Key News

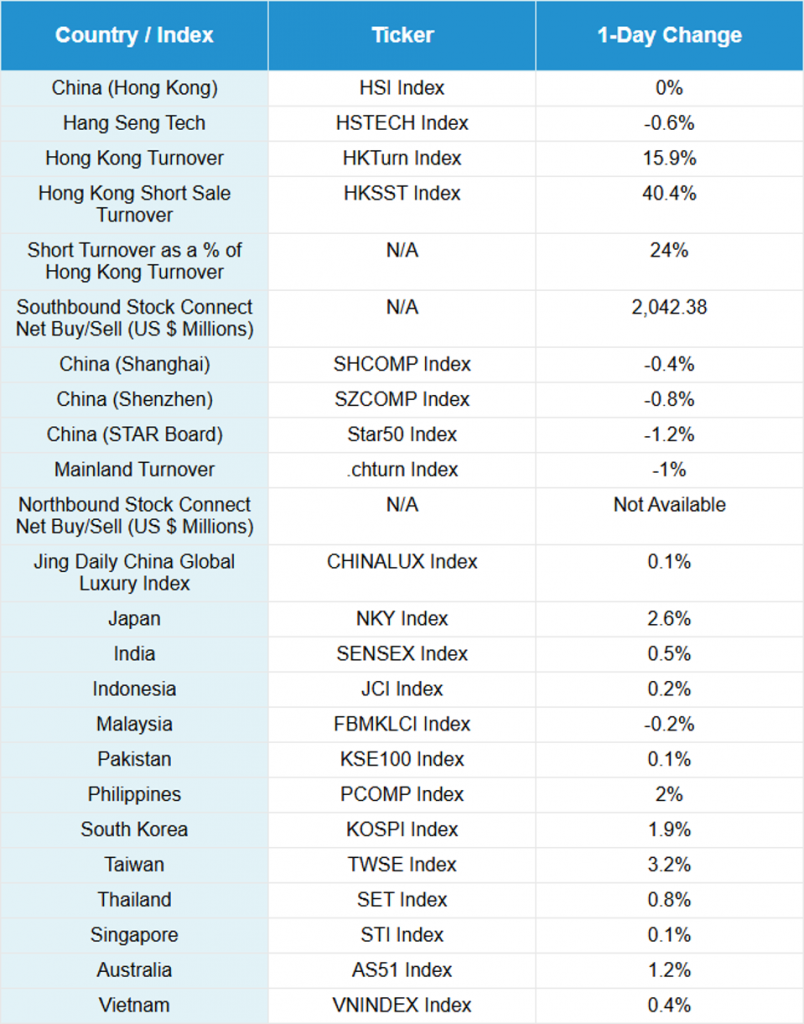

Asian equities cheered Nvidia’s earnings results, except for Mainland China and Hong Kong, which underperformed.

Investors also cheered Kuaishou’s Q3 results reported after yesterday’s Hong Kong close, as the stock gained +2.28%. We noted, with a bit of surprise, that CATL managed to close higher yesterday despite its six-month IPO lock-up expiring. The hammer appeared to drop a day late as the stock fell by -5.66%.

The 1- and 5-year Loan Prime Rates remained at 3% and 3.5% as anticipated. Despite leaving interest rates unchanged in today’s decision, China’s Housing Ministry is said to be mulling a host of new fiscal measures to revive the industry, including mortgage subsidies for new homebuyers, raising income tax rebates for existing mortgage holders, and reducing housing transaction costs. The first homebuyer subsidies would be the first of their kind in the country. This measure could amount to increasing the social safety net for households and families, which is also good for domestic consumption.

Mainland investors bought a healthy net $2 billion+ worth of Hong Kong-listed stocks and ETFs overnight on weakness. This was the highest net inflow from the Southbound Stock Connect since October 13th, and brings the 5-day total inflow to about $6.6B. Top buys were growth stocks on weakness, including Xiaomi and Alibaba.

Xiaomi said its electric vehicle business made a profit for the first time in the third quarter, a significant milestone for the smartphone and vehicle maker. It now expects to deliver more than 400,000 vehicles in 2025. The electric vehicle sector, as a whole, was notably weaker as Nio fell -3.20%, Li Auto fell -1.80%, Leapmotor fell -5.90%, and Xpeng fell -4.50%.

Hong Kong was flat while Mainland China was lower. Mainland China’s STAR Board was down by -1.20% due to weakness in the technology sector, despite holding its own in several recent sessions. Shanghai closed lower by -0.40%, while Shenzhen fell by -0.80%.

NetEase Q3 Earnings Overview

NetEase came short of analyst expectations in its third quarter earnings report after the Hong Kong close. Lofty estimates came into conflict with a lack of new hit titles and an expensive overseas expansion.

- Revenue increased by +8.20% to RMB 28.4B ($4B) from RMB 26.2B and versus analyst expectations of RMB 29.2B.

- Adjusted Net Income increased to RMB 9.5B ($1.3B) from RMB 7.5B and versus analyst expectations RMB 9.5B.

- Adjusted EPS increased to RMB 14.73 ($2.07) from RMB 11.63 and versus analyst expectations RMB 14.76.

- The board of directors approved a dividend of US$0.114 per share (US$0.57 per ADS) for the third quarter of 2025 to holders of ordinary shares and holders of American Depositary Shares (ADSs) as of the close of business on December 5, 2025.

- As of September 30, 2025, approximately 22.1 million ADSs had been repurchased under this program for a total cost of US $2.0 billion.

New Content

Read our latest article:

Labubu & Gen Z Spending: What China’s Designer Toy Craze Tells Us About the New Consumption Wave

Please click here to read

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.11 versus 7.10 yesterday

- CNY per EUR 8.20 versus 8.23 yesterday

- Yield on 10-Year Government Bond 1.81% versus 1.81% yesterday

- Yield on 10-Year China Development Bank Bond 1.88% versus 1.88% yesterday