Since we began tracking U.S. sectors, the Health Care sector has very often been one of the top performing on a long-term basis. Even through one- to two-year periods of underperformance, it has maintained its long-term edge. In addition, it has a strong history during market downtrends and has often led during positive market environments. On a net basis, since 1970, it is the second-leading sector behind Retail. The two have battled for the top spot for much of the last 25 years after emerging into the lead in the 1980s and 1990s. The reason for this enduring strength is that Health Care is both a staple industry that all consumers rely on and an innovation-driven sector led by advances in pharmaceuticals, biotechnology, genomics, and medical devices.

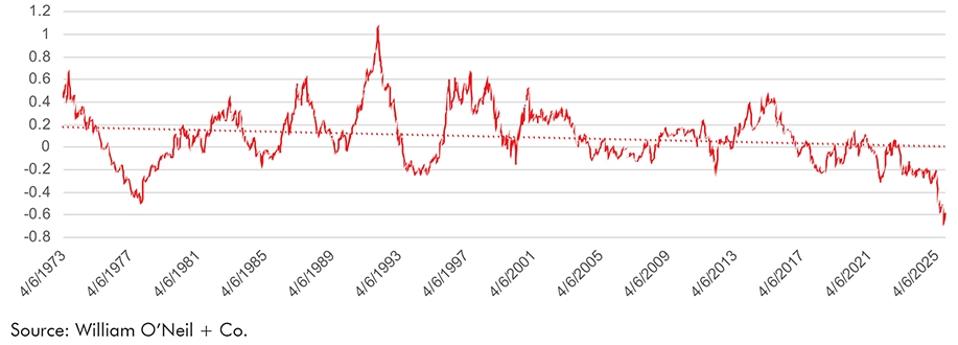

However, the past three years have seen historic underperformance for the sector. Since close to when the new bull market began (late October 2022), Health Care has lagged the S&P 500 by as much as 70% over a trailing three-year period (as of the week ended September 26). This surpassed its prior worst three-year period of -51%, which ended in December 1977. Several factors explain this underperformance. First, fears about changing government regulation have loomed over the industry, as both U.S. political parties are concerned with Health Care inflation and are actively seeking ways to lower costs. This has resulted in pricing pressure for pharmaceuticals, as well as lower Medicare and Medicaid rates for many medical services. Next, Health Care growth—slightly positive but below its historical trend—has been overshadowed by the growth in the technology sector driven by spending in AI. Finally, Health Care companies have also experienced cost pressures as labor rates and other expenses have risen, squeezing margins.

On a trailing one-year basis, the relative sector performance also matched all-time lows, reaching -32% for the week ended August 8. This has eased to about -18% currently, but even at that level, is within the worst 5% of all weeks since 1970. This level of underperformance has caught our attention. While many of the pressures that have hurt stock price performance remain, the magnitude of the underperformance suggests that sector stocks may be discounting an overly pessimistic future. Health Care will remain a key sector of the U.S. economy and one that will reward innovation. We’re constructive on services related to smaller biotechs, genetic testing, and select medical devices.

The O’Neil Health Care sector (market-cap weighted across all stocks) has made an interesting turn over the past four weeks. On a weekly chart, it has broken a downtrend which had been in place for the past year. This has led to a golden cross with the 10-WMA moving back above the 40-WMA. It has also made a series of higher lows, which is a constructive technical signal, and is just 4% off all-time highs after the recent recovery, despite its relative underperformance.

At the subgroup level there are several key groups to monitor. Currently, some groups appear to support a reversion trade in the near term, while other groups remain weak. We suspect that investors’ bearish worst fears will not be realized. If the economy slows, which may be indicated by slower consumer spending and a cooling job market, Health Care’s growth may look more attractive on a relative basis. Also, its relatively stable revenues should appeal to investors as other sectors slow or shrink. As a result, we think investors should consider increasing their exposure to the sector to around equal weight, especially given that many are currently underweight. Still, the sector has more to prove before it moves into a leadership position.

Because the sector is not a long-term leader at this point, we think it is best to pick spots wisely from within the space. Here are the few dozen Health Care names (with more than $3 billion market cap) that have already reported Q3 results. Although the overall average reaction is positive, it is still very mixed, with slightly over half declining post-results. Net positives have been Biotech (+2% on average), Ethical Drugs (+2%), Hospitals (+3%), Home Care (+2%), Products (+5%), Services (+3%), and Systems/Equipment (+5%), and the one stock in Distribution (+20%). This is offset by the net negatives in Managed Care (-5%), Research Equipment (-5%), and the one stock in Generics (-9%). We would add that while Research Equipment as a whole has reacted down, the area we are most positive on is contract research organizations catering to small- to mid-sized biotech companies (see MEDP).

Across our U.S. Focus List of top picks, in October we moved from just one stock (PODD) and a less than 2% weighting to five stocks and a 9% weighting. This is roughly in line with the S&P 500, which we think makes sense at this stage. Three stocks were added post-results and are still actionable or buyable in our view. One from each of the spaces we like most currently includes Biotech (INCY), Systems and Equipment (ISRG), and Genomic Testing Services (WGS).

Kenley Scott, Director, Global Sector Strategist at William O’Neil + Company, made significant contributions to the data compilation, analysis, and writing for this article.