Week in Review

- Asian equities were mixed for the week as Vietnam and India outperformed, while Mainland China’s STAR Board and the Philippines outperformed.

- On Monday, China reported an “unexpected” increase in the consumer price index (CPI) in October, up +0.2% year-over-year (YoY) versus September’s -0.3%.

- Xpeng unveiled an exceedingly lifelike humanoid robot at its 2025 Xpeng AI Day right after announcing 42,000 vehicles sold in October, representing a +30% increase from September.

- Internet earnings kicked off this week as JD.com and Tencent both beat estimates on adjusted revenue and net income in their third quarter earnings reports, though JD’s margins continue to be under pressure from instant commerce subsidies.

- Check out our latest video, where Xiabing Su attends the 2025 China International Import Expo.

Key News

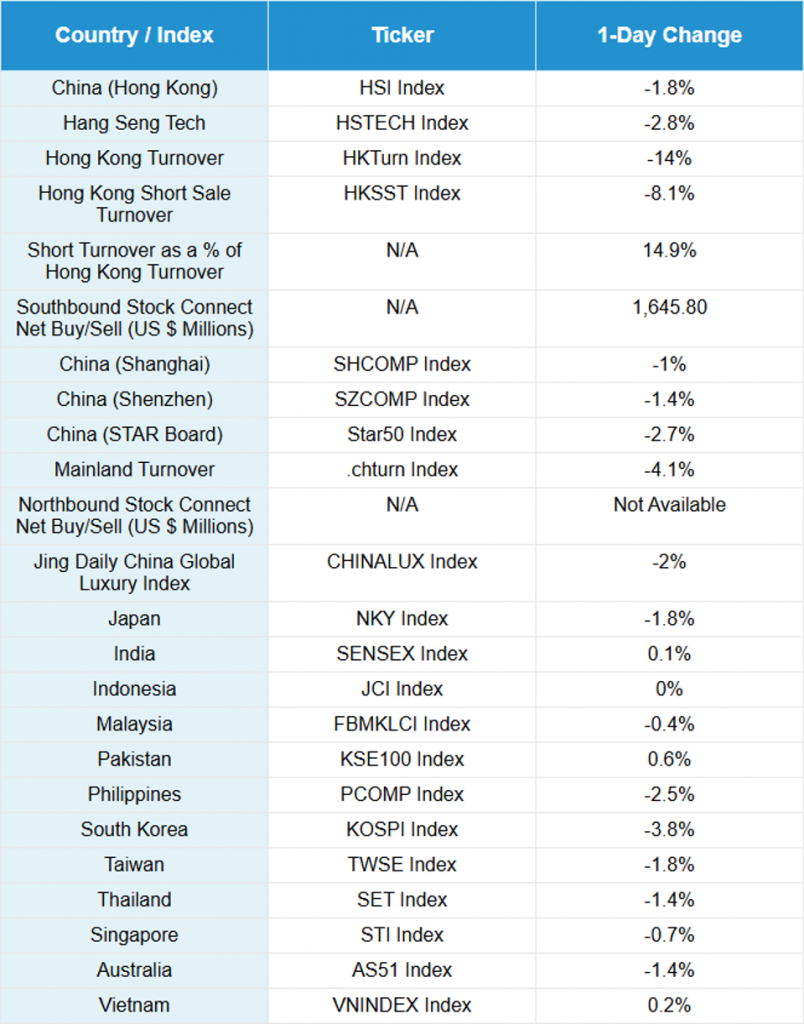

Asian equities curbed the week’s gain as the region followed US stocks south, led lower by growth stocks, except for India and Vietnam.

Hong Kong grinded lower across the trading day on terrible breadth as the Hong Kong stock heatmap resembles Omaha Beach. Mainland China was higher early as the Shanghai Composite hit a 52-week high intra-day after yesterday’s 52-week high, but plummeted into the close. Yes, China’s October economic data wasn’t great, but it wasn’t terrible, per the below.

Mainland investors bought a very healthy $1.66 billion worth of Hong Kong-listed stocks and ETFs, as Tencent and Alibaba saw large inflows, though Connect only accounted for 21% of turnover. This indicates to me that global, i.e. foreign, investors were sellers, especially as they are underweight India, which was up.

Alibaba, which fell -4.38% overnight, will partner with JP Morgan to create tokenized payments for B2B E-Commerce transactions. Alibaba will announce financial results on Tuesday, November 25th, after the close in Hong Kong. Tencent fell -2.29% despite yesterday’s great financial results. Yesterday, the company announced that Apple will get 15% of WeChat mini game purchases. Semiconductor Manufacturing International (SMIC) fell -2.78%, JD.com fell -6.03%, and Bilibili fell -1.79%. These stocks were all off despite better-than-expected results. Baidu fell -7.21% on no news, despite its continued AI push. JD Health gained +6.59% after beating analyst expectations with revenue up +29% year-over-year (YoY) and adjusted net income up +60% YoY.

Premier Li and the State Council had a meeting on implementing the 15th Five-Year Plan, including how to “enhance the supply and demand matching of consumer goods and further promote consumption”. Another focus was “accelerating the innovative application of new technologies and new models, strengthening the integration and empowerment of Artificial Intelligence”.

The Ministry of Finance’s Lan Foan was interviewed by Xinhua News Agency on fiscal policy to support the 15th Five-Year Plan. He noted supportive policies will continue, such as increasing the deficit rate, which has risen to 4% this year, in addition to the RMB 19.4 trillion worth of government bond issuance and tax and fee reductions that “exceeded CNY 10 trillion”. In response to raising domestic consumption, “we will vigorously boosting consumption” through “fiscal subsidies, loan interest subsidies and other policy tools to expand the consumption of goods and services”. He alluded to anti-involution efforts by stating “prevent “internal competition” and enhancing consumption capacity through “tax, social security and transfer payments”. Sounds good, though obviously a non-factor in today’s trading.

Nothing to report from today’s soybean watch.

October Economic Data Release

- New Home Prices month-over-month (MoM) -0.45% versus September’s -0.41%

- Used Home Prices MoM -0.66% versus September’s -0.64%

- Retail Sales +2.9% versus September’s 3% and expectations of 2.8%

- Retail sales of consumer goods excluding automobiles +4% YoY

- Online retail sales YTD YoY +9.6% YoY

- Industrial Production 4.9% versus September’s 6.5% and expectations of 5.5%

- Fixed Asset Investment -1.7% versus September’s -0.5% and expectations of -0.8%

- Property Investment YTD YoY -14.6% versus September’s -13.9% and expectations of -14.5%

- Residential Property Sales YTD YoY -9.4% versus September’s -7.6%

- FDI versus September’s -13.9% and expectations of -10.4%

New Content

Read our latest article:

Labubu & Gen Z Spending: What China’s Designer Toy Craze Tells Us About the New Consumption Wave

Please click here to read

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.10 versus 7.10 yesterday

- CNY per EUR 8.26 versus 8.26 yesterday

- Yield on 10-Year Government Bond 1.81% versus 1.81% yesterday

- Yield on 10-Year China Development Bank Bond 1.88% versus 1.88% yesterday

- Copper Price -0.10%

- Steel Price 0.23%