Key News

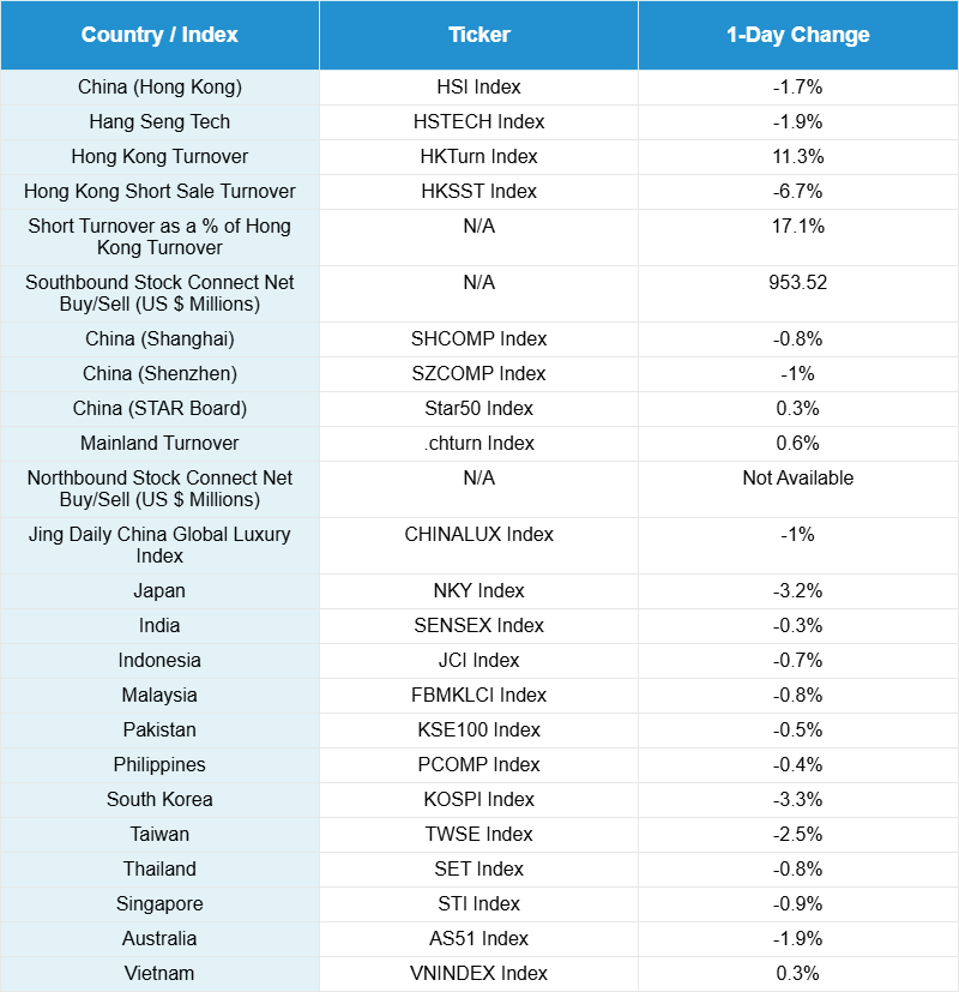

Asian equities were mostly lower overnight, except for Vietnam and Mainland China’s STAR Board, while Korea and Japan declined the most.

China and Asia followed Wall Street south overnight on AI valuation concerns and the lack of some economic data from the United States due to the government shutdown. Growth stocks were absolutely punished in Hong Kong, while they held up better in Mainland China, with some semiconductor stocks actually managing gains. Hong Kong volumes were right at the one-year average while Mainland volumes were slightly elevated overnight. Mainland investors were once again net buyers of Hong Kong-listed stocks and ETFs with nearly $1 billion worth of inflow via Southbound Stock Connect, a mutual market access program.

Technology and energy stocks were the hardest hit overnight, though some precious metals stocks saw gains. Macau gaming stocks were lower. No major domestic economic data releases are scheduled for this week, but investors remain cautious ahead of potential moves by the People’s Bank of China regarding loan prime rates on Thursday, though no or little change is expected as the central bank looks to other measures to stimulate consumption growth. Meanwhile, the government overall will be implementing the 15th Five-Year Plan, which could include limited fiscal stimulus.

Yum China held its Capital Markets Day. The company announced plans to expand to a whopping 20,000 stores by the end of 2026 and to 30,000 stores by 2030. As of the end of September 2025, Yum China operates 17,514 stores across China, which includes 12,640 KFC locations and 4,022 Pizza Hut outlets.

PDD Holdings Q3 Earnings Overview

Global E-Commerce giant PDD Holdings, which goes by Temu in the US and Europe, reported third quarter earnings overnight that beat analyst estimates.

- Revenue +9% to RMB 108.3 billion ($15.2 billion) versus estimate RMB 107.6 billion

- Net Income RMB 29.3 billion ($4.1 billion)

- Net Margin 27%

- Earnings per Share (EPS) RMB 19.7 ($2.8)

PDD beat revenue estimates slightly in its Q3 earnings. PDD management cited and exceedingly competitive landscape for E-Commerce in China and globally as the reason for continued declines in growth after very high growth in 2023, and 2024. They said that they will proceed with major investments in merchant support and platform upgrades, while prioritizing sustainable growth. The third quarter results came before the significant US-China trade reprieve, which is significant for PDD fundamentally speaking. The company does major business in the US and, as such, is more affected by trade matters than other China Internet companies, especially the de minimis rule as the company’s strategy has been mostly focused on small packages. PDD’s resilience has been quite impressive through the renewed trade spat with the US.

Baidu Q3 Earnings Overview

Search engine, AI, and autonomous vehicles giant Baidu reported third quarter earnings overnight that beat analyst estimates on revenue and adjusted earnings per share.

- Revenue -7% to RMB 31.2 billion ($4.4 billion) versus estimate RMB 30.9

- Net Income RMB 1.8 billion ($0.3 billion)

- Net Margin 6%

- Earnings per Share (EPS) RMB 5.4 ($0.8)

Baidu continues to feel the heat from search being directed toward competing large language models, underinvestment in new initiatives despite a high cash position, and unprofitable AI products. This was reflected in the company’s year-over-year decline in revenue. Nonetheless, analysts expected the worst, and the company came out on top this time.

Trip.com Q3 Earnings Overview

Online travel booking site Trip.com reported third quarter earnings overnight that beat estimates on revenue and earnings per share.

- Revenue +16% RMB 18.4 billion ($2.6 billion) versus estimate RMB 18.2 billion

- Net Income RMB 18.6 billion ($2.6 billion)

- Net Margin 100%

- Earnings per Share (EPS) RMB 26.8 ($3.8)

Strong holiday travel bookings for this year’s “Golden Week” helped contribute to Trip’s revenue beat in the third quarter. The 100% net margin was due to a one-time realized investment gain from the sale of an asset that was not disclosed by the company. EBITDA margin was closer to 30%.

New Content

Read our latest article:

Labubu & Gen Z Spending: What China’s Designer Toy Craze Tells Us About the New Consumption Wave

Please click here to read

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.11 versus 7.11 yesterday

- CNY per EUR 8.24 versus 8.24 yesterday

- Yield on 10-Year Government Bond 1.81% versus 1.81% yesterday

- Yield on 10-Year China Development Bank Bond 1.87% versus 1.87% yesterday

- Copper Price 0.06%

- Steel Price 0.10%