Trump-Xi Meeting Recap

The Ministry of Commerce’s Q&A with reporters included a concise outline of the Trump-Xi meeting per their spokesperson:

- The US will cancel the so-called “fentanyl tariff” imposed on Chinese goods (including goods from the Hong Kong Special Administrative Region and Macao Special Administrative Region). The 24% reciprocal tariff imposed on Chinese goods (including those from the Hong Kong Special Administrative Region and the Macao Special Administrative Region) will remain suspended for one year. China will adjust its countermeasures in response to the tariffs mentioned above. The two sides agreed to continue extending some tariff exclusion measures.

- The US will suspend the implementation of the 50% penetration rule for export control announced on September 29 for one year. China will suspend the implementation of relevant export control measures announced on October 9 for one year and study and refine specific plans.

- The US will suspend the implementation of its 301 investigation measures on China’s maritime, logistics, and shipbuilding industries for one year. Following the US’ suspension of relevant measures, China will also suspend the implementation of countermeasures against the US for a period of one year.

In addition, the two sides also reached a consensus on fentanyl anti-drug cooperation, the expansion of the agricultural product trade, and the handling of relevant cases involving enterprises. The two sides further confirmed the results of the Madrid economic and trade consultations, and the United States made positive commitments in investment and other fields. China will properly resolve the relevant issues related to TikTok with the United States.

Key News

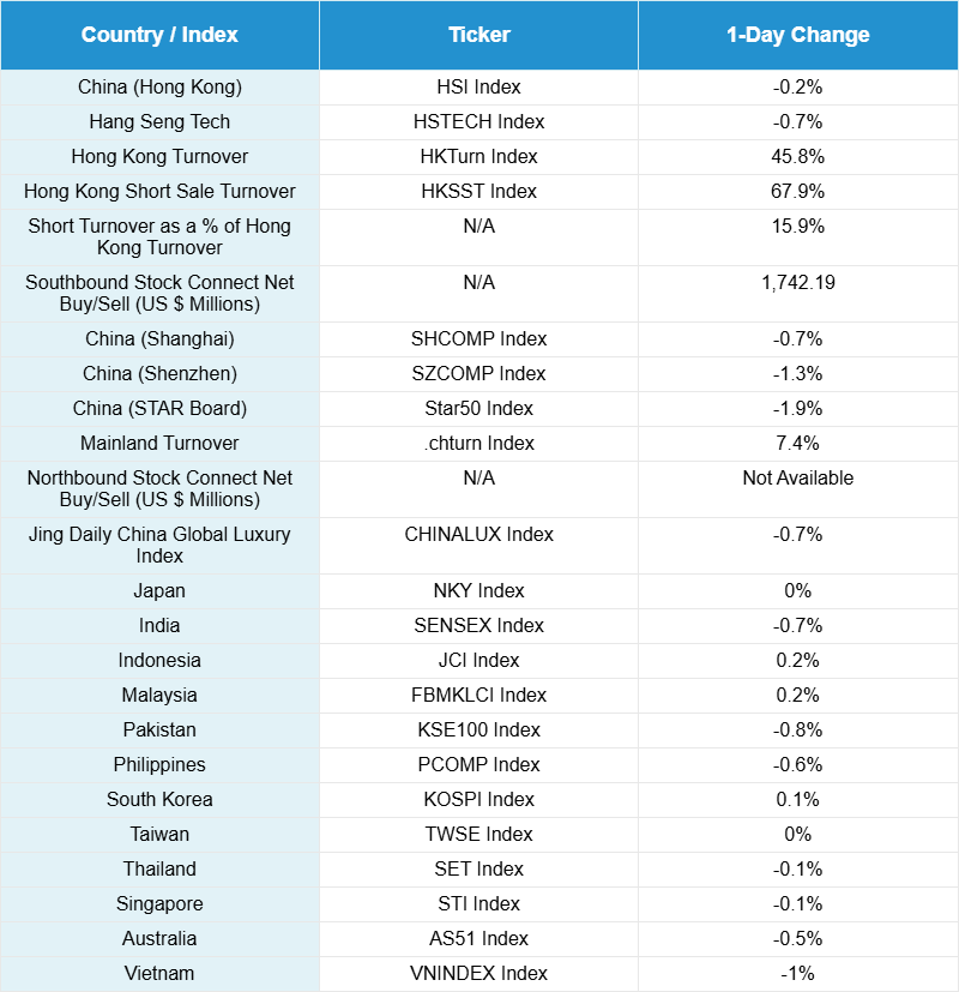

Asian equities were lower as investors recalibrated the potential for no December US Fed cut, as the US dollar strengthened overnight.

President Trump and President Xi had many positive things to say about their meeting, as today’s agreement met the market’s base forecast. We should assume dialogue will continue with the potential for a bigger, beautiful trade deal when President Trump visits China early next year.

Hong Kong volumes were very high, at 147% of the 1-year average, as markets faded in the afternoon, as the Hang Seng could close above 26,500, though stayed above 26,000. The Hang Seng Tech Index also closed above the 6,000 level. Despite a very large buy of the Hong Kong Tracker ETF from Mainland investors via Southbound Stock Connect, Connect trading accounted for only 22% of Hong Kong turnover today. This may indicate underweight foreign investors were getting involved in growth favorites, as battery giant CATL gained +2.5% and internet stocks outperformed, including Tencent, which gained +0.9%, Alibaba, which gained +0.6%, and Meituan, which gained +2.4%. It is interesting that Hong Kong-listed technology hardware stocks were off, as they could be a beneficiary of better US-China trade relations. However, one explanation was ZTE falling -11.4% after missing Q3 analyst expectations significantly. We had a similar situation in Hong Kong-listed healthcare stocks, which were off. Meanwhile, defensive non-ferrous metals stocks, which include precious metals and miners, had a strong day.

A similar situation occurred on the Mainland, as tech hardware, semiconductors, and healthcare were lower. Perhaps some profit-taking as a form of insurance, given that capital markets were also off. Yesterday we spoke about Longi Green Energy and whether their Q3 results would provide insight into the anti-involution solar campaign. Post close, the company reported Q3 net loss declined YoY to RMB -834MM from Q2 2025’s loss of RMB -1.13B and Q3 2024’s loss of RMB -1.26B. Distressed SOE real estate developer Vanke reported that after the close, Q3 operating revenue declined -27.3% YoY, while Q3 net loss increased to RMB 16B from RMB 8B YoY. Post-close, LXJM announced that its Q3 net profit increased by +32.49% YoY to RMB 4.874B. Hong Kong cut interest rates by 25bps following the US Fed due to the currency peg.

Live Webinar

Join us Thursday, October 30th at 11 am EDT for:

Chomping Today’s Ghouls: Market Exuberance, Tariff Uncertainty, and USD De-Risking

Please click here to register

New Content

Read our latest article:

Labubu & Gen Z Spending: What China’s Designer Toy Craze Tells Us About the New Consumption Wave

Please click here to read

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.09 versus 7.09 yesterday

- CNY per EUR 8.25 versus 8.27 yesterday

- Yield on 10-Year Government Bond 1.82% versus 1.82% yesterday

- Yield on 10-Year China Development Bank Bond 1.89% versus 1.88% yesterday

- Copper Price +0.41%

- Steel Price +0.52%