Key News

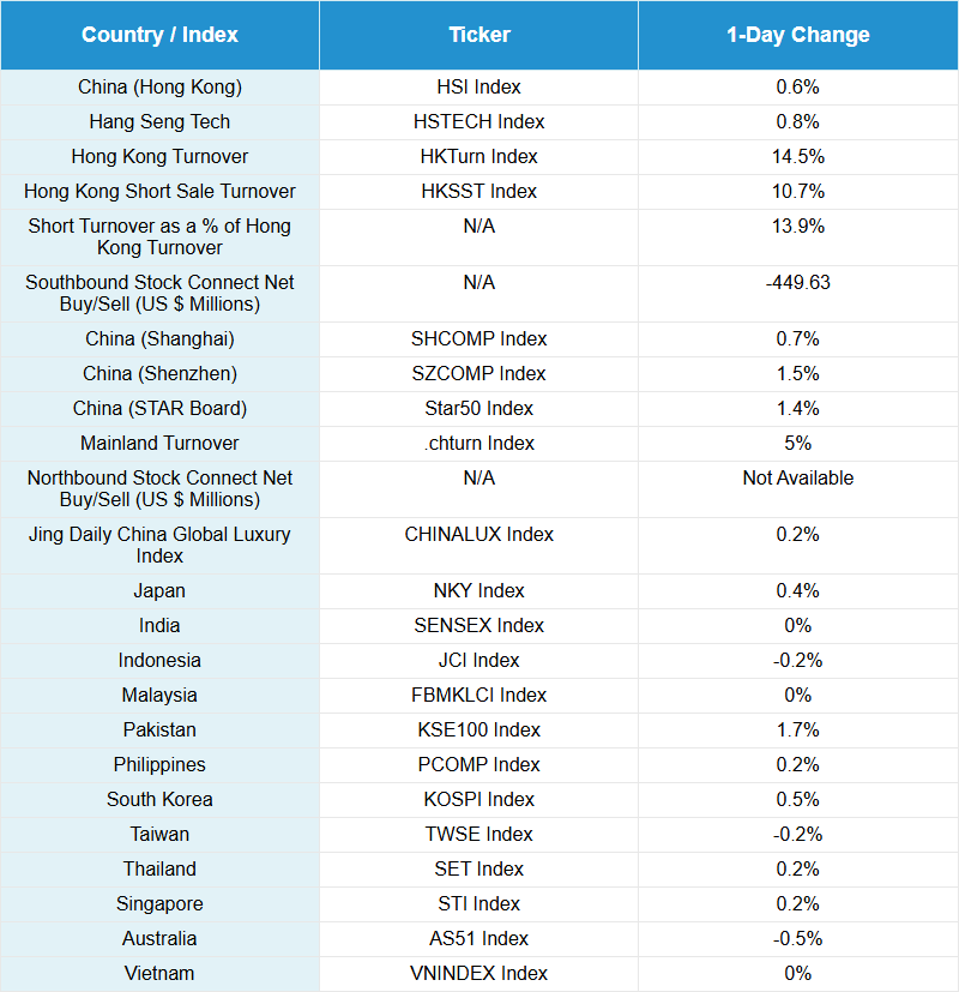

Asian equities had a good day, with Mainland China outperforming as the US dollar weakened overnight.

The Renminbi had a strong day versus the US dollar, closing at 7.09 CNY per USD. Mainland China grinded higher all day, led by electric vehicle (EV) battery giant CATL, which gained +7.56% following the CEO’s positive comments on exports. Growth sub-sectors led Mainland China higher, including non-ferrous metals (metals, mining, and precious metals), clean tech, such, as solar after multiple companies refuted negative rumors that led to yesterday’s steep drop, chemicals, pharmaceuticals and semiconductors in advance of Semiconductor Manufacturing International’s (SMIC) post-close financial results. SMIC gained +2.9% after revenues increased +9.7% year-over-year (YoY), including $2.38 billion in net income, which increased +29% year-over-year (YoY) to $191 million.

Hong Kong was flat all day until mid-afternoon, when reports emerged that Alibaba, which gained +3.32%, will launch an AI personal retail assistant based on its Qwen large language model, having previously focused on enterprise and corporate efforts. The talk is that the company will directly compete with OpenAI’s Chat GPT for users globally. Alibaba stock was a net large buy in Southbound Stock Connect today.

Hong Kong-listed Pharmaceuticals had a very strong day, though I don’t see a catalyst. Baidu fell -0.08% despite several positive announcements at Baidu World 2025. In addition to launching its updated large language model (LLM) Ernie 5.0, the company announced that it will upgrade its AI chip efforts from the Kunlun P800 next year, with the release of the Kunlun M100, an AI semiconductor chip, and the M300, slated for launch in 2027.

NetEase gained +0.9% on reports that the company’s new “Yanyun Shisix Sheng” martial arts game has 10 million users pre-registered for the Sony PlayStation launch on November 15th. Tencent Music Entertainment fell -10.69% after beating analyst expectations, but providing a weak Q4 guidance. I am surprised at the downdraft, candidly. Southbound Stock Connect was a rare net sell driven by a very large sale in the Hong Kong Tracker ETF and large net sell in the Hang Seng China Enterprise ETF.

After the close, October New Loans year-to-date (YTD) were RMB 14.97 trillion versus September’s RMB 14.75 trillion, and economist expectations of RMB 15.25 trillion. Meanwhile, Aggregate Financing YTD was RMB 30.9T versus September’s RMB 30.9T and economist expectations of RMB 31.255T. Premier Li Qiang will attend the G20 summit next week in South Africa.

An element of US ADR weakness yesterday was attributed to chatter that Singles Day sales weren’t strong, despite JD.com’s press release to the contrary. Tencent Music Entertainment’s weak Q4 guidance was potentially a factor despite beating analyst estimates.

Another factor was that several media sources noted China’s lack of US soybean purchases and its failure to remove the 13% US soybean import tariff. I did notice a big, $20 billion Brazil soybean purchase on Monday, though a local media source noted that the US soybean purchases will be exempted from the tariff since state-owned enterprises (SOEs) are doing the purchases. Seeing such a story garner so much attention is disheartening, though it highlights how fragile sentiment can be. Anyway, I’ll be monitoring these soybeans closely.

Overnight, the Ministry of Commerce was asked about US soybean purchases by a Reuters reporter. The MoC spokesperson said China-US Kuala Lumpur trade consultations, including “agricultural trade,” have been previously disclosed. Treasury Secretary Bessent stated that China will purchase 12 million metric tons of US soybeans in November and December 2025, and 25 million metric tons from 2026 to 2028. It is worth noting that Reuters did not write an article about the MoC interaction since clearly the outcome is not negative. It is feasible that the US soybean import data isn’t available due to the US government shutdown. Intra-day updates available on Twitter/X at @ahern_brendan.

Yesterday, we held our quarterly webinar, which I recommend checking out, as it contains a lot of valuable information and data. More data and less hyperbole is my 2026 New Year’s Resolution! My favorite data point, which highlights some great insights on active mutual fund positioning from Copley Fund Research, is the comparison of US and European China flows.

The European ETF market is $3 trillion, compared to the US’s $13 trillion ETF market. How is it feasible that Europe has $8 billion of China ETF flow this year versus the US’ $1.5 billion? This is the total of all ETFs in each market, net of selling costs. Europe has $20 billion of Emerging Markets ETF flow, versus the US’ $24 billion of Emerging Markets flow. Does it feel like US investors have a touch of home bias despite middling returns year-to-date (YTD) versus non-US markets? The real kicker is that there are 1,573 U.S.-listed ETFs focused on US stocks. 78 of them have more than $1.5 billion! SEVENTY EIGHT! That’s crazy; the entire China ETF market ranks that low. Pain trade higher!

I am headed to Singapore over the weekend for a week of work. I am really looking forward to this trip for a variety of reasons, including great food and the best customs and passport control globally.

Tencent Q3 Earnings Review

Tencent (700 HK) reported Q3 financial results after the Hong Kong close. Notably, the stock is still below its all-time high of 2021.

- Revenue increased +15% YoY to RMB 192.9B ($26.95B) from RMB 167.19B versus expectations of RMB 188.8B

- Adjusted Net Income increased +18% YoY to RMB 70.6B from RMB 59.81B versus expectations of RMB 66.03B

- Adjusted EPS RMB 7.577 from RMB 6.34 and versus expectations of RMB 7.11

- The company bought 35.4 million shares on the Hong Kong Stock Exchange for approximately HKD 21.1 billion.

JD.com Q3 Earnings Review

E-commerce giant JD.com (JD US, 9618 HK) reported Q3 financial results after the Hong Kong close.

- Revenue increased +14.9% to RMB 299.1B ($42B) from RMB 260.39B versus expectations of RMB 294.44B

- Adjusted Net Income decreased to RMB 5.8B ($800mm) from RMB 13.17B versus expectations of RMB 4.19B

- Adjusted EPS decreased RMB 3.73 ($0.52) from RMB 8.68 and versus expectations of RMB 2.70

- The company bought 40.4 million ADRs for approximately $1.5 billion during the nine months ended September 30, 2025.

Bilibili Q3 Earnings Review

Online gaming community and video provider Bilibili (BILI US, 9626 HK) reported Q3 financial results after the Hong Kong close.

- Revenue increased +5% to RMB 7.69B ($1.08B) from RMB 7.31B versus expectations of RMB 7.66B

- Adjusted Net Income increased +233% YoY to RMB 786.3mm ($110mm) from RMB 235.9mm versus expectations of RMB 645mm

- Adjusted EPS RMB 1.75 ($0.25) from RMB 0.57 and versus expectations of RMB 1.49

- The Company had repurchased a total of 6.4 million of its listed securities as of September 30, 2025, for a total cost of $116.4 million.

New Content

Read our latest article:

Labubu & Gen Z Spending: What China’s Designer Toy Craze Tells Us About the New Consumption Wave

Please click here to read

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.09 versus 7.11 yesterday

- CNY per EUR 8.24 versus 8.23 yesterday

- Yield on 10-Year Government Bond 1.81% versus 1.81% yesterday

- Yield on 10-Year China Development Bank Bond 1.88% versus 1.88% yesterday

- Copper Price +0.69%

- Steel Price +0.03%