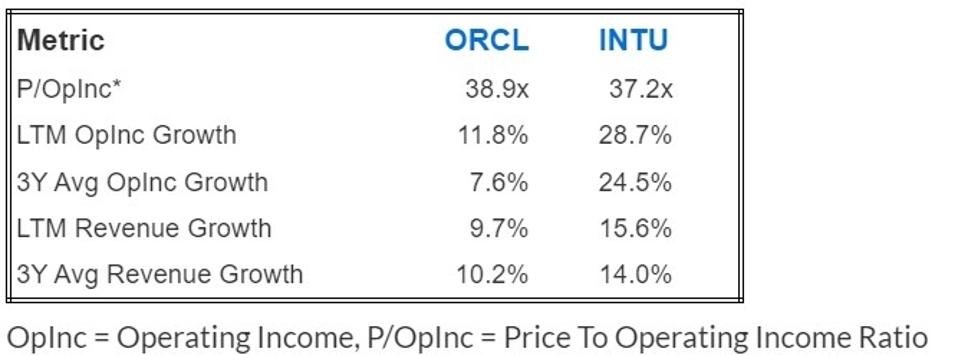

INTU serves as Oracle’s counterpart in the Application Software sector, which possesses:

1) A lower valuation (P/OpInc) in comparison to Oracle stock

2) However, it demonstrates superior revenue and operating income growth

This disparity between valuation and performance suggests that purchasing INTU stock might be preferable to acquiring ORCL stock

Oracle stock has been riding a wave of hype largely driven by investor enthusiasm over its expanding role in artificial intelligence and cloud infrastructure. The company’s strategic partnerships—particularly with Nvidia—and its aggressive push into AI-driven cloud services have positioned it as a credible challenger to hyperscalers like Amazon and Microsoft. Strong growth in Oracle Cloud Infrastructure (OCI) and surging demand for its AI-ready databases have fueled bullish sentiment, with investors betting that Oracle’s legacy enterprise customer base gives it a unique advantage in monetizing AI workloads. While fundamentals remain solid, much of the recent rally reflects high expectations for future growth rather than current earnings strength, making the stock feel more momentum-driven than value-based.

Over time, markets reward quality, which is precisely what the High Quality Portfolio encapsulates.

Key Metrics Reviewed

Do these figures provide a complete narrative? Consult Buy or Sell ORCL Stock to determine if Oracle still possesses an advantage that remains relevant. To give you a quick overview, Oracle (ORCL) offers cloud software as a service, domain-specific cloud solutions, application licenses, license support, an enterprise database, a development language, and middleware services.

This represents just one method to assess investments. The Trefis High Quality Portfolio evaluates a broader range of factors and is designed to minimize stock-specific risks while providing upside potential.

Is The Discrepancy In Stock Price Temporary?

One approach to assess whether Oracle stock is currently overpriced relative to other tickers is to compare how these metrics stood across companies precisely one year ago. If there has been a significant reversal in Oracle’s trend over the past 12 months, this could indicate that the current discrepancy is likely to correct. Conversely, ongoing underperformance in revenue and operating income growth for Oracle might solidify the argument that the stock is overpriced in relation to its competitors and may not adjust anytime soon.

Key Metrics Compared 1 Year Ago

Further Metrics to Think About

While buying based on valuation looks appealing, it needs careful assessment from various perspectives. This multi-factor approach is precisely how we design Trefis portfolio strategies. If you seek upside with a smoother experience than with an individual stock, consider the High Quality portfolio, which has surpassed the S&P and generated over 105% returns since its inception.