We’ve got a sweet deal on one of my favorite AI dividends (a 7.9% monthly dividend). And it’s not just because of last week’s stock market drop—though that does help.

Truth is, the bargain on this stout fund has been hanging around for a while now. But it’s on borrowed time indeed. We need to make our move.

Forget NVIDIA: This Is the Best AI Buy on the Board Pays A Monthly Dividend

The AI play in question is the Cohen & Steers Infrastructure Fund (UTF). It’s the closed-end fund (CEF) behind that 7.9% dividend (which, by the way, pays monthly).

In addition to the dividend, we like UTF because it’s a “tollbooth” play on AI. You won’t find an NVIDIA (NVDA) or a Microsoft (MSFT) here. Instead, UTF holds stocks that provide the servers, transmission lines and power plants that keep the AI—and indeed the whole digital economy—well-lit and connected.

AI’s voracious power demand is, of course, far from a secret. Data centers—the engines behind ChatGPT and its competitors—already account for about 4% of US electricity consumption, and that number is climbing fast.

And UTF is here for it. Around 35% of the fund’s holdings are in utilities, with another 18% in gas distributors and pipelines. The fund also holds about 15% of its assets in corporate bonds, which stand to gain as rates move lower.

(That, by the way, is exactly what I see happening as AI disrupts the job market and Jay Powell’s term ends in the spring; he’ll almost certainly be replaced by someone who will work with the administration to cut rates.)

All the big names you’d expect are here, including major utilities like NextEra Energy (NEE), Duke Energy (DUK) and Dominion Resources (D), gas distributors like Enbridge (ENB) and AI “backbones” such as cell-tower owner American Tower (AMT).

The fund is a holding of my Contrarian Income Report service, and is now in its second tour in our portfolio. Since we bought it in November 2020, it’s returned a tidy 40% for us—not bad for a “sleepy” fund like this in a period of mostly rising rates.

And in its first tour, from 2016 to 2019, the fund did even better, nearly doubling on a total-return basis. Given the discount it sports now (more on that in a sec) and much more favorable rate setup, this is the kind of return I expect in the next couple of years.

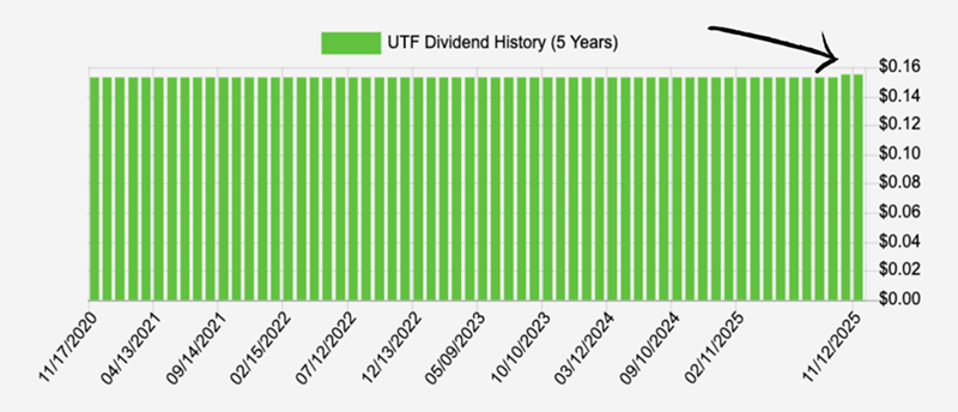

Before we get to the discount, let’s swing back to that dividend for a moment, because it really is about as steady as they come—and has even seen a modest uptick in the last couple of months:

AI’s thirst for electricity has sent the utilities sector—shown below by the performance of the go-to utility ETF, the Utilities Select Sector SPDR Fund (XLU), soaring past the S&P 500 this year.

This is not normal. This “low-drama” sector almost always trails stocks, and by wide margins, too. But while XLU—and many individual utility stocks—are crowded trades, UTF is anything but.

To get at the deal on offer here, we need to first remember that CEFs like UTF generally have a fixed share count for their entire lives. So they can, and often do, trade at different levels (discounts and premiums) to their net asset values, or NAVs. (NAV is another way of referring to the value of the fund’s underlying portfolio.)

And right now, UTF is doing something few other utility plays are—it’s trading at a steep, and sudden, discount:

That’s weird, given that pretty well everything is going UTF’s way right now. So why does this deal exist?

The reason goes back to the fixed share count I just mentioned. Because while CEFs don’t issue shares like regular stocks, they do sometimes offer existing investors the right to buy more. That’s what UTF has done. And the resulting fear of dilution prompted some shareholders to sell—driving that huge discount you see above.

Now it’s fair to doubt that a share issue could cause such a violent move, and lucky for us, with CEFs, we have a way to check.

With CEFs, when we get a setup like this, we simply need to look at the fund’s portfolio in isolation (something we can’t do with ETFs) and see what its real performance is doing. If it’s ticking along, as is the case here (see orange line above), we’ve almost certainly got a good buy setup.

That’s another reason why CEFs are smart contrarian investments. In regular stocks and ETFs, a bargain like this would appear and disappear fast—likely too fast for us regular folks to pounce. Not so with CEFs, because:

- CEFs are a small market, so big “discount swings” often go unnoticed for quite a while, and …

- CEF buyers tend to be risk-averse, so they’re quick to overreact to temporary worries, like a share issue.

Moreover, despite the slow-motion response to this drop, the fund’s discount is starting to close. It’s only a matter of time before its market price reassumes its rightful level above NAV. The time to make our move is now.

Brett Owens is Chief Investment Strategist for Contrarian Outlook. For more great income ideas, get your free copy his latest special report: How to Live off Huge Monthly Dividends (up to 7.6%) — Practically Forever.