Many small businesses are finally hitting the “unpause” button after several weeks of uncertainty. The government shutdown ending is huge for them.

Government payments flow again to defense contractors. Tech suppliers receive their checks (well, electronic deposits). Small biz cash flow is back!

The High-Yield Fund Ready To Soar Following The Government Shutdown

Our small business lender, FS Credit Opportunities (FSCO), is back, too. FSCO has a significant 3.7% stake in TCFIII Owl Finance, LLC—a pipeline straight to tech and defense players that have been waiting on Uncle Sam’s green light.

With the shutdown ending and contracts unlocking, these repayments are flowing. This is the income that keeps FSCO’s dividends rolling at their terrific 12.5% clip.

FSCO also lends to Penn Foster (2.7% of the portfolio)—an online education platform that provides vocational training to blue-collar folks.

You know, the jobs like welding that we badly need but nobody wants to do. Federal job grants froze, starving Penn’s student pipeline. Now? Funding restarts and enrollments return. Penn’s cash flow restarts, repaying FSCO once again.

We see a similar story with Monitronics International (2.6% of portfolio). It’s a home-security monitoring service for small businesses and houses. During the shutdown, new installations stalled, customers had trouble paying, and delayed FEMA grants slowed rural upgrades.

With the restart, Monitronics catches up on its “lost weeks” quickly—funding FSCO’s interest stream.

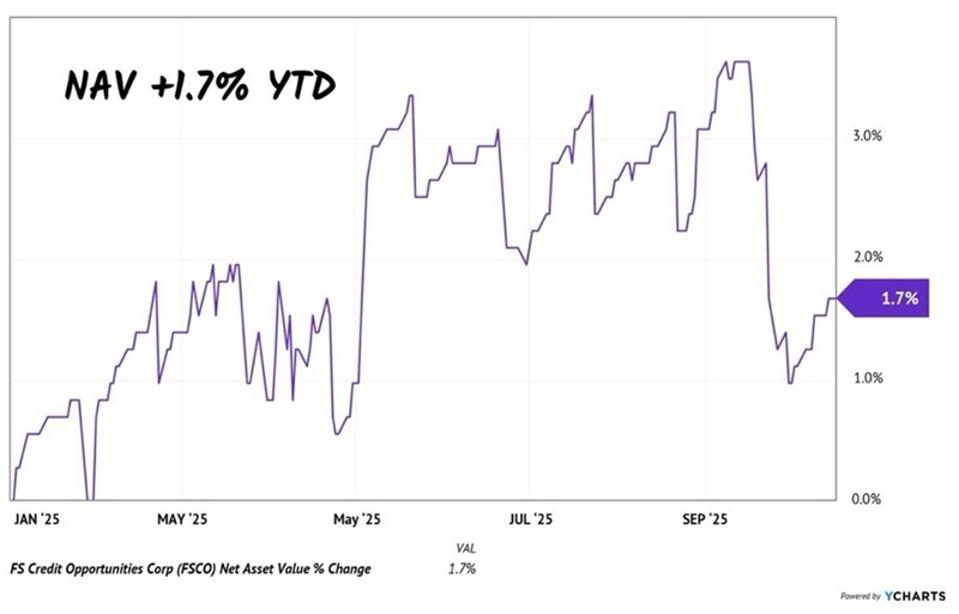

Given the magnitude of these interruptions, FSCO’s net asset value (NAV) has held up quite well year-to-date. NAV—the market value of the portfolio—has gained 1.7% in 2025, even amid the chaos.

Meanwhile, what shutdown? FSCO paid its dividend payment each month. This time last year, the fund dished 6 cents every 30 days. Now, thanks to two dividend hikes (latest in June), it rewards us with 6.8 cents per share (good for 12.5% per year!)

Yup. Paying out of capital to keep things sneakily “looking good.” Who looks (besides your CIO!)? These dividends are paid net of NAV. The NAV is often the “tell” as to the health of the payout. Think of it like blood pressure or heart rate variability (HRV)—a bad reading can be a leading indicator of trouble ahead. And a good reading a sign that all is well.

With FSCO the only problem has been the price, which is not a concern to independent thinkers like us. It means opportunity. Lower price? Higher yield on new dollars invested and better discount to NAV!

That’s one reason we like this: FSCO is a business development company (BDC) in a closed-end fund (CEF) wrapper. Our favorite feature of CEFs is that their prices swing wildly. When investors sell, they can send these funds down to discounts of their fair value (NAV). Buyers like us can profit.

In late summer, FSCO traded at a 3% premium to its NAV. Investors were paying $1.03 for $1 in assets. Investors paid up a wee bit for future FSCO rewards.

Now, it’s cheaper. But these vanilla bean investors don’t want it! FSCO trades at a 10% discount to its NAV as I write, or $0.90 on the dollar. (Bye bye, $1.03!) The shutdown scared investors, and the price drop (which moved mostly independent of NAV) fed on itself.

Well, the shutdown is ending. Soon, the discount window should narrow, too. For self-respecting contrarian investors, this is as good as it gets for this terrific 12.5% payer.

Brett Owens is Chief Investment Strategist for Contrarian Outlook. For more great income ideas, get your free copy his latest special report: How to Live off Huge Monthly Dividends (up to 7.6%) — Practically Forever.