Despite the Federal Government shutdown on Wednesday, the financial markets hit new all-time highs this week. The S&P 500, DJIA, and Russell 2000 all closed at new record highs on Friday (October 3rd).1 The Nasdaq hit a new record high on Thursday. The table shows weekly gains between 1% and 2% for the four major indexes. The far right-hand column shows year-to-date index changes. As can be seen, three of the indexes (S&P 500, Nasdaq, Russell 2000) have advanced at double-digit rates so far in 2025 (S&P 500, Nasdaq, Russell 2000) with the DJIA nearly there (9.91%).

As has been well publicized, the Federal Government shut down last Wednesday (October 1st). Certainly, a prolonged shutdown will have some economic consequences. But, at this writing, it has only been a couple of days, so there has been little economic impact. Shutdowns have occurred every five years, on average, since the 1990s. The longest such shutdown lasted 35 days, the shortest two days (’83, ’85, ’87). Note that there have been three lengthy closures over the past 30 years: 1996 = 22 days; 2014 = 17 days; 2019 = 35 days). Generally, such shutdowns have little overall equity market impact; that’s because they are usually short-lived and usually don’t have an impact on profit expectations. Nevertheless, a prolonged shut-down has the potential to have significant economic impacts.

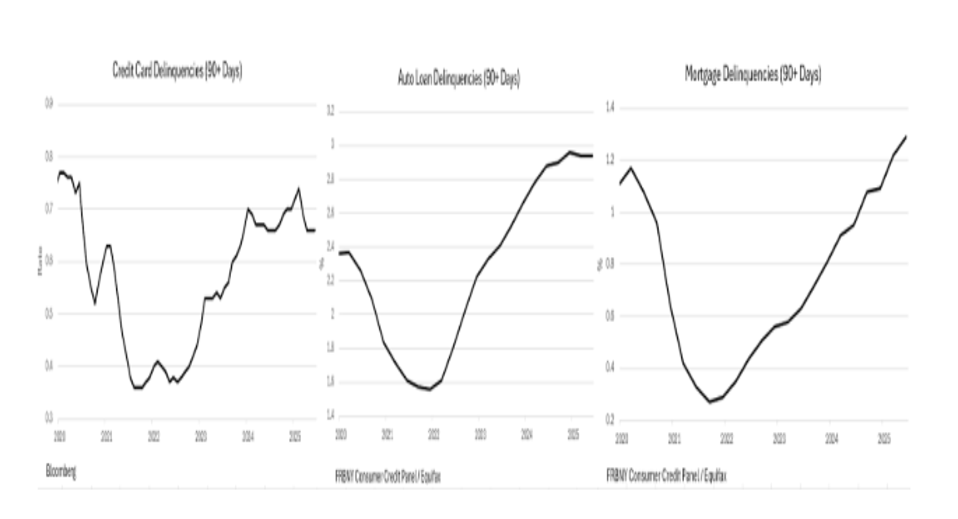

The current shutdown is occurring while the economy is showing signs of slowing. On the consumer side we see rising credit card, auto loan, and mortgage delinquencies (see above chart). In addition, the housing market, a key economic driver, appears to have slowed significantly.

The latest reading of the Pending Home Sales index, a leading indicator of housing activity, showed up in September at 74.7 and is now lower than in the first month of both the ’01 and ’08 Recessions (i.e., 89.8 September ’01; 80.2 November ’08). (Rosenberg Research, “Breakfast with Dave” 9/30/25)

Other Economic Signs

The Conference Board’s Leading Economic Indicators (LEI) have now declined for 17 months in a row. So, it isn’t a wonder why we are seeing increasing signs of an economic slowdown. The labor market continues to weaken. The government shutdown postponed BLS’ Nonfarm Payroll Report (NFP), which was due out on Friday, October 3rd; other labor market indicators show rapid weakening. The ADP monthly jobs report, highly correlated with the NFP, showed up in September with a net loss of -32K jobs2 (the market consensus was for this number was +51K; only off by -83K!) And the Job Openings and Labor Turnover Survey (JOLTS) shows a continuation of declining job openings, now approaching the 2020-2021 labor market softness.

The Conference Board’s monthly survey asks respondents about their view of the labor market.2

The responses:

- Jobs Plentiful: 26.9% September vs. 32.0% August (normal is > 50%);

- Jobs Not Plentiful: 54.0% September, the highest since March ’21;

- Jobs Hard to Get hit a 4.5 year high.

In addition, the Conference Board’s Consumer Confidence Index took a big hit in September, falling to 94.2 from August’s 97.8. The consensus estimate was 96.0, so a significant miss.3

The chart shows the rapid deterioration of the expectations of job availability in 2025, and, while off its peak, the current levels remain significantly above the 2020-21 Recession scare.

The Fed

With the government shutdown, economic data, like the NFP report, isn’t forthcoming. This makes it difficult for policymakers, especially the Fed’s Federal Open Market Committee (interest rates) to operate. Still, there is a significant amount of private sector data for them to chew on. We still see a 25-basis point rate reduction in the upcoming October 28-29 meetings, and likely another 25 basis points at the December 9-10 conclave. That is, with current economic conditions. If such conditions deteriorate rapidly over the next two months, the rate reductions could be steeper (i.e., 50 basis points in the December meetings).

Final Thoughts

If this government shutdown follows the pattern of the last few, it will be relatively short in tenure and have little economic impact. (Note that vital government services, like military, the post-office, air-traffic control, and TSA remain operative.) Of course, there is always the possibility of a prolonged shutdown which could have an economic impact. We will be following this topic, as long as it lasts, in our weekly economic updates.

Even before the shutdown, we were concerned about a slowing economy. Credit card and mortgage delinquencies have risen rapidly, showing a deteriorating consumer. We expect these trends to worsen in the near-term. And the housing market, always a source of strength for the consumer, has also gone downhill rather quickly.

As a result of these trends, the Fed will have no choice but to lower interest rates over the next few months. Their next meeting is at month’s end (October 28-29). We are highly confident that they will lower rates. The most likely rate reduction is 25 basis points. We think the economy needs a couple of 50 basis point shots.

Robert Barone, Ph.D.

(Joshua Barone and Eugene Hoover contributed to this blog.)

Robert Barone, Joshua Barone and Eugene Hoover are investment adviser representatives with Savvy Advisors, Inc. (“Savvy Advisors”). Savvy Advisors is an SEC registered investment advisor. Material prepared herein has been created for informational purposes only and should not be considered investment advice or a recommendation. Information was obtained from sources believed to be reliable but was not verified for accuracy.

Ancora West Advisors, LLC dba Universal Value Advisors (“UVA”) is an investment advisor firm registered with the Securities and Exchange Commission. Savvy Advisors, Inc. (“Savvy Advisors”) is also an investment advisor firm registered with the SEC. UVA and Savvy are not affiliated or related.

References

1 https://www.wsj.com/livecoverage/stock-market-today-government-shutdown-10-03-2025

3 https://www.conference-board.org/topics/consumer-confidence/