprise-level paid media.

So the platforms rebuilt their systems.

They created a layer that routes creator programming into paid media with the controls, targeting, and accountability that enterprise teams expect.

And new IAB research shows what that shift unlocked.

The IAB’s New Research: Inside The $37 Billion Shift To Creator Media

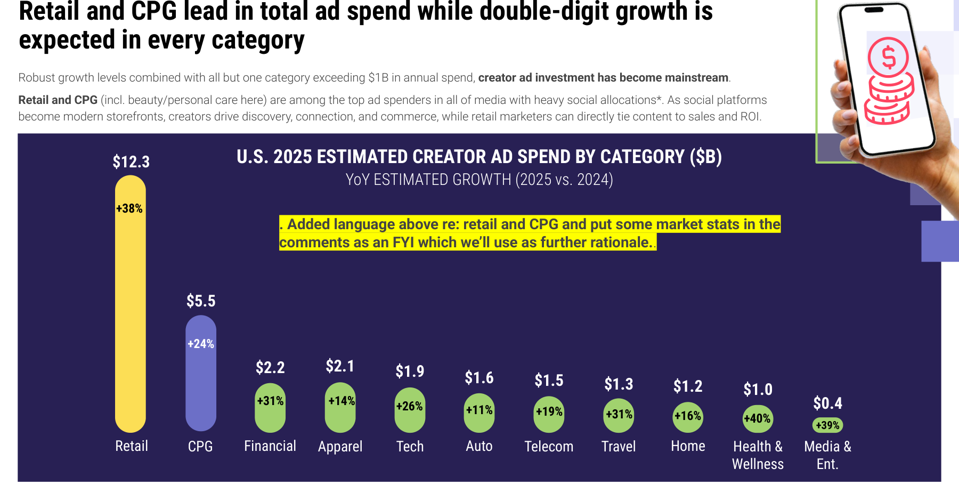

The new IAB Creator Economy Ad Spend Report projects $37 billion in creator-media investment for 2025, growing 4x faster than total media investment.

The study surveyed more than 450 U.S. advertisers across enterprise, mid-market, and emerging brands, giving one of the most explicit pictures yet of how budgets are shifting. Nearly 48% of advertisers now consider creators a must-buy channel, ranking third behind search and social.

Retail leads with $12.3 billion in planned creator spending, a 38% year-over-year increase.

CPG follows at $5.5 billion, representing a 24% increase.

Nine of the ten major advertising categories are expected to invest more than $1 billion in creator media next year.

These are the same categories that once built TV. Now they are driving creator media.

TikTok, YouTube & Instagram: From Social Platforms to Entertainment Networks

Audience behavior continues to evolve, and platforms have adapted.

Instagram, TikTok, and YouTube are no longer social networks. They operate as entertainment networks.

This shift was the focus of discussion at a recent Next in Media event hosted by journalist Mike Shields and sponsored by VuePlanner. The room brought together media leaders, brand marketers, investors, and operators across the creator-economy ecosystem.

Connor McKenna, Partner at Luma Partners, a leading strategic advisory and investment banking firm focused on digital media, marketing, and commerce technologies, explained the impact of this evolution.

“Instagram isn’t a social network. It is an entertainment app. On Instagram, only 7% of the time is spent on friends. The other 93% goes to creators, video, and recommended content. The audience is there for creators, so that is where brands have to be.” He continued. “People underestimate how significant this shift is. When the feed becomes entertainment, everything else reorganizes around it.”

Attention has moved from social graphs to entertainment feeds. And when the feed behaves like TV, the economics follow.

If the feed now functions as an entertainment network, and creator content acts as the programming, the real question becomes how do brands buy it at scale?

To answer that, it helps to understand how the media market has changed. As Mike Shields noted during the event, the rise of entertainment feeds is creating the kind of fragmentation that usually signals the start of a real media marketplace.

“When Instagram, TikTok, and YouTube all shift toward entertainment, you get real competition across platforms. That fragmentation is what creates the next major media channel. Wherever media fragments, technology and dollars follow.”

Moving from Organic & Influencer to Paid Media & Guarantees.

Ian Schafer, President and Co-founder of Ensemble, a Hoorae Media company and next-generation branded-entertainment studio curated by producer, writer, actor, and entrepreneur Issa Rae, argues that the business only works when marketers treat creator content as media.

“Think about all of this through the lens of media, not influencer work. When you control the media spend, you unlock the accountability that big brands need.”

He then broke down how the system actually scales: “If you understand what a view or an engagement does for your business, start by delivering those guarantees. Then build the optimal mix of creator content to hit those results. At Ensemble, we deliver everything through insertion orders. Nothing else.”

Why does this matter?

Once creator content runs through paid media systems, brands can buy, optimize, and measure it the same way they manage every other media channel.

Enterprise budgets no longer sit in a separate creator bucket. They move through the same systems that handle performance and brand advertising.

How Cricket Wireless’ “Making It” reframes creator work as entertainment programming

Ensemble’s new branded series “Making It,” produced with Cricket Wireless shows what this evolution looks like in practice. The series pairs established creators with rising talent and premiered on Cricket Wireless’s YouTube channel, with short-form extensions rolling out on TikTok and Instagram. Not as posts. As entertainment.

And because it runs through paid media rails, it delivers guaranteed reach and measurable delivery, exactly the way enterprise teams already buy media. “Making It” is entertainment inside the feed, powered by the systems already built for scale.

The $37B Opportunity: Why This Moment Matters for the Creator Economy

Creator marketing grew fast, but the operational sophistication didn’t. Teams had tools, not systems. Activity, not operations. They could execute, but they couldn’t build anything consistent because the infrastructure didn’t exist. No tech stack. No connected workflow. Now that the industry is building the missing infrastructure, the entire market is experiencing accelerated growth.

The IAB research and the conversations at Next in Media make the opportunity clear.

- Creators now supply the programming inside the entertainment networks where audiences spend their time.

- Platforms rebuilt the distribution layer so that creator content moves through paid media rails.

- And the missing infrastructure around workflow, supply, and measurement is finally coming online.

Put together, this is the unlock.

It’s what pulls enterprise budgets into the system.

It’s what pushes the $37 billion curve forward even faster.

And it’s what sets the foundation for the next era of modern creator media.