Key News

After the market closed overnight, the government released the “Recommendations of the Central Committee on Formulating the 15th Five-Year Plan for National Economic and Social Development”, which covered 15 key focus areas comprising sixty-one sub-areas. For investors, a few key points stood out:

- Accelerate high-level self-reliance in science and technology, and lead the development of new, quality productive forces. (Technology self-reliance was mentioned nine times in the document, making the priority clear, and artificial intelligence was mentioned eight times.)

- Build a strong domestic market and accelerate the construction of a new development pattern, emphasizing “vigorously boost consumption” and the “in-depth implementation of special actions to boost consumption.”

- While the term anti-involution was not explicitly used, the document addressed related themes such as excessive competition, “race to the bottom,” “unbalanced and inadequate development,” and promoting healthy rather than destructive competition.

- The plan also called to expand high-level opening up and foster a new situation of win-win cooperation, using the usual language on market opening and financial reforms.

- Economic stimulus measures included promoting an “active fiscal policy” and “strengthening coordination between fiscal and monetary policies.”

I cannot predict the future, but I would assume local investors will likely favor growth stocks in Hong Kong and Mainland China. Remember that many of the Mainland semiconductor companies sit on the STAR Board, while the largest cloud and AI players are listed in Hong Kong.

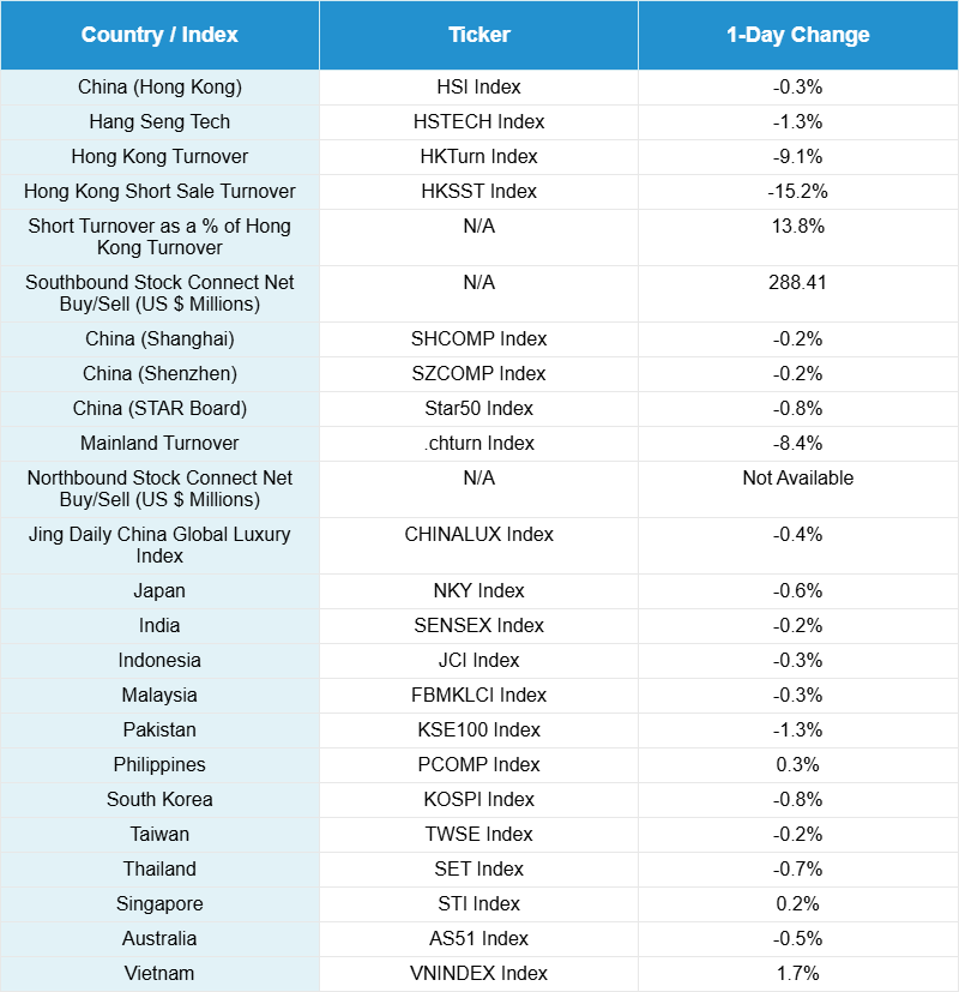

Asian equities closed lower on light volumes as Vietnam outperformed after a recent rally despite a weaker US dollar overnight. The Renminbi (CNY) appreciated against the US dollar, closing at 7.09 (recall that the CNY is quoted in US dollars per CNY, so a lower figure indicates appreciation).

Profit-taking hit growth stocks and favored sub-sectors especially hard. Markets appeared cautious ahead of tomorrow’s Federal Reserve policy decision and Thursday’s meeting between Trump and Xi in South Korea. Hong Kong will be closed tomorrow for Chung Yeung Day, which may have prompted traders to act quickly before the holiday.

HSBC rose +4.41% after solid third-quarter earnings, lifting Hong Kong banks. Meanwhile, growth sectors faced pressure: Alibaba fell -1.5%, Tencent fell -1.68%, and Zijin Mining declined -5.59%, along with healthcare, autos, household appliances, and semiconductors. Trading volumes were light, as Southbound Stock Connect activity accounted for just 23% of Hong Kong turnover, possibly indicating underweight foreign investor participation.

After the close, insurance giant Ping An reported profits for the first three quarters year-to-date, up +11.5% year-over-year (YoY), while Bank of China posted Q3 profit growth of +5% YoY. Mainland China mirrored Hong Kong’s sell-off in growth sectors, particularly semiconductors, non-ferrous metals, and pharmaceuticals. Technology hardware fared somewhat better, as Foxconn gained +1.69%. Aerospace stocks had a strong day. Sungrow Power reported a +57% profit increase year-over-year (YoY) and Ganfeng Lithium’s profit surged +364% YoY.

Mainland Chinese media noted Foreign Ministry spokesperson Wang Yi spoke with US Secretary of State Marco Rubio, while Premier Li attended and spoke at the China-ASEAN Leaders’ Meeting in Kuala Lumpur, Malaysia. China Securities Regulatory Commission (CSRC) Chairman Wu Qing delivered a speech at the 2025 Financial Street Forum Annual Meeting. The first flight in five years from India to China took place yesterday, connecting Kolkata and Guangzhou, business hubs rather than capital cities, highlighting strong business ties.

Reuters reported that India’s financial regulator may increase foreign ownership limits in state-owned banks from 20% to 49%. The twelve state-owned banks control 55%, equivalent to $1.95 trillion, of India’s total banking assets.

Out of curiosity, China’s big five state-owned banks collectively hold nearly $25.5 trillion in assets, compared to India’s total banking assets of about $4 trillion. Overall, the assets of Chinese banks, including both state- and non-state-owned banks, total approximately $66 trillion.

Live Webinar

Join us Thursday, October 30th at 11 am EDT for:

Chomping Today’s Ghouls: Market Exuberance, Tariff Uncertainty, and USD De-Risking

Please click here to register

New Content

Read our latest article:

Labubu & Gen Z Spending: What China’s Designer Toy Craze Tells Us About the New Consumption Wave

Please click here to read

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.09 versus 7.11 yesterday

- CNY per EUR 8.27 versus 8.27 yesterday

- Yield on 10-Year Government Bond 1.82% versus 1.84% yesterday

- Yield on 10-Year China Development Bank Bond 1.88% versus 1.88% yesterday

- Copper Price -0.28%

- Steel Price +0.85%