The beauty industry has hit an attention recession.

Paid creator collaborations have increased more than 41% since last year, yet engagement has fallen nearly 20%. The beauty giants are working harder, not smarter while indie brands are building stronger, longer-lasting attention.

To understand why, Traackr, the global creator intelligence platform, analyzed millions of posts from 256 beauty companies across TikTok, YouTube, and Instagram between 2023 and 2025, spanning the U.S., U.K., and France.

The findings reveal a clear pattern: independent brands such as Rhode, Rare Beauty, Huda Beauty, e.l.f., and Merit are increasing their share of influence at 14 times the rate of global portfolio companies, including Estée Lauder, L’Oréal, and Coty.

How Smaller Brands Are Outperforming Big Portfolios in Creator Marketing

Hailey Bieber’s beauty brand, Rhode, was acquired by e.l.f. Beauty in 2025 for $1 billion, a valuation that reflected far more than celebrity appeal.

When Rhode launched in 2022, Bieber’s star power drove 73% of the brand’s visibility. One post to her millions of followers could instantly sell out products. By 2025, that reliance had dropped to 14% as Rhode expanded its creator community from 2,000 to 8,000 active partners, extending visibility across new audiences while driving more consistent performance.

Traackr’s data shows a similar pattern across other high-performing indie brands. Nearly half of creators who work with independents return for repeat collaborations, compared with 38% for large portfolios.

Founded by beauty blogger Huda Kattan in 2013, Huda Beauty built its business around creators long before the rest of the industry. Today, 85% of its total attention comes from repeat creators, the highest rate in Traackr’s study.

Retained creators drive stronger visibility and lower cost per engagement. By expanding their community while deepening loyalty, indie brands like Rhode and Huda create networks that amplify their reach. For smaller brands, that efficiency is what makes growth possible.

“When you see the same creators showing up for a brand, it tells consumers that a relationship exists inside the brand’s world, not just around it,” said Sarah Davis, a Senior Professional Consultant at Traackr. “That depth creates credibility through consistency.”

The Smarter Way to Invest in Paid Creator Media

For many large brands, boosting (i.e., paying to amplify a creator’s post) is an automatic process. When a post goes live, it’s often promoted immediately to meet campaign targets.

Independent brands can’t afford to work that way. They wait to see what performs organically, then invest where audiences are already responding.

Traackr’s data shows indie brands boost about 10% of creator posts, compared with nearly 15% for portfolio brands.

Gisou, the hair-care brand founded by creator Negin Mirsalehi, boosts slightly more content than average, but paid posts deliver engagement roughly 2.5 times higher than those of portfolio brands. This selective approach requires more time and attention, but the results are stronger because the audience decides what’s worth investing in, rather than the media plan.

“You can’t scale what you can’t see,” says Pierre-Loïc Assayag, Traackr’s CEO and co-founder. “When creator data is unified, it shows exactly which content deserves amplification and which doesn’t. That’s how scale becomes efficient.”

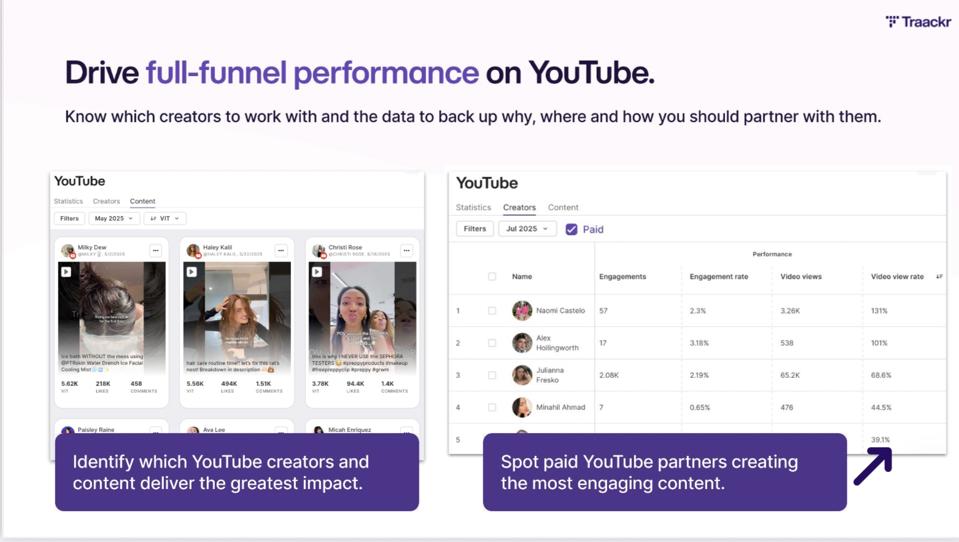

Why YouTube is Beauty’s Biggest Growth Opportunity

TikTok and Instagram may still dominate beauty feeds, but according to Traackr data, they’ve reached peak saturation. Beauty creators are posting more than ever, yet engagement continues to fall.

YouTube, meanwhile, has become the most significant opportunity for sustained attention in the beauty industry. It’s more intentional, the place people go to learn, compare, and spend more time with content.

Many marketing executives underestimate YouTube’s value simply because they don’t use it themselves.

Traackr’s data shows that independent-brand videos on YouTube average a 22% view-through rate, significantly higher than that of their portfolio peers.

Merit, the minimalist beauty brand known for its “five-minute face,” saw its YouTube visibility increase by 33% year-over-year. Its search-friendly, longer-form videos continue to earn views months after they go live extending their impact far beyond initial campaigns.

e.l.f. Beauty is proving that big brands can win here, too. Its YouTube visibility rose 27% year over year, one of the highest growth rates among portfolio brands.

How to Build Creator Marketing Infrastructure That Actually Works: Three Questions Every Beauty Brand Should Ask

The challenge for large beauty organizations isn’t creativity or budget. It’s infrastructure.

Most already have plenty of creator data, but it’s scattered across PowerPoint presentations, spreadsheets, and agency decks, making it hard to use.

“Even if a company has already prioritized creator marketing, most don’t have usable data today,” says Assayag. “Without it, they can’t benchmark against competitors, model performance across channels, or scale what works.”

According to Assayag, brands should start by asking three simple questions:

- Which creators do customers genuinely associate with our brand?

- Which organic posts perform best before we boost them?

- Where does our attention actually happen, YouTube, Instagram, or TikTok?

If the answers aren’t clear, the creator infrastructure isn’t strong enough.

With 15 years of data and a global view across multiple business categories, Traackr helps brands make those connections, turning reporting into insight and insight into action.

Moving From individual Campaigns to Building the infrastructure of Influence

Indie brands are proving that creator marketing is most effective when it operates as a cohesive system rather than a series of one-off campaigns. They see what’s working, double down fast, and cut what doesn’t.

The old playbook of more creators, more posts, and more spend has stopped working.

The new approach is clear: build long-term creator relationships, prove success before boosting, and go where attention lasts.

The brands that master this approach will own the next era of beauty marketing. The rest will keep spending more to matter less.