Key News

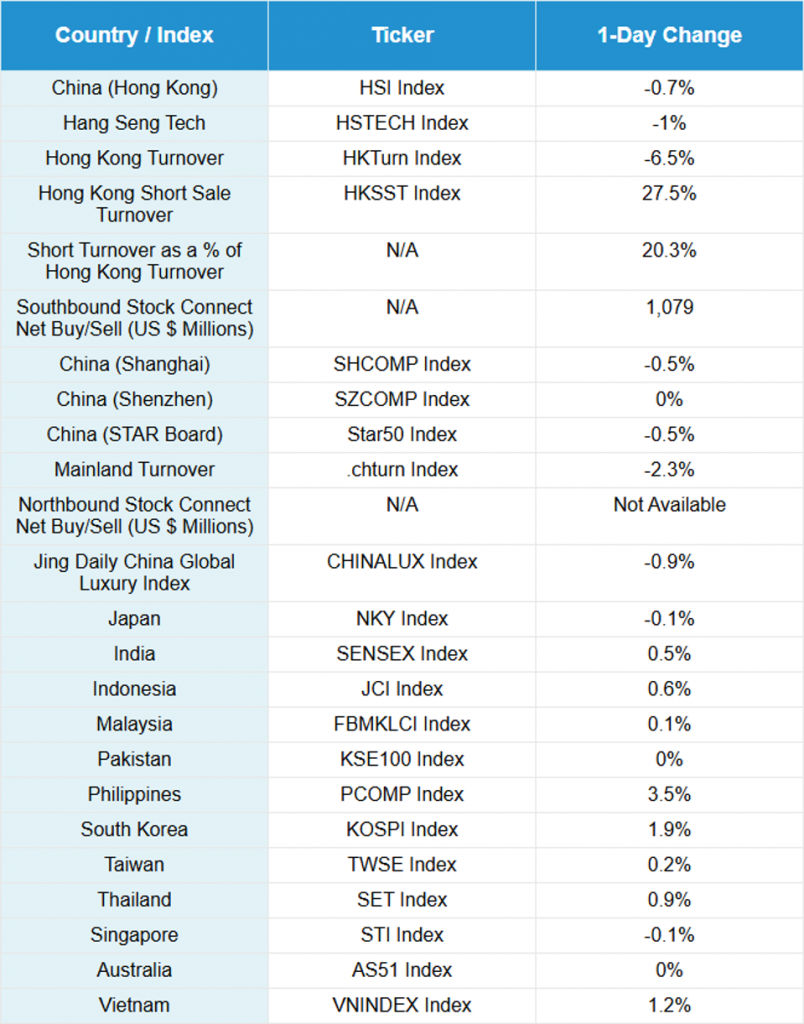

Asian equities were mixed overnight as the Philippines and Korea outperformed, while Hong Kong and Mainland China underperformed.

US Treasury Secretary Scott Bessent is said to be targeting significant progress on trade deals with China in certain sectors by Thanksgiving. Meanwhile, Trump has confirmed that China has begun buying soybeans and expects the country to fulfill its commitment by the end of the first quarter of 2026.

Hong Kong’s volumes were light, below the one-year average, overnight. There could have been a lack of buyers, apart from Southbound Stock Connect, which contributed to the market’s underperformance.

Alibaba was flat after its US listing fell -3.78% on Friday after the Financial Times reported the White House provides technology support to the Chinese army for use against the US. The headline got a lot of attention, though the company’s response was great, stating “The claims purportedly based on US intelligence that was leaked by your source are complete nonsense. This is plainly an attempt to manipulate public opinion and malign Alibaba.” I couldn’t agree more! It also confirms the benefits of our decision to hold the Hong Kong shares over the US shares. Mainland investors bought a net $266 million worth of Alibaba’s Hong Kong-listed stock via Southbound Stock Connect for the third day in a row.

Net purchases of Alibaba from Mainland investors have been strong over the past few days, after going into net sells in September and October. This is a strong indication that Mainland investors may have been buying the headline volatility. Alibaba will report third quarter earnings just before Thanksgiving, next week on the 25th.

Alibaba: Southbound Stock Connect Net Flow

Overall, Mainland investors purchased a healthy net $1 billion+ worth of Hong Kong-listed stocks and ETFs overnight on weakness.

The People’s Bank of China (PBOC), China’s central bank, will issue an interest rate decision on Thursday. We expect the central bank to leave most rates unchanged for the rest of 2025 while targeting other measures to stimulate the economy and the stock market.

Online travel booking site Trip.com fell -3.56% on China’s travel advisory for Japan. Airlines are providing refunds for Japan trips following the new Prime Minister Takaichi’s comments on a Taiwan invasion threatening Japan.

Electric vehicle (EV) and soon-to-be humanoid robotics maker Xpeng reported third quarter earnings results overnight.

- Revenue increased +101.8% to RMB 20.38 billion ($2.86B) versus analyst expectations of RMB 20.45 billion

- Revenues from vehicle sales were RMB 18.05 billion ($2.54 billion) for the third quarter of 2025, representing an increase of 105.3% from the same period in 2024.

- Adjusted Net Income was RMB -0.15 billion, as losses narrowed from RMB -1.53 billion in the third quarter of 2024 versus analyst expectations of RMB -0.54 billion.

- Adjusted earnings per share (EPS) increased to RMB -0.08 from RMB -1.67 versus analyst expectations of RMB -0.70

New Content

Read our latest article:

Labubu & Gen Z Spending: What China’s Designer Toy Craze Tells Us About the New Consumption Wave

Please click here to read

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

CNY per USD 7.10 versus 7.10 Friday

CNY per EUR 8.24 versus 8.26 Friday

Yield on 10-Year Government Bond 1.81% versus 1.81% Friday

Yield on 10-Year China Development Bank Bond 1.87% versus 1.88% Friday

Copper Price -0.95%

Steel Price +0.95%