IBM’s stock has seen impressive gains, rising 16% this past month and 32% year-to-date. The stock is trending higher again on October 7, following the announcement that Anthropic will integrate its AI models into IBM’s software offerings.

This adds to a series of positive developments that IBM stock has seen lately. IBM is experiencing strong demand for its enterprise AI solutions, particularly the WatsonX platform, which has positioned the company well within the expanding artificial intelligence market.

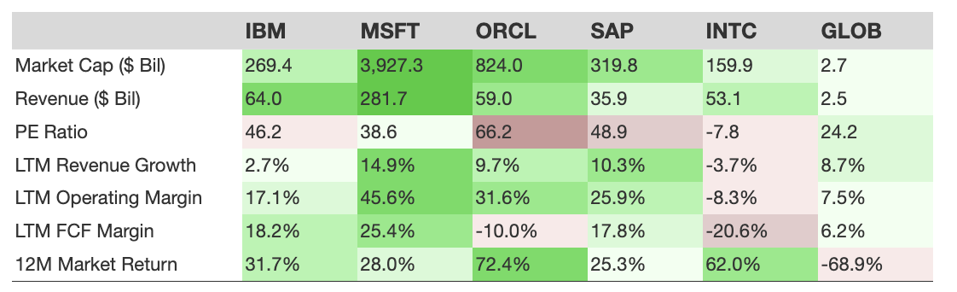

Further boosting confidence in IBM’s long-term potential, a recent partnership with HSBC demonstrated a significant real-world breakthrough: applying quantum computing to bond trading. With IBM’s stock on the rise, the natural next question is: how does it compare against its peers? Below is an analysis of how IBM stacks up in size, valuation, growth, and margin.

- IBM’s operating margin of 17.1% is robust, although lower than most competitors – behind MSFT (45.6%).

- IBM’s revenue growth of 2.7% over the past year is modest, falling short compared to MSFT, ORCL, SAP, GLOB, while slightly surpassing INTC.

- IBM’s shares increased by 32% in the last year, and the stock trades at a PE of 46.2, even though competitors such as ORCL and INTC yielded better returns.

As a brief overview, IBM offers integrated global solutions and services across software, consulting, infrastructure, and financing, including hybrid cloud platforms, open-source software, and server and storage solutions.

The stock of IBM has seen a significant rise lately, and we find it to be currently unattractive. This may come across as a warning, as there is considerable risk involved in depending on a single stock. Nonetheless, there is immense value in adopting a more diversified approach, such as the one we employ with the Trefis High Quality Portfolio. It has comfortably outperformed its benchmark—a combination of the S&P 500, Russell, and S&P MidCap indexes—and has achieved returns exceeding 91% since its inception. Why is that? As a group, HQ Portfolio stocks provided better returns with less risk versus the benchmark index; less of a roller-coaster ride, as evident in HQ Portfolio performance metrics.

Why is this significant? IBM has just risen 16.5% in a month – a peer comparison contextualizes stock performance, valuation, and financials – emphasizing whether it is genuinely outperforming, falling short, and most importantly – can this momentum continue? Read Buy or Sell IBM Stock to determine if International Business Machines remains a solid investment. Additionally, there is always the potential for decline after a substantial surge – review how the stock has decreased and rebounded in the past through the IBM Dip Buyer Analysis perspective.

Revenue Growth Comparison

Operating Margin Comparison

PE Ratio Comparison

Remember, investing in a single stock without comprehensive analysis can be risky. Consider the Trefis Reinforced Value (RV) Portfolio, which has outperformed its all-cap stocks benchmark (combination of the S&P 500, S&P mid-cap, and Russell 2000 benchmark indices) to produce strong returns for investors. Why is that? The quarterly rebalanced mix of large-, mid-, and small-cap RV Portfolio stocks provided a responsive way to make the most of upbeat market conditions while limiting losses when markets head south, as detailed in RV Portfolio performance metrics.