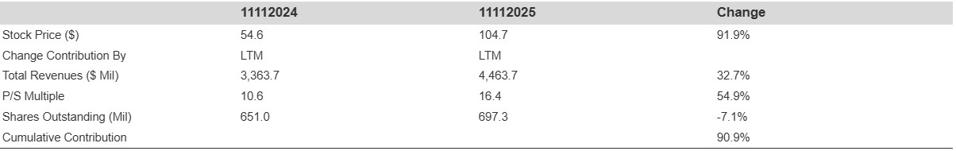

Roblox (RBLX)’s stock has soared nearly 92% over the past year, fueled not only by accelerating revenue but also by renewed investor enthusiasm that has effectively doubled its valuation multiple. The rally has been underpinned by robust user growth, expanding partnerships, and innovative strategies that continue to redefine the creator economy.

However, shares have recently pulled back following a softer-than-expected earnings report and cautious near-term guidance. The market’s reaction reflects temporary concerns about expense growth and margin recovery rather than any deterioration in core fundamentals. Underneath the volatility, Roblox’s expanding user base, rising bookings, and improving monetization initiatives reinforce its long-term growth potential. For patient investors, the recent dip could represent an appealing opportunity to build exposure to a platform steadily evolving into a cornerstone of the social and creative economy.

Let’s delve into the narrative behind this momentum.

What is unfolding here? The stock price soared 92%, propelled by a 33% increase in revenue and a 55% enhancement in the P/S multiple. Let’s explore the significant events that led to these changes.

Before we delve into the specifics of the events that caused the stock surge, let’s see what market wisdom suggests: Investing in a single stock can be risky, but a broader, diversified strategy can provide substantial value. Quiz time: Over the last 5 years, which index do you believe the Trefis High Quality Portfolio has outperformed — the S&P 500, the S&P 1500 Equal Weighted, or both? You might be surprised by the answer. Discover how our advisory framework equips you to stack the odds in your favor.

Here Is Why Roblox Stock Moved

- User & Engagement Growth: Q3 2025 DAUs increased 70% YoY to 151.5M, with hours engaged rising by 91%. Consistent user growth.

- Strong Revenue & Bookings: Q3 2025 bookings jumped 70% YoY to $1.9B. Q3 2025 revenue climbed 48% YoY. Robust financial growth.

- Enhanced Creator Economy: DevEx payout to creators increased by 85% in Q3 2025, elevating creator earnings over $1B in a 12-month period.

- Strategic Partnerships: Shopify integration for physical goods (early 2025) and an IP licensing platform were launched.

- Product Innovations: New AI tools, 100K player servers, and avatar technology were revealed at RDC 2024/2025.

Our Current Assessment Of RBLX Stock

Opinion: We currently view RBLX stock as relatively expensive. Why is that? Take a look at the complete story. Read Buy or Sell RBLX Stock to understand what shapes our present viewpoint.

Risk: A reliable method to evaluate RBLX’s risk is to review its most significant declines during market upheavals. It dropped approximately 83% from peak to trough during the 2022 inflation crisis alone. That’s a notable reduction, notwithstanding all the positive growth factors surrounding the stock. Although solid fundamentals are important, history indicates that during major sell-offs, RBLX can still experience substantial losses. Therefore, even if the current situation appears robust, be prepared for sudden downturns if broader market stress occurs.

RBLX stock may have enjoyed significant gains recently, but investing in a single stock without thorough, detailed analysis carries risks. The Trefis High Quality (HQ) Portfolio, featuring a selection of 30 stocks, has a history of consistently outperforming its benchmark, which includes all three indices — the S&P 500, S&P mid-cap, and Russell 2000. What accounts for this? As a collective, HQ Portfolio stocks have delivered superior returns with lesser risk compared to the benchmark index; resulting in a smoother investment experience, as demonstrated in HQ Portfolio performance metrics.