Today we’re going to run a simple “rinse and repeat” trade that—time and time again—gives us income investors what we all really want: High—but sustainable—dividends, plus a nice capital gains “bonus.”

In other words, the full package of income and upside. In investing, this combo goes by the name total return, and it’s what we really need to focus on to build a portfolio that lets us retire with true peace of mind.

Most investors know this, but then quickly forget it when they run up against a stock with a massive yield, like the 21.1% (!) payout on Prospect Capital Corp. (PSEC), a business development company (BDC) that makes loans to mid-sized US companies.

And admittedly, PSEC’s payout is compelling: For every $100,000 invested, you get $1,758 in dividends every month! Who wouldn’t be tempted?

Okay. Over to you, total return.

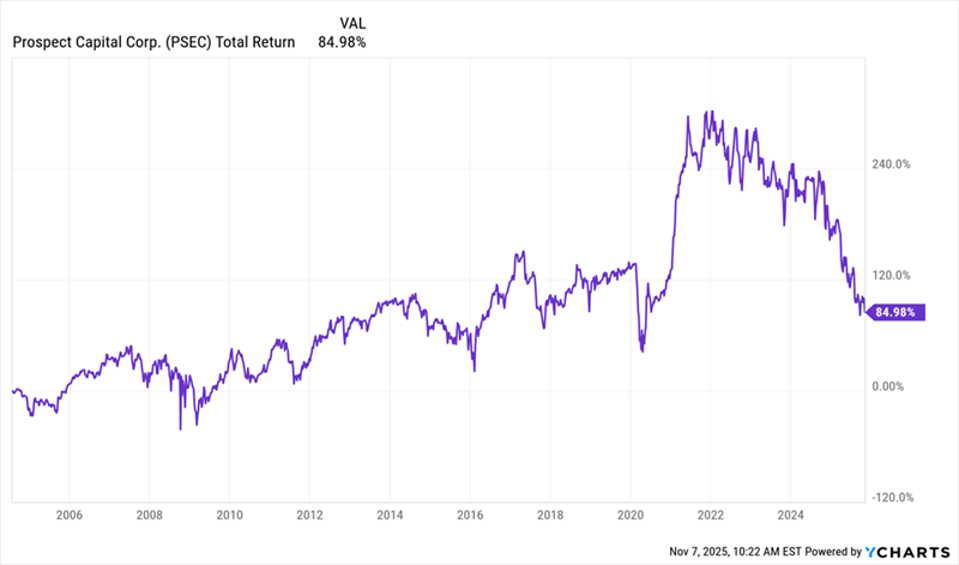

Here we see that PSEC booked an 85% total return over a 21-year period. And remember, that’s with dividends included!

In other words, price drops are stealing away what the dividend gives, leaving investors with a sad annualized return of roughly 3%. That’s worse than US government bonds, and it’s much riskier, too.

PSEC is a classic example—and admittedly a bit of an extreme one—of how focusing mainly on dividend yields can steer you onto the rocks. But going the other way—zeroing in on tiny yields in hopes they’ll keep your income (and gain potential) safe—doesn’t work, either.

2 Dividends To Consider For Retirement

Consider an ETF like the State Street SPDR S&P Dividend ETF (SDY), whose 2.6% yield is small but still more than double that of the S&P 500. That’s some consolation for yield-hungry investors—especially since SDY has had a much better return than PSEC in the last decade.

But when it comes to getting real, safe and high income from your portfolio, you’re best to take a “Goldilocks” approach: Find a yield that’s not too low but also not too high. That typically means a yield around 8% to 10%.

Now let me stop right here and say straight out that, yes, such a payout sounds sky-high to most people. But it’s actually much more sustainable than it looks.

After all, if the stock market grows by about 10.5% per year (as it has over the last hundred years), couldn’t a fund that holds blue chip US stocks and pays out about 8% annualized deliver such a payout for a period of years?

The answer is yes. It comes in the form of the Liberty All-Star Equity Fund (USA), a closed-end fund (CEF) that yields slightly more than that—10.9%—and has posted the kind of return needed to deliver that payout over the long haul, sailing past SDY.

Not only has USA, which holds S&P 500 mainstays like NVIDIA (NVDA), Visa (V), Capital One Financial (COF) and Meta Platforms (META), beaten SDY over the last decade, but it has done so while actually growing dividends.

Before we go further, I should point out that USA commits to paying 10% of its net asset value (NAV, or the value of its underlying portfolio) as dividends every year, in four quarterly installments of 2.5% of NAV each. This is why this line fluctuates a bit.

The upshot here is that this management simply “converts” a slice of the returns from these stocks into dividends, delivering both capital gains and real, significant income to shareholders.

That brings up another question: If USA commits to paying 10% of NAV as dividends, how does the fund pay more than that—10.9% as of this writing?

That’s because CEFs often trade for less than their assets are worth. USA for example, trades at a 9.8% discount to NAV as I write this. And when you calculate the dividend based on per-share NAV it comes out lower than the yield based on the market price.

That’s one way a CEF discount benefits us. The other comes back to that “rinse-and-repeat” trade I mentioned a second ago.

Because if you can buy a CEF at a discount, then you can buy stocks like Microsoft, Amazon.com, and Capital One Financial for less than they cost on the market. Then our play is straightforward: Hold the CEF, collect the dividends, then sell when the fund trades at a premium.

That is the “Jedi” way to play CEFs, and it’s at the heart of my CEF Insider newsletter.

With a fund like USA, which has been around for over 30 years, one can simply buy when the discount is wide, wait for the premium that comes around every few years, then sell for a profit.

Someone who bought USA in the 2010s, for example, when its discount was over 15%, then sold in 2021, when the premium rose to 15% would’ve banked strong gains on top of the big income stream the fund paid over that time.

But when you sell, what do you buy? Obviously, another high-yielding, heavily discounted CEF! By rotating between funds like this, you can secure a diversified portfolio with a big yield—and pocket “discount-driven” gains when the opportunity presents itself.

Think of that upside as an added bonus—and an antidote to the very real risk of getting hung up on dividend yield alone.

Michael Foster is the Lead Research Analyst for Contrarian Outlook. For more great retirement income ideas, click here for our latest report “Indestructible Income: 5 Bargain Funds with Steady 10% Dividends.”