Key News

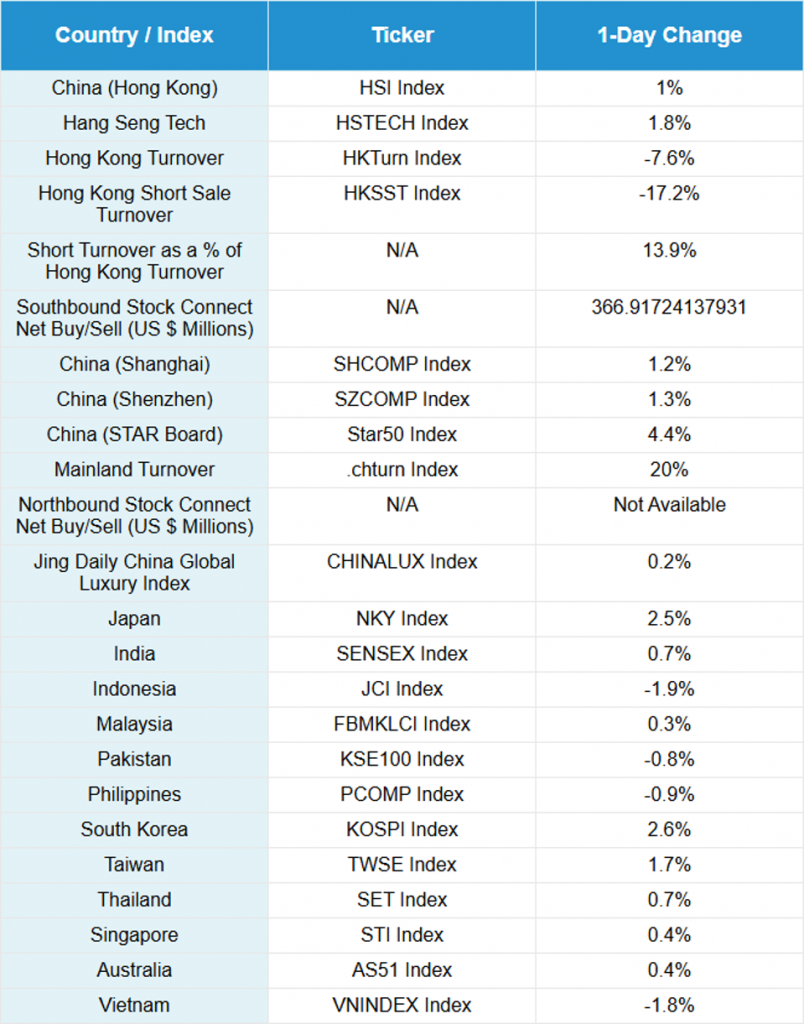

Asian equities had a strong day, as most markets rose more than 1% after US Treasury Secretary Scott Bessent, the US Trade Representative, and China’s Vice Premier He Lifeng reached a “preliminary consensus” following two days of negotiations.

The underlings have teed up an agreement for the big bosses Trump and Xi to sign on Thursday in South Korea. China’s Renminbi (CNY) rallied versus the US dollar to 7.10 per US dollar. In addition to easing trade tensions, another factor was the 15th Five Year Plan’s emphasis on AI, technological independence, and semiconductors, as growth stocks led gains in both Hong Kong and Mainland China.

Hong Kong volumes were higher, though not significantly, in an indication of the skepticism of trade talks, despite the China underweight in many portfolios. Hong Kong’s most heavily traded stocks were mega-cap growth stocks, led by Alibaba, which gained +3.15%, Tencent, which gained +2.90%, CATL, which gained +1.45%, and BYD, which gained +1.63%. Meanwhile, semiconductors outperformed, and non-ferrous metals rebounded (precious metals and metals and mining subsectors), due to reports saying that Mainland gold dealers will hike gold prices despite weakness in the spot price.

Biotech contract research organization WuXi AppTec gained +4.07% (2359 HK) in Hong Kong and +2.73% in Mainland China (603259 CH) on Q3 financial results that beat analyst expectations, with revenue up +15.3% year-over-year (YoY) and net income up +82.9% YoY.

Like in Hong Kong, growth stocks, sub-sectors, and stock exchanges all outperformed led by technology hardware, semiconductors, software, non-ferrous metals, and healthcare.

The 2025 Financial Street Forum kicked off, as PBOC President Pan Gongsheng, Li Yunze from the China Bank and Insurance Regulatory Commission (CBIRC), China Securities Regulatory Commission (CSRC) Chairman Wu Qing, and Foreign Exchange Administrator Zhu Hexin all gave keynote speeches. Gongsheng’s speech reiterated easy financial conditions, stating that the central bank will “…continue to adhere to a supportive monetary policy stance, implement appropriate loose monetary policies, comprehensively use various monetary policy tools, provide short-term, medium-term and long-term liquidity arrangements, and maintain relatively loose social financing conditions.”

The CBIRC head stated the agency will focus on “expanding domestic demand. We will strengthen the supply of funds for major projects and boost consumption expansion and upgrading. ”

China’s top government leaders met in the Great Hall of the People in Beijing as the 14th NPC Standing Committee met.

Industrial Profits increased in September, according to an official data release overnight, up +21.6% YoY, which brought the year-to-date (YTD) YoY increase to +3.2%, bolstered by a strong September move by high tech manufacturing, which increased +8.7% YoY. Not a factor in today’s trading but noteworthy.

Sunday’s New York Times Business Section included an article titled “Will Silicon Valley’s China Obsession Pay Off?” by Li Yuan. The article included this sentence: “Part of the reason American tech leaders amplify China’s capabilities, or its threat, is to pressure Washington into squeezing their Chinese peers with tariffs and regulation, and to win federal funding. By framing China’s rise as an existential challenge, they can push the government to pour money into their industries. The more they can alarm U.S. politicians and the public, the greater their leverage, and the more power they ultimately gain.” There are far more industries that this thesis could be applied to, other than technology, which ironically has many companies that are dependent on China for a good chunk of their revenue.

Today’s headline is from my favorite show growing up in the 1980’s: The A-Team. After finishing a successful mission, leader Colonel Hannibal Smith played by actor George Peppard, who says this line while chomping on his cigar.

Live Webinar

Join us Thursday, October 30th at 11 am EDT for:

Chomping Today’s Ghouls: Market Exuberance, Tariff Uncertainty, and USD De-Risking

Please click here to register

New Content

Read our latest article:

Labubu & Gen Z Spending: What China’s Designer Toy Craze Tells Us About the New Consumption Wave

Please click here to read

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.11 versus 7.12 yesterday

- CNY per EUR 8.27 versus 8.28 yesterday

- Yield on 10-Year Government Bond 1.84% versus 1.85% yesterday

- Yield on 10-Year China Development Bank Bond 1.88% versus 1.92% yesterday

- Copper Price 1.23%

- Steel Price 0.75%