Caesars Entertainment (CZR) stock deserves a place on your watchlist.

Here is why – it is presently trading within the support range ($22.21 – $24.54), levels from which it has rebounded significantly in the past.

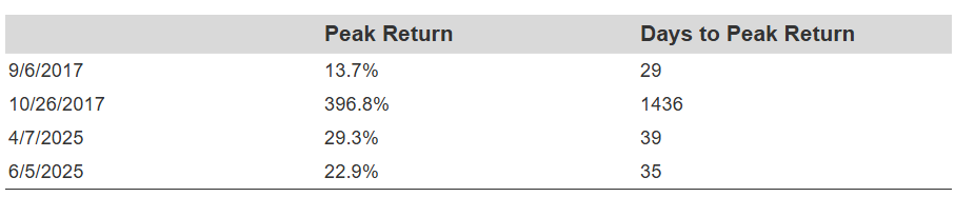

Over the last 10 years, Caesars Entertainment stock attracted buying activity at this point 4 times and subsequently managed to yield an average peak return of 115.7%.

But is the price movement sufficient by itself? Do the fundamentals look right? As a quick background, Caesars Entertainment functions as a gaming and hospitality entity managing 52 U.S. properties with around 55,700 slot machines, video lottery terminals, and e-tables distributed across 16 states. A big player in gaming business.

Below are some key data points for Caesars Entertainment that should assist in making a decision:

- Revenue Growth: -0.1% LTM and 3.2% average over the last 3 years.

- Cash Generation: Nearly 0.4% free cash flow margin and 19.3% operating margin LTM.

- Recent Revenue Shocks: The minimum annual revenue growth recorded over the last 3 years for CZR was -0.2%.

- Valuation: CZR stock is traded at a PE multiple of -25.1 (CZR earnings are in the red)

- Opportunity vs S&P: In comparison to the S&P, you receive a lower valuation, get lower revenue growth, but a superior operating margins

For fuller comparison – see Buy or Sell CZR Stock to determine the strength of this buying opportunity. Of course, investing in a single stock can be risky, but there is significant value in a wider diversified approach. If you desire potential gains with reduced volatility compared to holding a solitary stock, consider the High Quality Portfolio (HQ) – HQ has surpassed its benchmark – a combination of S&P 500, Russell, and S&P midcap index, achieving returns exceeding 105% since its inception.

What Is Stock-Specific Risk If The Market Crashes?

No matter what, CZR is not shielded from significant sell-offs – no stock is. Specifically, it suffered a drop of nearly 90% during the Covid pandemic, declined around 73% amid the inflation shock, and fell by 35% back in 2018. These are considerable reductions, even given the various advantages the company may possess. This illustrates that regardless of how robust the fundamentals, stocks like CZR can still endure severe declines when the market struggles.

However, the risk is not confined to major market crashes. Stocks can decline even when markets are performing well – consider occurrences such as earnings reports, business updates, and changes in outlook. Read CZR Dip Buyer Analyses to explore how the stock has bounced back from steep declines historically.

The Trefis High Quality (HQ) Portfolio, which consists of 30 stocks, boasts a history of meaningfully outperforming its benchmark which encompasses all three – the S&P 500, S&P mid-cap, and Russell 2000 indices. What accounts for that? Collectively, HQ Portfolio stocks have provided superior returns with reduced risk in relation to the benchmark index; less volatility, as demonstrated in HQ Portfolio performance metrics.

Complete Trefis analysis of CZR stock