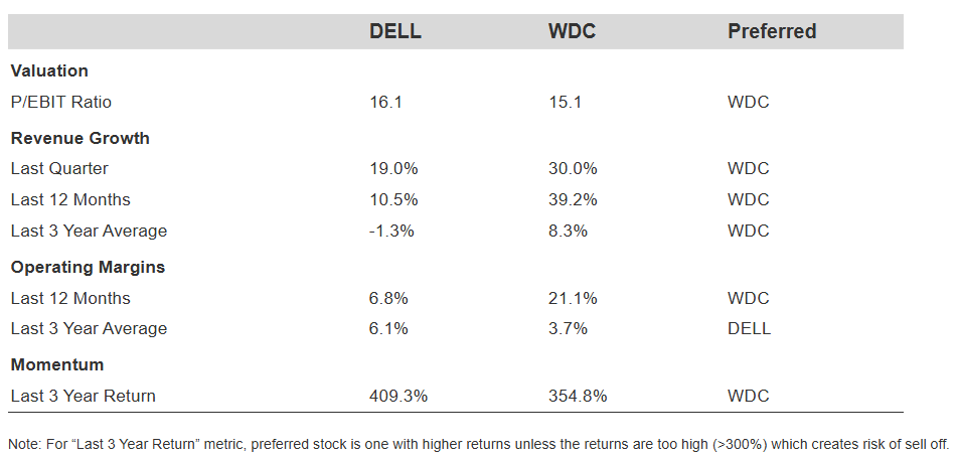

Western Digital (WDC) stock shows stronger revenue growth across key periods, better profitability, and a relatively lower valuation compared to Dell Technologies (DELL), suggesting investors may find WDC a more compelling opportunity.

- WDC’s quarterly revenue growth was 30.0%, versus DELL’s 19.0%.

- Its last twelve months’ revenue growth reached 39.2%, surpassing DELL’s 10.5%.

- WDC’s LTM margin stands higher at 21.1% versus DELL’s 6.8%.

Investing in individual stocks can be risky, which is why diversification and strategic asset allocation matter. Staying invested through volatility has historically paid off—investors who exited the S&P 500 during 2020 missed the subsequent rally. Trefis High Quality Portfolio and Empirical Asset Management’s asset allocation strategy are both designed to reduce volatility and help investors stay the course.

DELL operates across infrastructure, client devices, and VMware segments, offering desktops, workstations, software, and multi-cloud, networking, security, and digital workspace solutions. Meanwhile, WDC develops and sells data storage devices such as HDDs, SSDs, and flash-based embedded storage for computers, mobile phones, tablets, and wearables.

Valuation & Performance Overview

See more revenue details: DELL Revenue Comparison | WDC Revenue Comparison

See more margin details: DELL Operating Income Comparison | WDC Operating Income Comparison

But do these numbers tell the full story? Read Buy or Sell WDC Stock to see whether Western Digital’s lead holds or if Dell Technologies still has potential (see Buy or Sell DELL Stock).

Historical Market Performance

No matter how strong the numbers look, stock investing is never without risk. Market drawdowns can happen suddenly. Read WDC Dip Buyer Analysis and DELL Dip Buyer Analysis to see how both stocks have recovered from past declines.