Have you considered using a QCD vs RMD for charitable giving, reducing your tax burden and potentially alleviating Medicare surcharges (IRMAA)? Many people use some portion of the required minimum distribution (RMD)for charitable giving, being unaware of using the qualified charitable deduction (QCD) for the same purpose. A QCD effectively is pre-tax, meaning all of the money can be given to qualified charities. On the other hand, the RMD is reduced by taxes, so you are giving less than what you would have if no taxes had been taken out. For tax year 2025, you can donate up to $108,000 (estimated to be $115,000 for 2026).

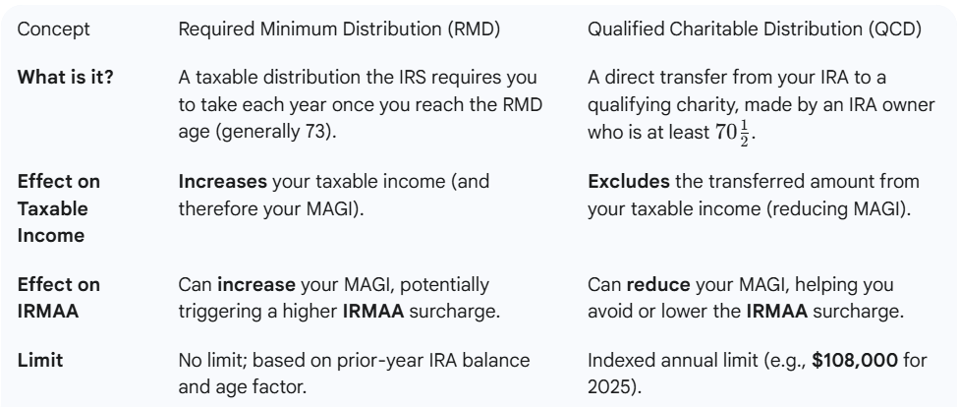

I see two commonly confused concepts that determine your giving efficiency: the Qualified Charitable Distribution (QCD) and simply taking your Required Minimum Distribution (RMD) and then writing a check. The difference between these two paths often adds up to hundreds or even thousands of dollars in savings, especially for mass-affluent households.

This article walks through the rules, compares the side-by-side effects on your savings, and clarifies why the QCD vs RMD choice can improve your retirement outcome.

Key takeaways up front

- A QCD is a direct transfer from an IRA to charity that can count toward your RMD and (if done properly) is excluded from your reported MAGI which can reduce or avoid IRMAA surcharges.

- RMDs are calculated from IRS life-expectancy tables. Under current rules, most IRA owners don’t have RMDs until age 73; once they start, the RMD is taxable income unless you satisfy it with a QCD.

- For retirees near IRMAA-thresholds, modest donations via QCDs can meaningfully reduce Medicare premium surcharges sometimes more than the out-of-pocket tax cost of other strategies. (See the tables below and the CMS IRMAA schedule used in these examples.)

QCD vs RMD: How the strategies differ

Short definitions and the practical difference:

- Required Minimum Distribution (RMD). A taxable distribution the IRS requires you to take each year once you reach the RMD age. The RMD amount is determined by dividing your prior-year IRA balance by a life-expectancy factor from the IRS Uniform Lifetime Table III for most people. You would you Table II is for use by owners whose spouses are more than 10 years younger and are the sole beneficiaries of their IRAs. That distribution is generally includible in your taxable income. See Distributions from Individual Retirement Arrangements( IRA)

- Qualified Charitable Distribution (QCD). A QCD is a direct transfer from your IRA to a qualifying charity made by an IRA owner (or beneficiary) who is at least 70½. QCDs, up to the indexed annual limit, are excluded from your taxable income and can satisfy all or part of an RMD. For 2025 the annual indexed QCD limit is $108,000 (indexed for inflation). (That limit rose recently; always check IRS guidance.)

Why that feels important: RMDs increase your adjusted gross income (MAGI). MAGI is used by Social Security and Medicare to determine Medicare Part B/Part D surcharges (IRMAA). QCDs, when properly executed, reduce MAGI because the donated amount is not included in taxable income so a QCD can reduce or eliminate an IRMAA surcharge that would otherwise be triggered by taking the RMD as taxable income.

QCD Vs RMD: Illustrated

Illustration (ages 71 → 91) with these assumptions so you can see the mechanics.

- Starting IRA balance: $1,000,000 (this is the balance at the end of the tax year before age 71).

- Annual growth: 6% (applied to the prior-year ending balance).

- RMD math: RMD for year = prior-year-end IRA balance ÷ IRS Uniform Lifetime Table divisor for the IRA owner’s age in that year (Table III from IRS Pub. 590-B). For ages before RMD age (under current law that is generally 73 for people who reached that age after 2022), RMD = $0.

- QCD behavior: If an RMD is required, we model the owner satisfying the RMD by making a QCD equal to the RMD amount (subject to the indexed QCD cap $108,000 for 2025). QCDs reduce MAGI to the extent they are used to satisfy RMDs.

- Income & MAGI baseline:

- Social Security is simplified as 85% taxable for MAGI (this is a conservative simplification for illustration; actual taxable portion depends on filing situation and provisional income rules).

- Pension income is treated as fully taxable for MAGI calculations. (State income tax effects are omitted.)

- IRMAA: Used the official Medicare/CMS 2025 cost schedule (monthly Part B totals and Part D add-ons) to compute the annual IRMAA extra cost (difference above the $185 standard Part B) and Part D add-ons. IRMAA is based on MAGI reported to SSA (two years prior in practice); we use the CMS* published brackets/rates for 2025 to show likely premium effects. See 2025 Medicare Costs

Important caveat: This model purposely isolates the effect of RMD vs QCD on MAGI and IRMAA. I did not model federal income tax brackets, state taxes, Social Security taxation formula in full detail, or charitable-itemization interactions: those can matter a lot. Use this as an illustrative comparison; your tax advisor should run precise numbers before acting.

QCD Vs RMD Scenario 1 : Baseline household

- Owner age: 71, spouse 69.

- Pension: $48,000 (owner).

- Social Security: $36,000 (owner).

- IRA: $1,000,000.

- No other pension income from spouse.

QCD Vs RMD Scenario 1: Higher household pension

- Same owner (71) and spouse (69), but spouse has $100,000 of pension income (in addition to the $48k owner pension and $36k Social Security).

- Same IRA: $1,000,000.

Both households are assumed to live to age 100, tables run ages 71–91 to keep the window manageable while covering the most IRMAA-sensitive years.

QCD Vs RMD when RMD taken as a QCD

I created two full year-by-year tables (ages 71 → 91) showing for every 3 years:

- prior year IRA balance, RMD amount (if any), QCD used (if RMD satisfied with QCD), end-of-year IRA balance (Grow 6% then subtract RMD), MAGI with RMD, MAGI with QCD (RMD excluded), annual IRMAA extra (Part B/Part D combined) under each approach, and a simple net cash comparison ignoring income tax (see notes).

You can review the interactive tables I generated above in this chat (they’re labeled clearly for Scenario 1 and Scenario 2). The tables were computed using the IRS Uniform Lifetime Table for the distribution factors and the CMS 2025 IRMAA schedule cited below. The underlying code and data were for illustration only treat as an educational tool, not personalized tax advice.

Short example from Scenario B (showing why QCD matters most when baseline MAGI is higher):

- With the spouse’s $100k pension the household’s baseline MAGI (before RMD) is already high adding a $40k–$80k RMD can push MAGI into a higher IRMAA bracket where monthly Medicare surcharges jump significantly. Using a QCD to remove the RMD from MAGI often keeps the couple in a lower IRMAA bracket and reduces annual Medicare surcharge by several hundred to several thousand dollars that year frequently larger than the QCD dollars’ net tax saving alone. (See the Scenario B table for the year-by-year magnitudes.)

Interpreting the QCD vs RMD scenarios

- Years before 73: Under current RMD rules most taxpayers don’t have an RMD at ages 71–72. QCDs are allowed once you’re 70½, though so you can use QCDs before the RMD age if you want to give tax-efficiently earlier.

- When RMDs begin (age 73 and later under current law): The RMD appears and increases taxable MAGI. If that RMD moves MAGI across a CMS/IRMAA threshold, the family pays an additional Part B/Part D surcharge for that year and because Medicare premiums are monthly, that extra can add up quickly.

- QCD effect: When the owner directs the RMD straight to an eligible charity as a QCD, the amount satisfies the RMD but does not increase MAGI (up to the QCD cap). That frequently avoids or reduces IRMAA, producing immediate, measurable savings on Medicare premiums in the year(s) the QCD is used.

- Practical constraint QCD cap: For 2025 the indexed individual QCD cap is $108,000. For many retiree IRAs, typical single-year RMDs are below that cap, but very large IRAs or very old ages can produce RMDs that exceed the QCD limit. Always verify current limits before planning.

QCD Vs RMD execution keys

- Confirm eligibility: QCDs require IRA ownership and age 70½ or older at the time of the distribution. Roth IRAs are generally not used for QCDs since distributions are usually tax-free already (but check custodial rules).

- Direct transfer required: The IRA custodian must transfer funds directly to the charity (or issue a check payable to the charity). If you withdraw cash into your bank account and then write a check, it generally won’t qualify as a QCD.

- Keep records: Get written acknowledgment from the charity and retain the IRA custodian’s 1099-R showing the distribution code and amount. New 1099-R reporting options changed recently confirm how your custodian reports QCDs.

- QCDs and donor-advised funds (DAFs): Many QCD rules exclude DAFs as QCD recipients check current guidance if you plan to give through a DAF. (Recent law changes have clarified certain one-time QCDs to CRT/CGA; consult counsel.)

Evaluating QCD Vs RMD if you want to act

- Run the numbers for your actual pension, Social Security taxation, other incomes, and your specific IRA balances (the ordering and timing of withdrawals matter). I can run a personalized projection if you provide those numbers.

- Ask your IRA custodian how they report QCDs (1099-R codes changed recently). Get the custodian’s process for direct transfers to charities.

- Coordinate with your tax advisor so you understand how a QCD will interact with itemized deductions, standard deduction changes, and any state income tax rules in Illinois.

- Consider my article, Roth IRA Vs Traditional IRA Tax Clarity For Retirement Savings and Use Roth IRA Conversions To Cut Your Taxes And Boost Retirement Income for more related discussion.

QCD vs RMD final observations

- Couples with higher baseline MAGI (pension + Social Security + other taxable income) who are near IRMAA thresholds often get the most immediate, practical benefit from using QCDs to satisfy RMDs: the QCD both satisfies the RMD and lowers MAGI, which can reduce or eliminate IRMAA surcharges that otherwise would add hundreds of dollars per month. See Scenario B’s year-by-year results for concrete numbers. Medicare

- For lower-income retirees (baseline MAGI well below IRMAA thresholds) the primary benefit of a QCD is the charity (and potential federal tax timing/benefit), not IRMAA savings.

As you have read, the issue is multifaceted. Consider seeking out professional help from qualified tax planning and tax preparation professionals to help you determine your QCD vs RMD strategy.