Taxes, tariffs, SNAP, and immigration have been at the center of debate in Washington D.C. and across the nation. As Republicans and Democrats point the finger of blame at each other, Americans are left to pick up the pieces. In fact, most of today’s political narratives sound like a fairy tale, more specifically, a Grimm fairy tale with dark overtones. In short, each party is exaggerating their worst-case scenario, which creates fear and excites their voter base. For example, arguments about extending the 2017 tax cuts, tariffs, SNAP benefits, immigration, and more, have become the latest political battleground. Here, we will try to cut through the noise to bring a measure of clarity on these issues.

Lower Taxes: Good or Bad?

One political battleground is in the arena of taxes. Reducing taxes puts more money in the hands of consumers and businesses, and when they spend this money, the economy flourishes. When Congress passed the OBBB and President Trump signed it into law on July 4, 2025, among other items, it extended the existing marginal tax rates, rather than letting them expire, which would have increased taxes across the board. I wrote about this in a recent article, “Who Benefited Most From Trump’s Tax Cuts? The Answer May Surprise You.” While taxes are needed to fund government operations, a smaller, more efficient government would need less tax revenue than a large, inefficient government, which is what we’ve had for a long time.

Gross Tariff Revenue to Date

We’ve heard the president suggest that the U.S. has received trillions in tariff revenue thus far. According to bipartisianpolicy.org, the actual figure as of November 7, 2025, was $227.3 billion. Is this an accounting shell game? Not necessarily. In accounting, there are two primary methods used, the cash basis method and the accrual method. Under the accrual method, income and expenses are recognized as they are earned or incurred, even though they may not have been received or paid as cash. Thus, if the administrations figure includes expected tariff revenue, then the number would be much higher.

That said, gross tariff revenue is higher in 2025 than in previous years. As of the same date in 2022 (Nov 7), the federal government had collected about $99.8 billion. By the end of 2022, gross tariff revenue hit $117.5 billion, the second largest amount to date. This is still about $100 billion lower than 2025.

To give money back to taxpayers, President Trump has floated the idea of sending a $2,000 rebate check to millions of Americans with income levels below certain thresholds. This sounds more like a Democrat idea, but Trump did approve checks for Americans in his first term after Covid hit. Is this a rebate? A way to garner votes? Perhaps both? Regardless, it sounds more like a socialist idea than a capitalist idea. Perhaps it’s a new capitalist-socialist merger.

SNAP: A Political Hot Potato?

The Supplemental Nutrition Assistance Program, or SNAP, began in 1974. In its first full year, 12.9 million Americans received SNAP benefits. This equates to 6% of the population at the time, at an estimated cost of $3.43 billion. When the government shut down, October 1, 2025, it placed SNAP benefits in jeopardy. Currently, there are an estimated 42 million Americans depending on SNAP benefits, representing about 12.3% of the population. According to macrotrends.net, the total cost of SNAP in 2024 was about $97.4 billion, down from a peak of $151 billion in 2021.

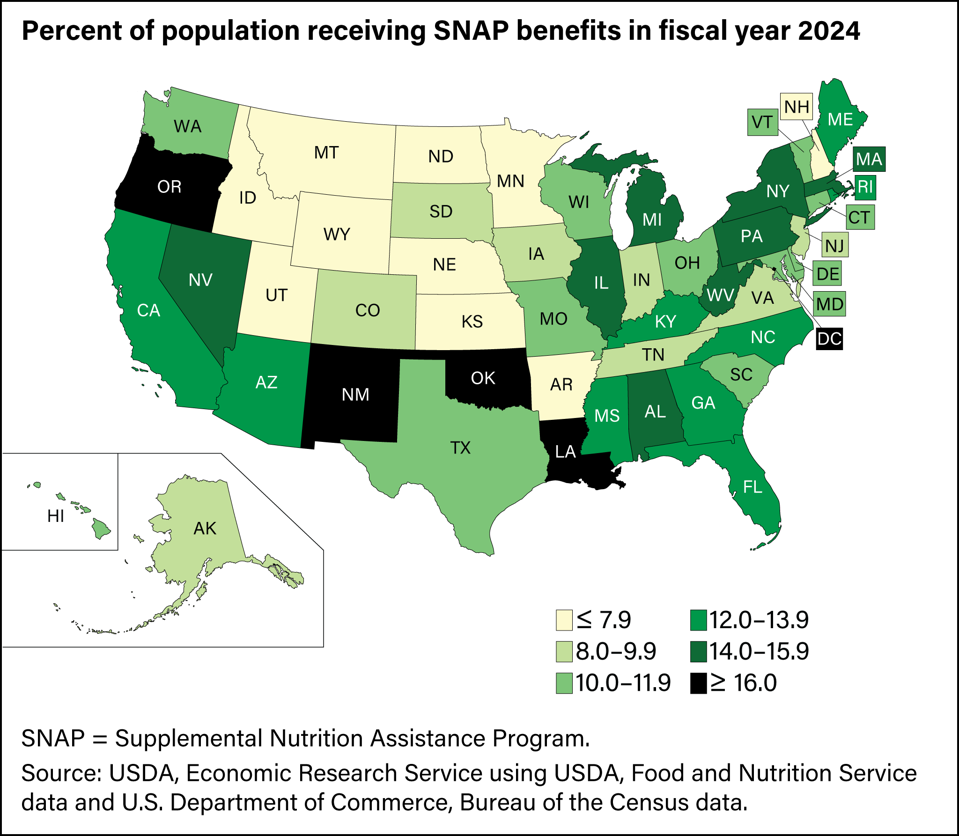

The USDA – the agency that oversees SNAP, lists four states with greater than 16% of its residents on the program. They are Louisiana, Oklahoma, New Mexico, and Oregon. Washington D.C. is also above that threshold. There are 10 states with less than 7.9% of their population receiving SNAP. They are Montana, Idaho, North Dakota, Wyoming, Utah, Nebraska, Kansas, Minnesota, Arkansas, and New Hampshire. The following chart provides more information on all states.

Immigration: Do We Need It?

Legal immigration is an important part of the U.S. economy, as it increases the workforce, boosts productivity, and helps the economy grow. However, during the open-border, Biden years, many entered the country illegally, including criminals, prompting deportations from the Trump administration. Sir Issac Newton said it best in his Third Law of Motion, which says that for every action, there is an equal and opposite reaction. The extreme, unchecked open border policy under Biden is being met with a robust deportation policy under Trump. Unfortunately, whenever such a monumental task is tried in a brief period, mistakes can happen.

How many immigrants are in the U.S.? Various sources estimate that as of June 25, 2025, the U.S. had about 51.9 million immigrants, making up 15.9% of the U.S. population. In January 2025, there were about 53.3 million immigrants. Thus, the current figure (June 2025) is about 1.4 million lower than in January, marking the first decline in over 50 years. The largest number of new arrivals occurred in 2023 when over 3 million individuals came to America during the Biden presidency.

Taxes, tariffs, SNAP, and immigration continue to be hot button issues. As each party pushes their own narrative, Americans are left to decide who is telling the truth. Moreover, with the onset of AI, getting to the truth has become much more difficult. Suffice to say that there is truth on both sides, just not the whole truth. I’m reminded of the old TV series, Dragnet, where Sgt. Joe Friday famously said, “just the facts, mam.” Is that too much to ask? No. But it seems to be quite a challenge these days.