The market’s enthusiasm for Copart (CPRT) has cooled lately, despite the company’s solid fundamentals. The stock is down about 30% over the past six months, even as the S&P 500 has gained roughly 20% over the same period. Investors have pulled back amid revenue misses, softer vehicle-sales volumes, and a slowdown in total-loss assignments from insurers — a key driver of Copart’s auction supply.

Yet the pullback may have gone too far. If the stock were to reclaim its prior high, that would represent roughly 50% upside from current levels. And with its consistently strong margins — a sign of pricing power and healthy cash generation — CPRT still looks like a quality business trading at a discount. Here are some details.

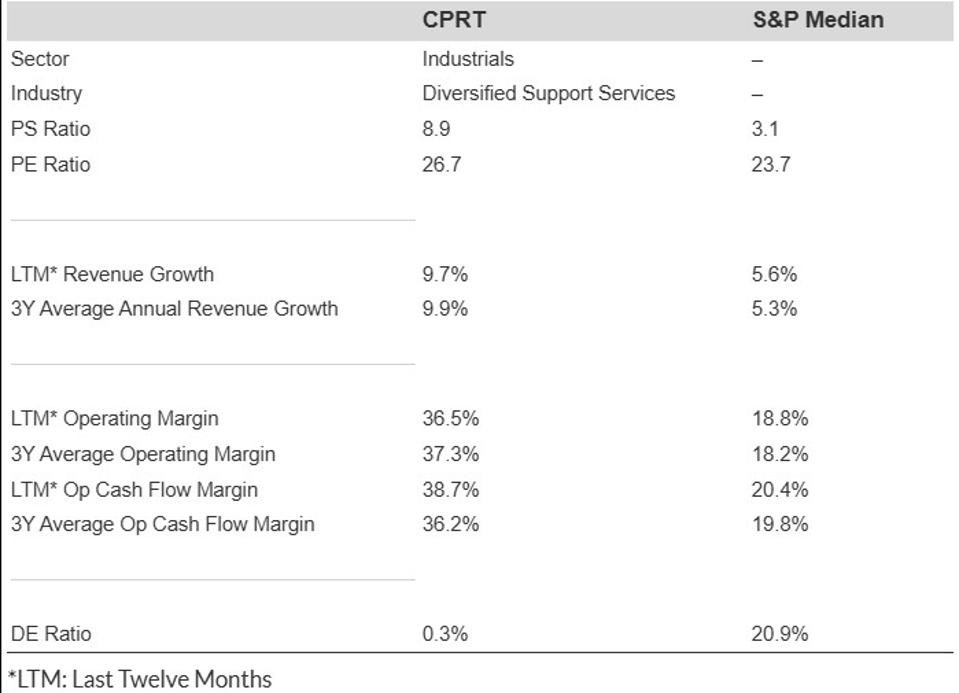

- Revenue Growth: Copart experienced growth of 9.7% LTM and a 9.9% average over the last 3 years, but this isn’t a growth narrative

- Recent Profitability: Approximately 38.7% operating cash flow margin and 36.5% operating margin LTM.

- Long-Term Profitability: Roughly 36.2% operating cash flow margin and 37.3% operating margin for the last 3-year average.

- Available At Discount: With a P/S multiple of 8.9, CPRT stock is currently at a 24% discount compared to one year ago.

Although revenue growth is beneficial, this isn’t a growth viewpoint. Pricing power and high margins yield consistent, predictable profits and cash flows, which lower risk and permit capital reinvestment. The market usually rewards such attributes.

For a brief overview, Copart offers online vehicle auctions and remarketing services worldwide, utilizing cutting-edge virtual bidding technology for licensed dismantlers, rebuilders, dealers, and exporters.

But do these figures provide the complete picture? Read Buy or Sell CPRT Stock to determine if Copart still possesses an advantage that remains solid.

If you are looking for potential gains with lower volatility compared to holding a single stock, consider the High Quality Portfolio (HQ) – HQ has surpassed its benchmark, which encompasses the S&P 500, Russell, and S&P midcap index, achieving returns above 105% since its inception. Risk management is crucial – contemplate what long-term portfolio performance could look like if you combine 10% commodities, 10% gold, and 2% crypto with HQ’s performance metrics.

Stocks Like These Can Outperform. Here Is Data

This is how we make our selections: We focus on stocks with a market cap greater than $10 billion and include those exhibiting high CFO (cash flow from operations) margins or operating margins. Furthermore, we only consider stocks that have significantly declined in valuation over the past year.

The statistics below reflect stocks with this selection approach applied since 12/31/2016.

- Average 12-month forward returns of almost 19%

- 12-month win rate (percentage of selections yielding positive returns) of about 72%

But Consider The Risk

CPRT is not exempt from major sell-offs. It experienced a loss of approximately 52% during the Global Financial Crisis and about 44% during both the Dot-Com Bubble and the Covid pandemic. The correction in 2018 also impacted it, dragging it down over 32%, while the inflation surge erased roughly 35%. Even with strong fundamentals, this stock can endure substantial declines when the markets turn volatile.

However, the risk isn’t confined to significant market crashes. Stocks may decline even when the markets are performing well – consider occurrences like earnings reports, business updates, and outlook changes. Read CPRT Dip Buyer Analyses to explore how the stock has bounced back from sharp declines in the past.

The Trefis High Quality (HQ) Portfolio, consisting of 30 stocks, boasts a history of consistently outperforming its benchmark that includes all three indices – the S&P 500, S&P mid-cap, and Russell 2000. What accounts for this? Collectively, HQ Portfolio stocks delivered superior returns with lower risk compared to the benchmark index; a smoother ride, as reflected in HQ Portfolio performance metrics.