In the spring, market participants warned that the US Treasury market was dead. Pundits, financial reports and analysts at the time were predicting a significant decline in global demand for US Treasuries due to the implementation of tariffs, an increasing budget deficit, a credit rating downgrade and the Trump administration’s “America first” policies.

Six months later, the Treasury market says, “I’m not dead.”

Why Investors Thought US Treasuries Would Sell Off

Since April, there have been a number of reasons why investors were concerned about bonds, specifically US Treasury bonds.

#1: Liberation Day

The announcement of broad-sweeping tariffs on April 2 initially spooked the financial markets. Equity markets dropped and risk measures in bond markets increased. The expectation was that tariffs would slow the US economy, increase inflation and force bond yields higher and corporate profits lower.

#2: Moody’s Downgrade

On May 16, Moody’s Ratings cut the credit rating of US Treasury debt to AA+ from AAA. This was the last of the three major debt rating agencies to downgrade US Treasury debt below the highest rating of AAA. As I discussed in an article dissecting the downgrade, Canada, Germany, Switzerland, Norway and a handful of other countries now have a higher rating than the US. Typically, when a bond is downgraded or markets expect a downgrade, the price will reset lower to compensate for the increased risk.

#3: The One Big Beautiful Bill Act (OBBBA)

Signed into law on July 4, the OBBBA is estimated to cost $3.4 trillion over the next 10 years, according to the Bipartisan Policy Center. This policy adds to the already increasing deficit, currently running at $1.78 trillion for 2025, and to future deficits, which will have to be financed through the increased issuance of US Treasuries. The amount of US Treasury debt outstanding is now at $29.7 trillion and growing. The expected increase in supply has the potential to push yields higher (prices lower) on bonds should demand not increase proportionately.

#4: Trump Administration Policies

The Trump administration’s deglobalization policies could also be seen as inflationary. Trade protection, onshoring of less efficient manufacturing and selective retaliatory trade restrictions, in addition to tariffs, all threaten to increase consumer inflation.

Why US Treasuries Have Remained Strong

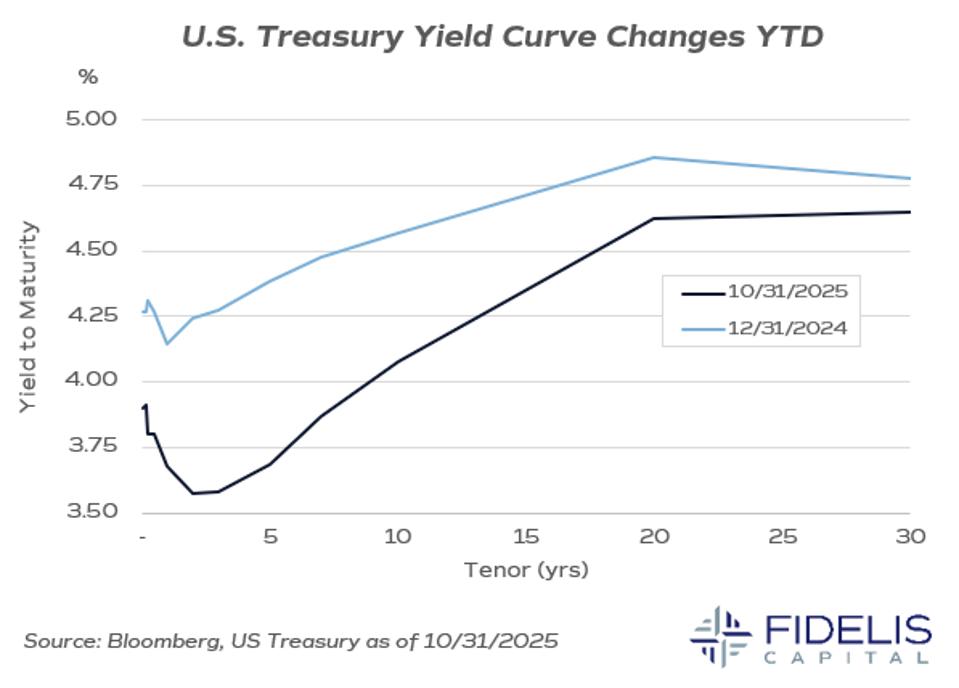

Despite these apprehensions, the Treasury market has been well behaved year-to-date. The most recent data show that demand for US Treasuries has remained strong throughout the year. Treasury yields across all maturity buckets are substantially lower compared to the beginning of the year.

Fears of foreign buyers abandoning US Treasuries in favor of local bonds have also not materialized. In fact, the amount of US Treasuries held by foreign entities has increased by over 6% for the first seven months of the year, consistent with the longer-term trend. Of the top five countries holding US debt, only China has shown a reduction in holdings this year, however that has been a consistent trend over the last four years.

“Death of the US treasury market” fears have not been realized for a few reasons. One of the main reasons being that there is no substitute for the US Treasury market and the US fixed-income market as a whole. The US Treasury market, despite its credit rating downgrade, remains the largest, most liquid market on the planet.

#1: The US Treasury Market Is The Largest Bond Market In The World

According to the Securities Industry and Financial Markets Association (SIFMA), the amount of US Treasury securities outstanding as of September-end is $29.7 trillion with over $1 billion in average trading volume. Additionally, the US bond market—which includes not only Treasuries but corporate bonds, municipal bonds and other domestic issuers—is the largest bond market in the world. In total, the US fixed-income market is over 40% of the world’s bond market, with the EU accounting for 18% followed by China at 17%.

Size matters when it comes to execution, liquidity and price transparency in bond markets. There is no other market that can match the size and transactions of the US bond market, and at its core is the US Treasury market.

#2: Inflation Remains Relatively Steady

Concerns about a bond sell-off stemming from increasing inflation have not materialized because inflation remains stable. Although domestic inflation is holding steady above the Fed’s target of 2%, the most recent data shows CPI YoY% at 3.0%, where it started the year. It has been in the range of 2.3% to 3.0% all year.

Tariff-induced inflation specifically has not shown up. This can be attributed to actual tariff rates being significantly lower than what was initially announced and companies being reluctant to pass on increased prices to consumers. This may change as we move into 2026, but for now, it remains subdued.

#3: Don’t Fight The Fed

The decline in the fed funds rate has also benefited Treasury bonds. The Fed has reduced short-term interest rates at its last two meetings and is expected to further reduce rates through 2026. When considering its dual mandate, the Fed’s focus has been on the decline in employment data, with inflation reduction taking a back seat at recent meetings.

Also, during its October meeting, the Fed announced the end of its Quantitative Tightening (QT) program, which reduced the amount of Treasuries held on the Fed’s balance sheet. This means that the Fed will maintain its current holdings of US Treasuries, supporting Treasury bond prices at the margin.

The Bottom Line: The US Treasury Market Is The World’s Largest Bond Market

While the doom-sayer’s prediction of the US Treasuries demise has yet to occur, I do not believe that it will come to fruition in the near term. As Samuel Clemens (aka Mark Twain) once wrote, “The report of my death was an exaggeration.” According to Bloomberg, the US Treasury market has returned 6.01% YTD as of October-end. Not bad for a much-berated asset class just a few short months ago.